A blow-out month for watches

A changing market for watch collectors is putting new brands in the spotlight. Chris Carter reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It has been a blow-out month for watch sales and the fun’s far from over. Christie’s and Sotheby’s in Geneva have sold CHF22.8m (£18.5m) and CHF15.2m (£12.3m) of collectable timepieces respectively. And Phillips in association with Bacs & Russo, a consultancy, stole the show with CHF68.2m (£55.2m) raised at its recent “Geneva Watch Auction: XIV”, almost doubling the previous record high for an auction total.

Several other records went along the way at the Phillips auction, including the highest price for a watch from an independent watchmaker – the Philippe Dufour Grande & Petite Sonnerie in yellow gold wristwatch sold for CHF4.8m (£3.9m). Watches by Omega, Roger Smith, and Christian Klings also all fetched record-high prices. All of the watches on offer found buyers – a rarity known in the auction world as a “white glove” event.

That could be because more are turning up, says senior consultant Aurel Bacs. “One sometimes wondered if the auctioneers weren’t on the tribune of a UN assembly, with 3,000 participants coming from 84 countries,” he said. “[It] felt from the rostrum that there is more volume and depth in the watch market than ever before, with competitive and active bidding coming in from all around the world.”

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Collectors are also getting younger, notes Carol Besler in the Robb Report. Sotheby’s reported that 31% of its bidders were new faces, and 38% of the total were under 40 years. One effect of this demographic change is that what constitutes a “grail” watch, such as a Patek Philippe or a Rolex, is being redefined, with independent makers “starting to see soaring numbers”, some of which represent new designs.

What to bid for next

Next up in the auction calendar this month is Phillips’ “The Hong Kong Watch Auction: XIII”, 25-26 November. The top lot is the unique Patek Philippe Ref. 3448/100 “The Blue Royale” platinum perpetual calendar wristwatch (pictured, top and above) with sapphire-set indexes and moon phases, from around 1973. Patek Philippe’s groundbreaking reference 3448 was first introduced in 1962 as the world’s first self-winding perpetual calendar wristwatch, a unique feature it claimed all to itself for the following 16 years. The watch for sale is the only known example to have sapphire-set indexes around the dial. It is expected to fetch HK$10m (£960,000).

Another highlight from the sale is an auction debut for a Rolex Daytona reference 6241 yellow gold chronograph wristwatch with a “Paul Newman John Player Special” dial, known as “The French JPS”, from around 1968. One of the rarest Daytonas ever produced, it is valued at up to HK$9.4m (£900,000). On 27 November, in Hong Kong, Christie’s is auctioning a Patek Philippe split-second chronograph Ref. 1436 in yellow gold, made for US banker and watch collector Henry Graves Jr in 1946. It has been given a high estimate of HK$23.5m (£2.3m).

A watch for book lovers

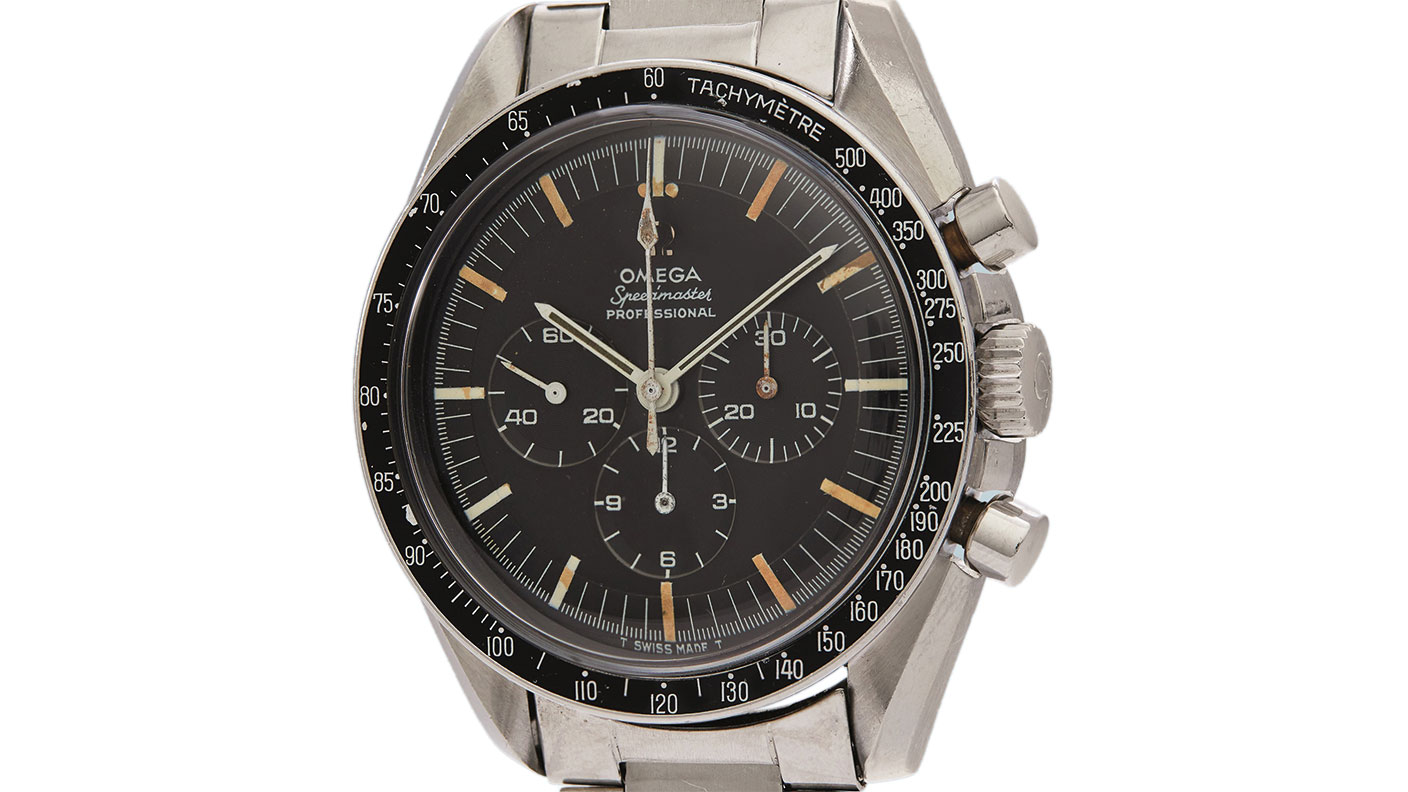

A 1968 Omega Speedmaster Professional, reference 145.012-67 SP, worn by American novelist Ralph Ellison, will be auctioned in New York on 12 December with Phillips. Invisible Man was the only novel Ellison published in his lifetime, in 1952. In it, Ellison’s nameless narrator chronicles “the black experience in America of being ‘invisible’ to society at large – as if the black experience takes place in a parallel universe that only overlaps American society in acts of violence, oppression, and exclusion”, says Jack Forster on Hodinkee. The book is “one of the 20th century’s most revered works of American fiction”.

And for lovers of literature, that only adds to the Speedmaster’s lustre. “Watches are terribly personal things,” says Gary Shteyngart in The Wall Street Journal. “How many times a day had Ellison looked down at the same dial and rushed toward an appointment, a dinner, a drink, or toward the humidor to light one of the cigars with which he was perpetually acquainted?”

Ellison owned the watch until his death in 1994, aged 81. The Speedmaster was resold in 2016, along with two other watches, at an auction in New York for $6,000. “That’s the sad part”, the watch’s consignor, collector Ted Walbye, tells Shteyngart. “If it was a major celebrity like Marlon Brando or Paul Newman, it would have so much cachet in terms of pop culture.”

For a watch owned by one of America’s greatest 20th century writers, you’d think it would command a high price, says Forster. But it carries an estimate of only $10,000 to $20,000. “It looks like there’s a chance that a Speedmaster with the most important literary provenance I can ever recall for a timepiece at auction might go for a song.”

Auctions

Going…

Check your change, says Marc Shoffman in The Sun. There are hundreds of online listings for rare Kew Garden-themed 50p coins, with some having sold for up to £700 on Ebay. The Royal Mint released 210,000 of the limited edition 50p coins, depicting the Chinese pagoda at Kew Gardens, in 2009 to mark the 250th anniversary of the Royal Botanic Gardens. Their rarity means they have topped the latest 50p scarcity index from tracking service Change Checker. By comparison, ten million Brexit 50p coins entered circulation last year, bearing the inscription “Peace, prosperity and friendship with all nations”. Other coins are also in demand. Last week, a rare Lord Kitchener £2 coin, from 2014, fetched £1,200.

Gone…

Rumours of the existence of a mint condition “no H” penny from 1882 had circulated among coin collectors for over a century, says David Brown in The Times. Some called it a myth. The Victorian penny’s (pictured) allure stems from a peculiarity in its design. Almost all pennies struck that year came from the Heaton Mint in Birmingham and featured an “H” for Heaton below the Britannia emblem. But a small number of “no H” pennies were also minted in London, with somewhere between 16 and 50 thought to exist. Most are in “fair condition”. However, in the summer, an elderly collector appeared at London auction house Baldwin & Sons, bearing the mint condition penny. It sold last week for £37,200.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton