Art auctions bounce back as rare Leonardo da Vinci sketch sells for £8.9m

A rare Leonardo da Vinci drawing shows up at auction – and goes under the hammer for £8.9m. Chris Carter reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Last Thursday, a drawing of a bear’s head by Leonardo da Vinci sold for almost £8.9m with Christie’s in London, setting a new record price for a drawing by the artist. The previous record of £8.1m, for a drawing of a horse and rider, had been set two decades ago. But that’s understandable given that only a handful of drawings by the Renaissance master are still in private hands. They seldom appear at auction. Measuring just 7x7cm, da Vinci drew Head of a Bear in the early 1480s using a technique called silverpoint, where a stick of silver, rather like a proto-pencil, is carefully applied to a specially prepared piece of paper. But unlike a pencil, silverpoint doesn’t permit mistakes, so it requires a fine, delicate touch. Da Vinci learnt the technique while still in his youth from his mentor, Andrea del Verrocchio, himself a leading artist in Florence at the time. With it, da Vinci was able to undertake his famous detailed anatomical studies of the natural world.

Flemish painter Peter Paul Rubens was another, later, Renaissance artist, who regularly sketched the world around him. While on a tour of Italy in the early 1600s, Rubens filled the pages of what came to be known as his Theoretical Notebook with notes and drawings that served to develop his technique as an artist. The notebook later passed to André-Charles Boulle, cabinet-maker to Louis XIV of France. While in his possession it was lost in a fire in 1720 – all except for, it was believed, a couple of pages. Recently, a pen-and-ink drawing of a satyress reaching for a herm (a bust used as a marker) of the Greek god Pan, bought on a hunch in a small French sale for a few thousand euros, was compared to later copies of drawings from the notebook made before it was destroyed. Experts proclaimed it a missing original, and with that the buyer’s hunch paid off handsomely. This third surviving page fetched just over half a million pounds with Sotheby’s in London last week.

Authentication can bring riches, but it can also bring headaches for collectors eager to cash in. In 2016, French auction house Tajan valued a drawing depicting the martyrdom of Saint Sebastian, made around the same time as Head of a Bear, at up to €30,000. It was one of a box of drawings given to “Jean B” in 1959 as a present from his father for passing his medical exams. Yet one auctioneer, Patrick de Bayser, was intrigued by diagrams and notes written in mirror-writing on the reverse. The drawing had also been executed by a left-handed artist. His suspicions were confirmed by Carmen Bambach, a curator at the Metropolitan Museum of Art in New York and a leading expert on da Vinci. Here was a lost Leonardo, valued at around €15m. At that point, the French government offered the doctor €10m for it. He refused and the culture ministry refused an export licence, claiming it could have been stolen. The drawing is now at the centre of a legal drama soon to be played out in Paris.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Art auctions bounce back

It’s not just Old Master drawings that have commanded huge sums recently (see left). Modern art has too. Sales of British, impressionist, modern and contemporary art in London with Sotheby’s this summer made a combined £156.2m, the strongest results from summer sales with the auction house since 2018 and a sign that collectors’ appetites have returned following last year’s lockdowns. “After a year like none other, summer in London is firmly back, revitalised, and looking to a bright future,” says Sotheby’s expert Alex Branczik.

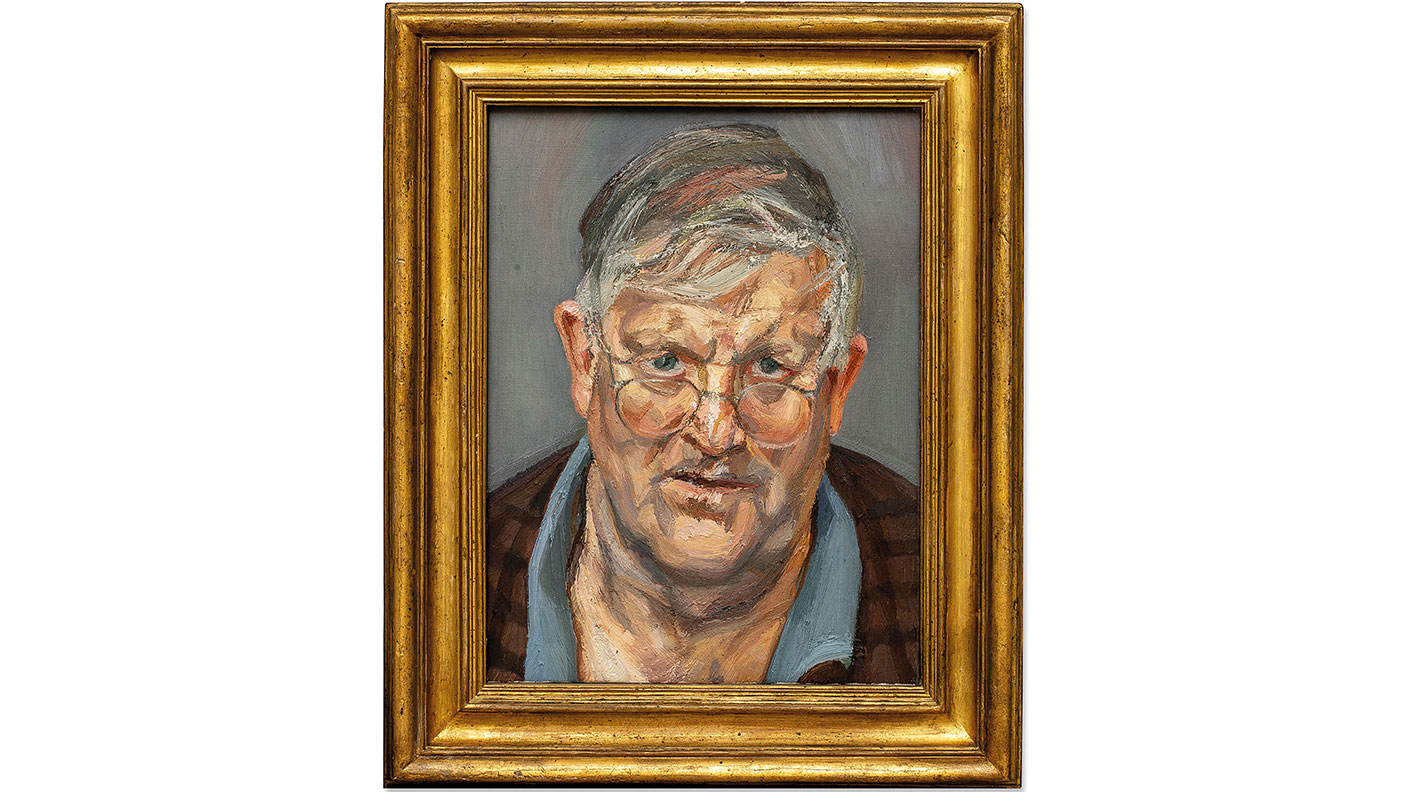

Tensions calmées by Wassily Kandinsky (1937) led the way this season, selling for £21.2m, while Lucien Freud’s portrait of fellow British artist David Hockney (pictured), painted in 2002, fetched £14.9m.

Sales at Christie’s, Sotheby’s and Phillips, the global “big three” auction houses, in the first half of 2021 hit $5.9bn, a rise of 230% over the same Covid-19-stricken period of last year, but also 3.5% up on the first half of 2019, according to London-based art market analysis firm ArtTactic. The value of online sales rocketed to $670.6m so far this year compared with the first six months of 2020, representing a gain of 70% – an 870% rise over the value of online sales in the first half of 2019. The shift online seems here to stay. Auction houses have “started to embrace digital fully and not just as an ad hoc alternative”, ArtTactic’s founder and managing director, Anders Petterson, tells Barron’s Penta.

Impressionist, modern, post-war, and contemporary art “has emerged as the titan of the auction market”, notes ArtTactic’s report; jewels and watches have also performed strongly so far this year. Perhaps there has been no greater change, however, than in the rise of digital art, with non-fungible tokens (NFTs) still making waves.

Auctions

Going…

A Patek Philippe Ref. 5711/1A-014 Nautilus, with its olive-green dial, is one of the most sought-after watches released this year, and one is heading for auction with Antiquorum in Monaco on Wednesday. The new model is a replacement for the discontinued blue-dial Ref. 5711/1A-010 to “help tamp down the outrageous secondary market for the Nautilus”, says Bryan Hood for the Robb Report. “So much for that. Less than three months after its release, the green dial is all but impossible to find and selling for up to ten times its $34,893 retail price.” The watch has a pre-sale estimate of between €60,000 and €180,000.

Gone…

A unique 18k gold Patek Philippe Ref. 3448 “Alan Banbery” automatic perpetual calendar wristwatch with English calendar, leap year indication and “no moon” (pictured) was the standout sale from this year’s spring watch season, says Christie’s. Banbery was one of the most influential figures at Patek Philippe from 1965 and keeper of the watchmaker’s private collection. The watch, made in 1970, “can be described, without exaggeration, as one of the most famous wristwatches in the world”, the catalogue note enthuses. It sold for almost HK$29.1m (£2.7m) in Hong Kong in May, setting a new record for the 3448 model.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

UK unemployment hits highest level since 2021 – will interest rate cuts follow?

UK unemployment hits highest level since 2021 – will interest rate cuts follow?UK unemployment reached its highest rate in almost five years by the end of 2025. Is AI to blame and will the Bank of England step in with an interest rate cut in March?

-

Did UK inflation fall in January?

Did UK inflation fall in January?After rising in December, analysts expect the next round of UK inflation data to show that disinflation returned in January

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton