House prices suffer unexpected August ‘hiccup’, Nationwide HPI finds

There was a minor reversal in house prices in August, according to the latest Nationwide House Price Index

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

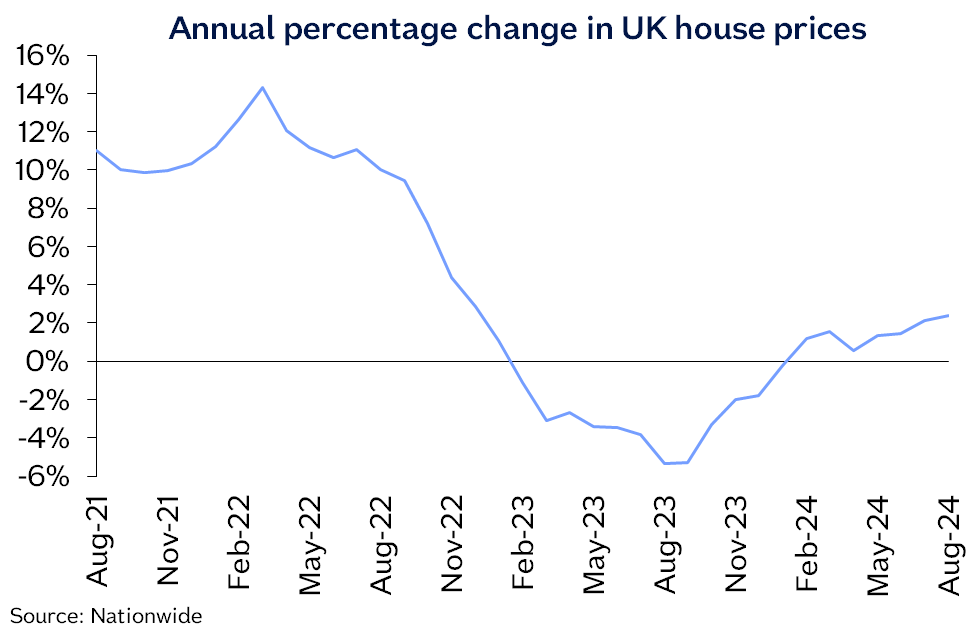

Yearly growth in house prices has continued to gather pace despite a small summer setback in August, the latest Nationwide House Price Index (HPI) has found.

Average property prices rose 2.4% against August 2023 - the fastest rate of growth for 20 months. It meant a typical home came in at £265,375, which is around 3% below the all-time high recorded in the summer of 2022.

But this figure also marked a 0.2% decrease compared to July 2024’s data, once seasonal effects were taken into account. This was the first month-on-month reversal since the spring, and, according to an assessment of economists’ forecasts by Capital Economics, was an unexpected setback.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It comes as the property market continues to battle against a high interest rate environment. While average mortgage rates are coming down in the wake of the Bank of England’s base rate cut - its first since 2020 - wages and savings have been eroded by three years of high inflation. It means affordability is still an issue for many prospective buyers.

Nationwide: economic recovery ‘should’ strengthen house prices

Despite the minor monthly reversal, Nationwide sounded a positive note about the outlook for house prices. The building society’s chief economist Robert Gardner said: “While house price growth and activity remain subdued by historic standards, they nevertheless present a picture of resilience.

“[This is] in the context of the higher interest rate environment and where house prices remain high relative to average earnings, which makes raising a deposit more challenging. Providing the economy continues to recover steadily, as we expect, housing market activity is likely to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth.”

This view was echoed by UK economist at Capital Economics Ashley Webb, who said: “We doubt the small slip in house prices in August is the start of a renewed and sustained fall. Admittedly, we think house prices will rise by just 0.3% over the remaining four months of this year and that house price inflation will ease to around 2.0% in Q4.

“But the improving economic outlook and a further decline in mortgage rates will possibly mean house prices regain momentum next year. Indeed, our view that Bank Rate will be cut from 5.00% now to 3.00% by the end of next year, instead of to 3.75% as investors anticipate, suggests mortgage rates could fall from 4.8% now to a little below 4.0% by the end of 2025. That could result in house prices growing by an above-consensus 5.0% y/y in Q4 2025.”

House prices are trending upwards (image: Nationwide)

Despite these encouraging forecasts, estate agents have suggested full confidence in the market is still yet to return. Nicky Stevenson, managing director of national estate agency Fine & Country, said: "The Bank of England's base rate cut in August has encouraged many potential buyers to move forward with their plans, but for some there is a sense of hesitation. Speculation about another rate cut later this year may be causing some buyers to wait a little longer before making a move.

"With inflation hovering around the government's 2% target and interest rates remaining low, there are promising opportunities for those looking to buy a home or move up the property ladder. In response to this, a mortgage price war has erupted in recent weeks as lenders compete to undercut one another to attract buyers.

"This has certainly breathed new life into UK property. However, while some buyers are benefiting, others may still face affordability challenges.”

Nigel Bishop, managing director of Recoco Property Search said he was seeing hesitancy on the part of buyers, who are waiting to see what the new government announces in September and at its first Budget the following month. Measures that are expected to be announced include new housebuilding targets and the Freedom to Buy scheme.

But he added that housing market activity could rise as sellers attempt to beat the tax hikes Rachel Reeves is expected to introduce in October. He said: “More homeowners have been motivated to put their property up for sale amid fears over an increase in Capital Gains Tax and Inheritance Tax in the upcoming Autumn Budget.

“As we are seeing more sellers entering the market, we predict buyer interest and activity to pick up after the summer holidays. Although this will create a more competitive market environment for house hunters, the influx of homeowners wanting to sell quickly will allow more room for price negotiations.”

Energy-efficient properties ‘command price premium’

Alongside its monthly HPI, Nationwide has released the findings of research it has conducted into the effect energy performance certificates (EPCs) can have on house prices. Using a 12-month comparison of average prices in England and Wales up to the month of June 2024, the lender found a high A or B EPC rating adds an average premium of 2.8% to a property.

Meanwhile, a poor energy efficiency rating of F or G can lop 4.2% off the value of a home. In 2019, the same research found the price penalty of a low EPC rating was 3.5%, with the value added by a good rating sitting at 1.7%.

Commenting on the findings, Robert Gardner said: “The value that people attach to energy efficiency is likely to continue to evolve, especially if the government takes measures to incentivise greater energy efficiency to help ensure the UK meets its climate change obligations.

“Decarbonising and adapting the UK’s housing stock remains critical if the UK is to meet its 2050 emissions targets, especially given that emissions from residential buildings account for 15% of the country’s greenhouse gas emissions.”

Nationwide also found that energy efficiency is improving in England, with 48% of housing stock in England rated as C or higher in 2022. This compared with just 18% of homes meeting this standard in 2012. It calculated that making the average home more efficient would cost £7,400 - but this bill could climb as high as £13,500 on a property with a low EPC score.

It comes after research carried out by Morningstar found there was an average difference of £13,000 between the value of a high-to-medium-rated EPC property compared to a medium-to-low-rated one. However, consumer watchdog Which? recently raised concerns that the scores aren’t always a reliable measure of energy efficiency.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how