Collectables: a busy month for watch lovers

A number of rare and valuable timepieces are up for grabs this November. Chris Carter reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

November is going to be a busy month for watch collectors. Auction house Phillips, in association with Bacs & Russo, a watch consultancy, is holding two high-profile sales in Switzerland. The first, “The Geneva Watch Auction: XIV”, on 5 and 7 November, promises to be a showstopper. Top billing goes to an “astonishingly well preserved” Patek Philippe wristwatch reference 2499 from 1952 (pictured). This first series example in yellow gold bears the stamp of its Venezuelan retailer, Serpico y Laino, on the bracelet and comes with a CHF4m (£3.2m) high pre-sale estimate.

Given its “unparalleled” rarity, according to Phillips, it may come as a surprise to watch aficionados, who previously had no idea this particular watch existed, that there is also a second previously unknown 2499 for sale. Both are perpetual calendar chronographs (meaning a watch that displays calendar information while also having the ability to record time); the second 2499 is a second series with a “superb dial”. It is expected to sell for at least CHF800,000 (£630,000). Rare pairs of watches appears to be a theme. Phillips is also offering a fascinating and highly desirable Rolex “Deep Sea Special” (see below); as is Christie’s in Geneva on 8 November.

The Michelangelo of watches

Four Grande & Petite Sonnerie watches by Swiss watchmaker Philippe Dufour, which chime the hour and quarter hour depending on whether they are set to “grande” or “petite sonnerie” mode, are among the other highlights of the Phillips auction. “To us and a huge community around the world, Philippe Dufour is the horological equivalent of Michelangelo,” say senior consultant Aurel Bacs and Phillips watch specialist Alexandre Ghotbi. “The importance of his work cannot be overstated.” Dufour began making his Grande Sonnerie pocket watches in the early 1980s, before miniaturising the movement to be able to fit on a wristwatch, of which five with white enamel dials were made. The yellow gold version of the wristwatch is the most valuable of the quartet up for sale, valued by the auction house at up to CHF2m (£1.6m).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A sale of incredibly rare pieces

Collectors will also be keeping their eyes on a complete set of five “incredibly rare” and “historically relevant” F.P. Journe “Souscription” N°1 watches. New to the market, these watches were sold to existing clients and friends of watchmaker François-Paul Journe under subscription, in order to finance the creation of his own brand in 1999. “[He] is certainly one of the most talented watchmakers of his generation… [whose] creations have gained incredible traction,” say Bacs and Ghotbi. Collectors would appear to agree. Sotheby’s in Hong Kong held its “Important Watches” sale last week, at which a F.P. Journe Tourbillon Souverain “Souscription” wristwatch sold for almost HK$16m (£1.5m). A yellow gold Patek Philippe 2499 first series of the kind mentioned above, that had been restored in the early 1990s, also made its market debut at the Sotheby’s auction. It fetched HK$9.9m (£930,000).

The Holy Grail for Rolex collectors

The Deep Sea Special, two of which are appearing at auctions with Phillips and Christie’s in Geneva next month (see above), is “something of a Holy Grail among Rolex collectors”, says James Stacey for Hodinkee. It is famous for being able to survive a trip to the bottom of the ocean. In 1953, Rolex set out to design a watch that could reach depths in excess of 35,000 feet below the waves without being crushed. That’s easier said than done, says Stacey. “Humans can’t simply dive that deep, or really anywhere close.” It’s the height of a commercial airliner at cruising altitude, but inverted. After many years of test dives, on 23 January 1960 Rolex finally strapped the Deep Sea Special to the side of the Bathyscaphe Trieste, a submarine crewed by US Navy Lieutenant Don Walsh and Swiss oceanographer Jacques Piccard, and waited as their watch descended to the bottom of the Mariana Trench in the Pacific, the deepest place on Earth.

The Deep Sea Special reached a depth of 35,787 feet – and survived. That particular watch is now on display at the Smithsonian Institution in Washington DC. But Rolex made 35 commemorative versions in 1965, says Bryan Hood in the Robb Report. The integrated bracelet combines stainless steel and gold, while housed beneath a gigantic domed crystal is a black dial with gold markers. On the back of the case, the date of the dive and its water-resistance rating is etched. Examples of the commemorative Deep Sea Specials have only appeared at public sale five times – on the last occasion one sold for HK$3.4m with Christie’s in Hong Kong (£262,000 at 2009 rates). This time both examples should sell for more. Phillips has placed a CHF2.4m (£1.9m) high estimate on theirs.

Auctions

Going…

Around 800 items that belonged to the British singer Amy Winehouse, who died in 2011, will be up for sale with California-based Julien’s Auctions on 6-7 November. Winehouse’s parents have decided to let her personal and professional possessions go and at prices that give her fans a chance to buy something, the auction house’s Martin Nolan tells Reuters. Most of Winehouse’s dresses are priced at $2,000 to $4,000; opening bids for belts, perfume, shoes, ballet slippers, guitars and drum kits start as low as $50. The green and black figure-hugging halter dress by Naomi Parry that Winehouse wore at her last stage performance, in Belgrade a month before her death at the age of 27, is expected to sell for at least $15,000.

Gone…

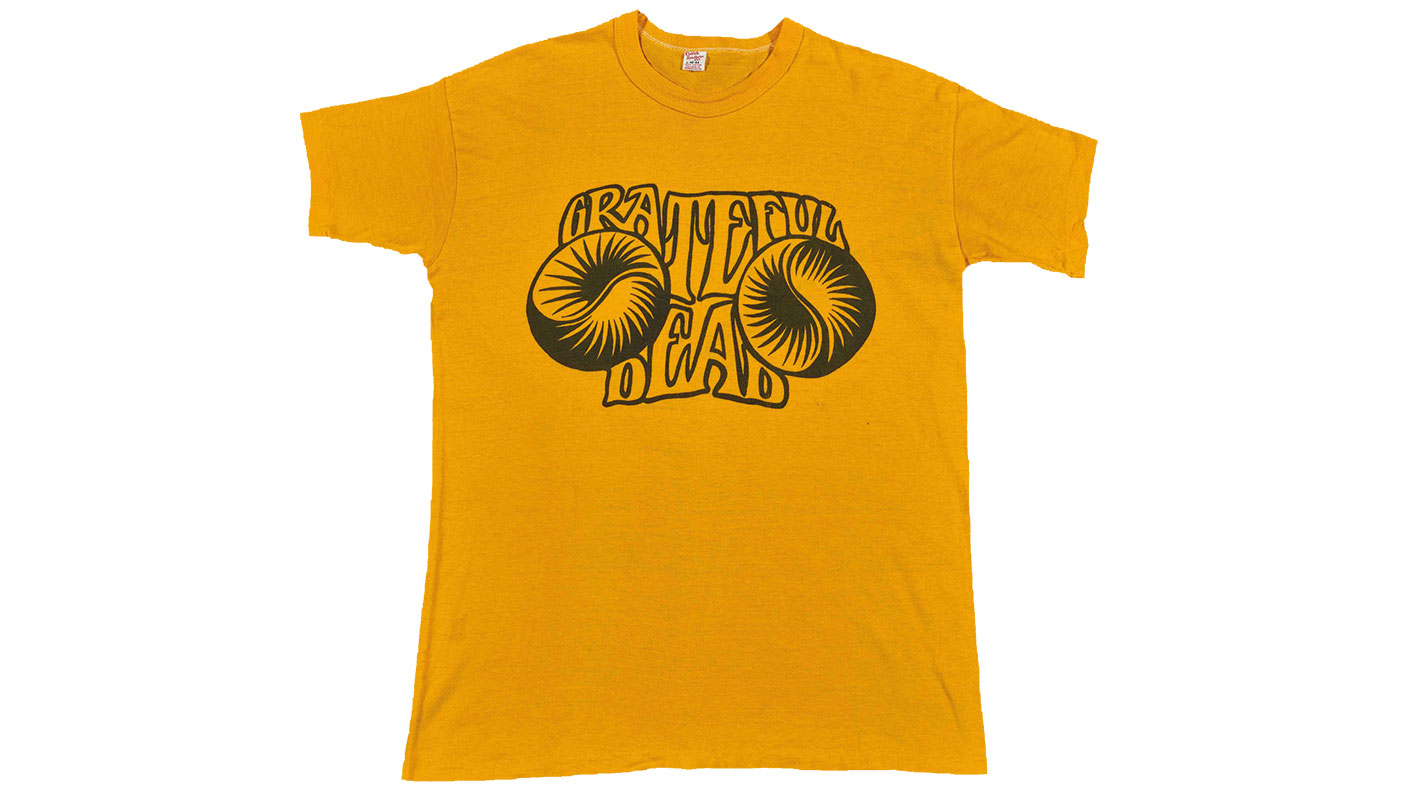

A vintage Grateful Dead t-shirt from 1967 sold at auction with Sotheby’s in New York last week. Designed by Allan “Gut” Terk, who was a key figure in California’s counterculture in the 1960s, the item is one of the earliest official t-shirts produced for the iconic rock band. The previous auction record had been held by a Led Zeppelin t-shirt from a 1979 show at Knebworth, Hertfordshire, which fetched $10,000 on eBay in 2011, says NME. That record was smashed by the Grateful Dead t-shirt, which sold for $17,640.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton