Below zero: oil plunges into negative territory

US oil’s unprecedented collapse is mostly due to how it is traded – but also to the shock to global GDP, says Alex Rankine.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

American oil magnate John D. Rockefeller once said that “we are refining oil for the poor man and he must have it cheap and good”. But as the “Ghost of John D. Rockefeller” twitter account quipped this week, “I didn’t mean this” cheap.

The plunge is due mostly to the technicalities of how oil is traded: using futures contracts. These are deals to buy and take delivery of oil, or sell it, at a certain point in the future. Futures cover various periods of time, from one month to several years. The price typically quoted is for the front-month, or current one, and this is where the collapse occurred.

The price of US oil benchmark West Texas Intermediate (WTI) plunged by more than 300% on Monday, taking prices for delivery next month from $17.85 a barrel to an unprecedented minus $37.63 at the market close. European prices have remained above zero, but Brent crude (the benchmark non-US futures) had still tumbled 22% to a 21-year low around $15 a barrel by mid-week.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Demand for oil is plummeting

The trigger for the fall in the price of the May WTI future was plunging demand. The International Energy Agency forecasts that global oil demand will fall by 29 million barrels per day (mbpd) this month, a decline of about one-third compared with last year’s levels. That has created a huge surplus, recently thought to have reached about 20mbpd.

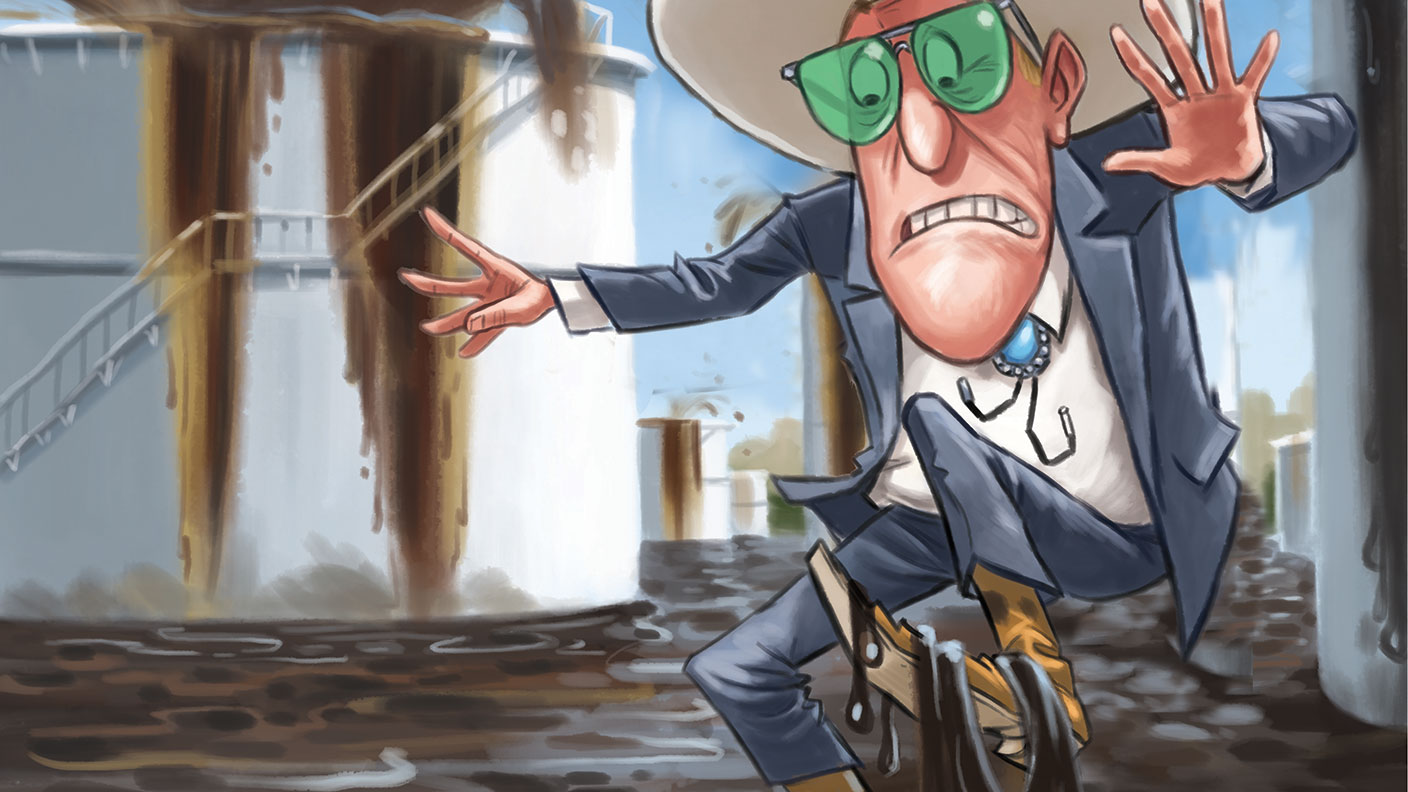

With demand plummeting, the price of a contract to take delivery of oil in May duly plummeted too. Traders who are used to working on computer screens without the risk of “getting any oil on their expensive suits” panicked, writes Neil Irwin in The New York Times. With the delivery date for May’s oil contract fast approaching, there were no buyers for their oil paper and no storage space available to put it in the meantime. That forced them to pay businesses that are equipped to handle the delivery of thousands of gallons of a volatile, toxic fuel to take the problem off their hands. The result was negative prices.

Trouble in America

America has emerged as the world’s top petroleum producer in recent years, but the country’s storage and transportation infrastructure has struggled to keep up, says Spencer Jakab for The Wall Street Journal. European crude traders have opted to “wait out the price slump at sea”, says The Economist, paying $200,000 a day to charter crude tankers to store excess oil. Yet landlocked American oil producers have no such storage fallback. The result is that the country’s oil has become “less than worthless”.

It doesn’t help that US producers have been slow to turn off the supply taps, says Lex in the Financial Times. More than 12 million barrels of oil still come onto the local market every day despite the existing glut. Negative oil prices can also be understood as representing a shortage of available storage and right now “oil storage space is like gold”.

The bigger picture: a deflationary shock

This slump is more than a mere quirk, says John Authers on Bloomberg. We are entering a brave new world: oil hasn’t been this cheap in real terms since Richard Nixon ditched the dollar’s peg to gold in 1971, the event that marks the start of the modern financial regime. The fuel has fallen so much that Microsoft Corporation alone is now worth about as much as “the entire market value of all the energy and materials companies in the S&P 500” combined.

Negative oil prices are more evidence of the “extraordinary deflationary shock” that Covid-19 has dealt to the economy, says Irwin. As global demand for goods and services evaporates over the next few months oil may not be the last market to experience such a severe price slump.

A crude awakening

Most of the immediate pain of negative oil prices was probably limited to “a small number of speculative investors” caught on the wrong side of the price swing, says Mark DeCambre for MarketWatch. Yet evidence that the oil market is “unravelling” has knocked confidence hard. “America’s oil patch is having a heart attack” as more and more heavily indebted producers are forced to turn off the taps, says Jakab.

A return to negative prices cannot be ruled out, says Samuel Burman of Capital Economics. The June WTI price is in positive territory for now – although it has slipped below $10 a barrel – but it could run into exactly the same storage problems this time next month. Plummeting Brent crude prices suggest fear that international prices could go the same way as American ones. A volatile few months are in store for oil.

The outlook for the second half of the year, however, is improving. Output cuts by key producers Opec and Russia removing almost 10mbpd from global supply will start in May, while the latest price crash could prompt even deeper cutbacks on the US shale patch. Any easing of lockdowns could also help demand tick back up. Prices look set to stabilise in the second half. A new bull market, however, remains a distant prospect.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.