Nationwide HPI: UK property values climb as market steadies ahead of Budget

Monthly house prices grew by 0.3% following a 0.5% rise in September

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

House prices continued to climb in October as the market indicated signs of resilience ahead of the Budget.

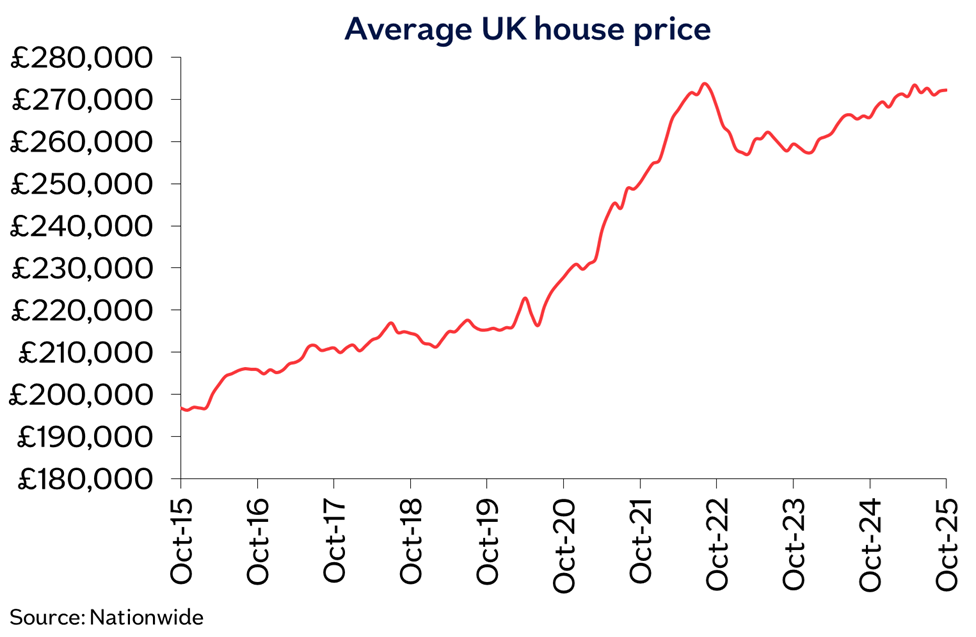

The latest Nationwide House Price Index (HPI) showed average property values rose by 0.3% on a monthly basis, following a 0.5% increase in September.

The building society said annual house price growth also climbed slightly from 2.2% in September to 2.4% in October.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The average price of a home now sits at £272,226, up from £271,995 in September.

Robert Gardner, chief economist at Nationwide, said the housing market remained steady, with prices rising modestly and mortgage approvals close to pre-pandemic levels.

He said: “Against a backdrop of subdued consumer confidence and signs of weakening in the labour market, this performance indicates resilience, especially since mortgage rates are more than double the level they were before Covid struck and house prices are close to all time highs.”

Gardner added housing affordability would improve “modestly” if wages continue to outgrow house prices and as interest rates fall as predicted.

The latest data from Nationwide comes ahead of the Autumn Budget next month, with Rachel Reeves reportedly mulling property taxes to top up the government’s coffers.

The Chancellor could announce a new tax on the sale of homes over £500,000, which would replace Stamp Duty, and remove the capital gains tax exemption on primary residences worth more than £1.5million.

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, said anticipation of what is to come next month was prompting caution from the market.

“Buyers have been gradually adjusting to the end of the stamp duty tax break in the Spring, with mortgage approvals edging up slightly in September,” said Haine. “But fresh uncertainty around potential property tax reforms appears to be having a dampening effect on market activity.”

She added the typical slowdown in the run up to Christmas had kicked in earlier as buyers and sellers brace for any announcements from the Chancellor.

Meanwhile, seasonally adjusted figures published by HMRC on 31 October showed the number of residential housing transactions in September was 95,980 - 4% higher than the same month last year, and 1% higher than August 2025.

Non-seasonally adjusted estimates of the number of residential transactions was 102,420, 8% higher than September 2024 and 2% lower than August 2025.

Richard Donnell, executive director at property portal Zoopla, said that the housing market currently has its largest sales pipeline for four years, with 350,000 homes working their way to completion.

"We expect transactions to start to plateau now they are back in line with the long run average of 1.2 million sales a year,” he added.

However, Donnell warned: “Budget uncertainty is starting to hit new sales agreed over £500,000 which will limit further growth in sales over 2026 unless the chancellor makes a bold move such as cutting Stamp Duty in the Budget which would boost sales.”

Most popular home renovations revealed

Separately, Nationwide also published research today revealing the most popular renovations carried out by homeowners over the last five years.

The building society found kitchen and bathroom revamps were the most popular, with 71% of respondents carrying out either, or both.

Meanwhile, 42% added a bathroom or ensuite while 25% added another toilet to their property.

Of those that undertook work, roughly a third made green improvements to their property, with 56% of this amount adding solar panels.

Nationwide found 69% of younger homeowners (aged 25-34) had made environmentally-friendly upgrades to their home in the previous five years.

In contrast, older homeowners (aged 55+) were least likely to have made green improvements, with just 18% having done so over the last half decade.

The building society also researched how much certain renovations can add to the value of a home, with extension or loft conversions boosting property value by 24%. On a property worth £500,000, that would add £120,000.

Extra bedrooms were found to boost a property’s value by 13%. On a home valued at £500,000, that would add £65,000.

Gardner said: “Location remains key to house values, but other factors, such as the number of bedrooms, are also important to homebuyers.”

He added that buyers are willing to pay more for a greater amount of useable space, with a 10% increase in floor space adding around 5% to the price of the average home.

“But our analysis suggests that it is additional bedrooms that are key to adding value. For example, adding space to create an additional double bedroom can add 13% to the value of an existing two-bedroom house," he said.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sam has a background in personal finance writing, having spent more than three years working on the money desk at The Sun.

He has a particular interest and experience covering the housing market, savings and policy.

Sam believes in making personal finance subjects accessible to all, so people can make better decisions with their money.

He studied Hispanic Studies at the University of Nottingham, graduating in 2015.

Outside of work, Sam enjoys reading, cooking, travelling and taking part in the occasional park run!

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how