European bank stocks bounce back

European bank stocks were part casualty and part cause of Europe’s lost decade. Now it’s clearly turned the corner, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It’s difficult to imagine a time when anybody was more bullish on Europe than America, but this was a popular investment thesis before the global financial crisis. The US had a giant housing bubble, a vast trade deficit and a currency in steady decline. Consumers were heavily dependent on spending their savings, according to statistics at the time (this data later got revised, and those eight quarters with a negative savings rate turned out to be an error – a good example of how unreliable statistics can be, as I discussed last week). Europe also had housing bubbles, but otherwise looked sounder and was well placed to benefit from emerging market growth.

We all know how this theory turned out. Europe has trailed the US on virtually every financial measure since the crisis (one can very fairly argue that Europe still offers a better quality of life in many ways, but that’s not what we are looking at). The reasons for this go beyond the idea that America is simply more innovative and dynamic, with a whole series of events working against Europe or for the US.

The eurozone debt crisis dragged on far too long, with far too much can-kicking. The shale revolution created a huge advantage for US growth and for the trade balance. Regardless of one’s views on Brexit itself, most people would acknowledge that the process was a distracting, exhausting upheaval for both Britain and the EU. Most recently, Russia’s invasion of Ukraine turned an energy disadvantage into a crisis, put a full-scale war on the borders of a continent that was complacent and completely unprepared for it, and sent uncertainty and fear rocketing. Look back at all this and maybe we should be amazed that Europe hasn’t done even worse.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Still, it didn’t help that Europe put its head in the sand much more than America when cleaning up its banks after the crisis. US policymakers did not exactly get this right – banks were bailed out too freely, there was no accountability for the actions that led to the crisis, and interest rates were cut too low and stayed there too long. Yet its bank stress tests were a success: they led to clear recapitalisation plans, restored confidence in the sector and left banks able to lend again.

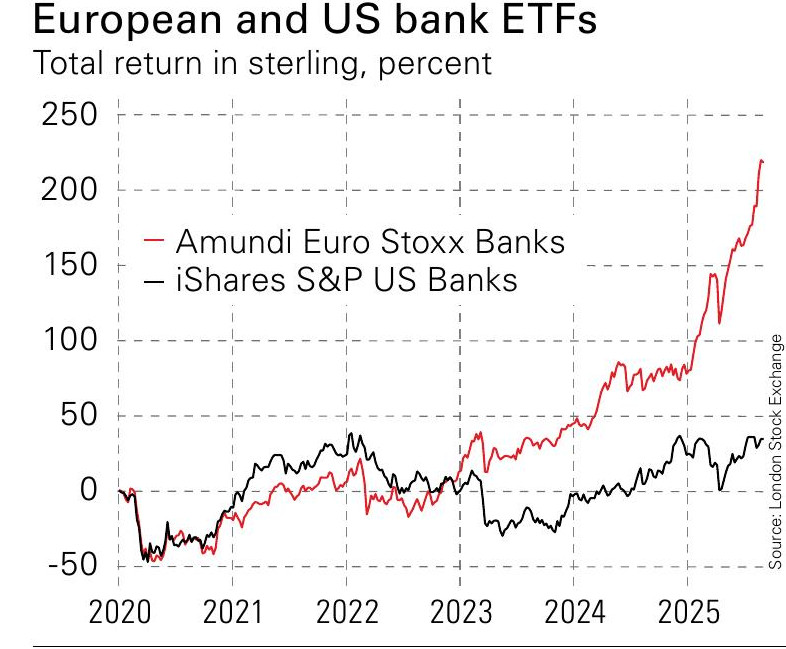

European banks stocks are accelerating

Europe’s stress tests were a fudge, and markets knew it. Banks were not recapitalised quickly: they only gradually recognised bad debts while they rebuilt capital. Ultra-low interest rates hurt profitability and made this process slow. That meant that they were in a weak position to lend, even if demand was there. So, US bank shares far outstripped European ones for the next decade.

Yet on the eve of the pandemic, European banks were finally in better shape. After shares bottomed in April 2020, they began to rally. Since 2023, they have beaten US banks and are accelerating. Valuations are rising: the Euro Stoxx Banks index is on a price/book of 1.1, up from 0.7 two years ago. Banks are highly cyclical, and I never like the sector, but they are central to the economy. If Europe is to regain ground against the US this decade, they should have further to run over the long term.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China