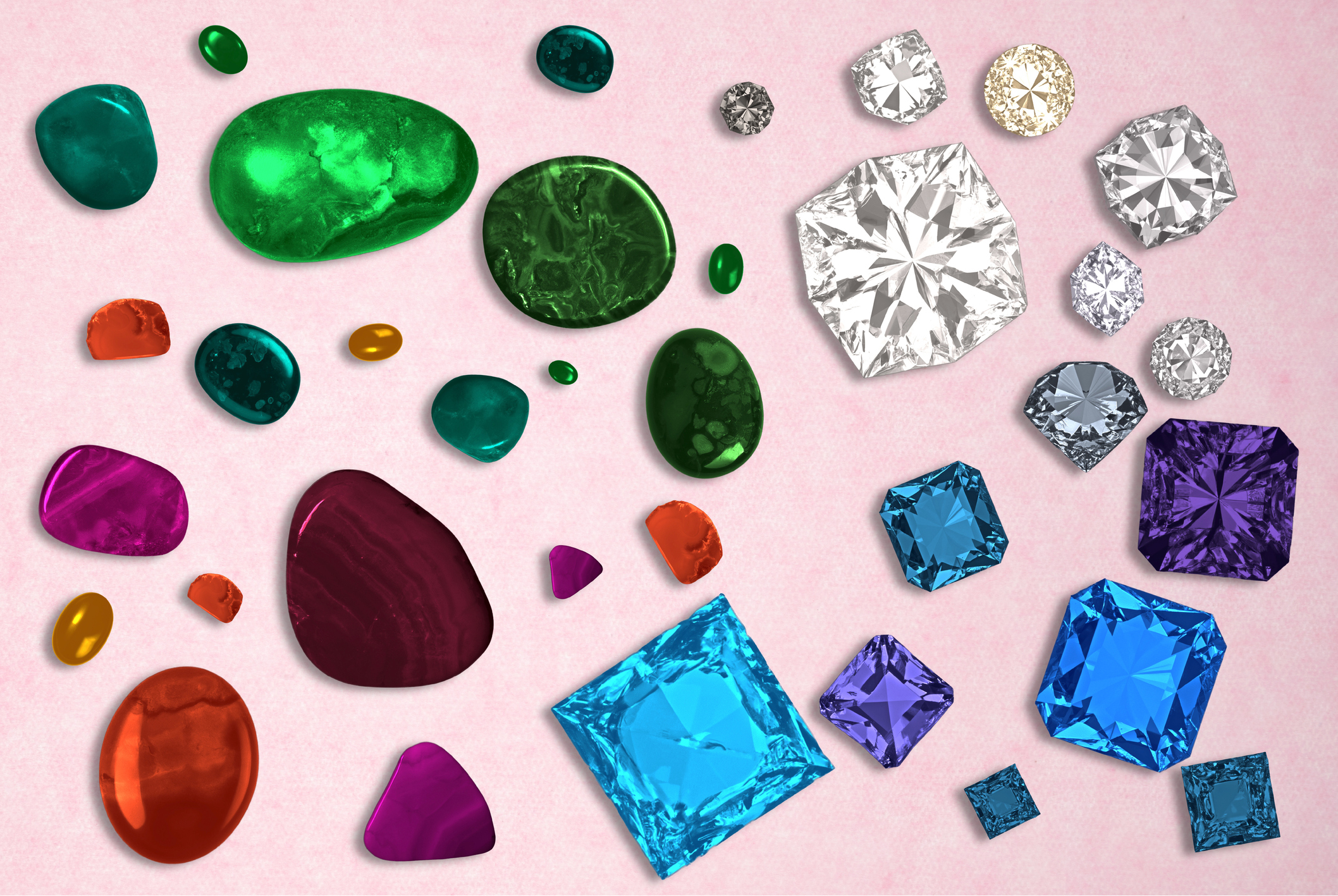

Could colour diamonds add a sparkle to your portfolio?

Diamonds of various shades never go out of fashion, says Chris Carter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The rock now gracing Taylor Swift’s finger, along with US president Donald Trump’s doubling of tariffs on goods from India, has given a welcome boost to the diamond industry. Swift’s engagement lifted the shares in some listed jewellery retailers, while India cuts and polishes most of the world’s diamonds – and Americans are the biggest consumers of diamond jewellery, as Jinjoo Lee notes in The Wall Street Journal. But the lift to diamond prices is unlikely to last much longer than Swift’s wedding cake. That’s because the rise of an almost unlimited supply of synthetic colourless diamonds has tarnished the industry. Colour diamonds, on the other hand, have proved much more resistant.

That’s down to a number of factors, not least of which is the rarity of colour diamonds relative to colourless ones. Only around 0.01% of gem-quality mined diamonds are colour diamonds of the “fancy” type (a measure of the intensity of colour in the Gemological Institute of America [GIA] grading system). They are vanishingly rare. And, naturally, every single one is a little bit different, not only because of the varying sizes, hues, tones and saturations, but also because of the presence of imperfections within the diamonds, known as “inclusions”. So, tracking valuations for colour diamonds is tricky. But with that caveat in mind, prices for fancy colour diamonds have grown at a compound annual rate of 5.7% a year for the past two decades, according to the Fancy Color Research Foundation (FCRF).

How much has the most expensive colour diamond sold for?

This summer, a 10.38-carat pink diamond once owned by Duchess Marie-Thérèse d’Angoulême, the only surviving child of the ill-fated French queen Marie Antoinette, sold for almost $14 million with Christie’s in New York. The record of the most expensive colour diamond ever sold at auction also belongs to a pink gem – the 59.60-carat Pink Star, which fetched $71.2 million with Sotheby’s in Hong Kong in 2017. These prices are not surprising when you consider the lengths to which nature has gone to make them.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Diamonds are created under immense pressure deep underground over millions, if not billions, of years. Yellow diamonds – the most common, although still incredibly rare – contain nitrogen, while blue diamonds contain boron and black diamonds graphite. But pink diamonds get their colour not from impurities, but from the extra stresses they received during their formation that altered their lattice crystal structure. The same goes for red diamonds, which are really just an extension along the colour scale of pink diamonds. They are the rarest of all, and only a handful exist in the world. And since the closure of Rio Tinto’s Argyll mine in Australia in 2020 – which had been responsible for 90% of the world’s supply of newly mined pink diamonds – no more or very few are now coming onto the market. Small wonder, then, that, last month, police in Dubai arrested a gang of thieves who had gone to great lengths to steal a 21.5-carat pink diamond. It had been valued at $25 million.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton