Fans open their wallets for tennis memorabilia

Roger Federer’s old clobber could be yours, along with a host of other tennis memorabilia. Chris Carter reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Wimbledon got under way on Monday. But this year, more money looks set to be made in the auction room with tennis-related sales than on the court. Last week, an auction of 20 items of tennis memorabilia from the record-breaking career of Swiss great Roger Federer raised £1.3m for Federer’s charitable foundation with Christie’s in London. The signed outfit and racket Federer used during his triumph over Spain’s Rafael Nadal in the 2007 Wimbledon final smashed its £50,000 estimate to sell for £187,500, as did the outfit Federer wore for his French Open victory in 2009. “Every item [reminds] me of great moments of my career so far,” Federer said ahead of the sale. It turned out he wasn’t the only one, with buyers handing over four times the combined pre-sale low estimates.

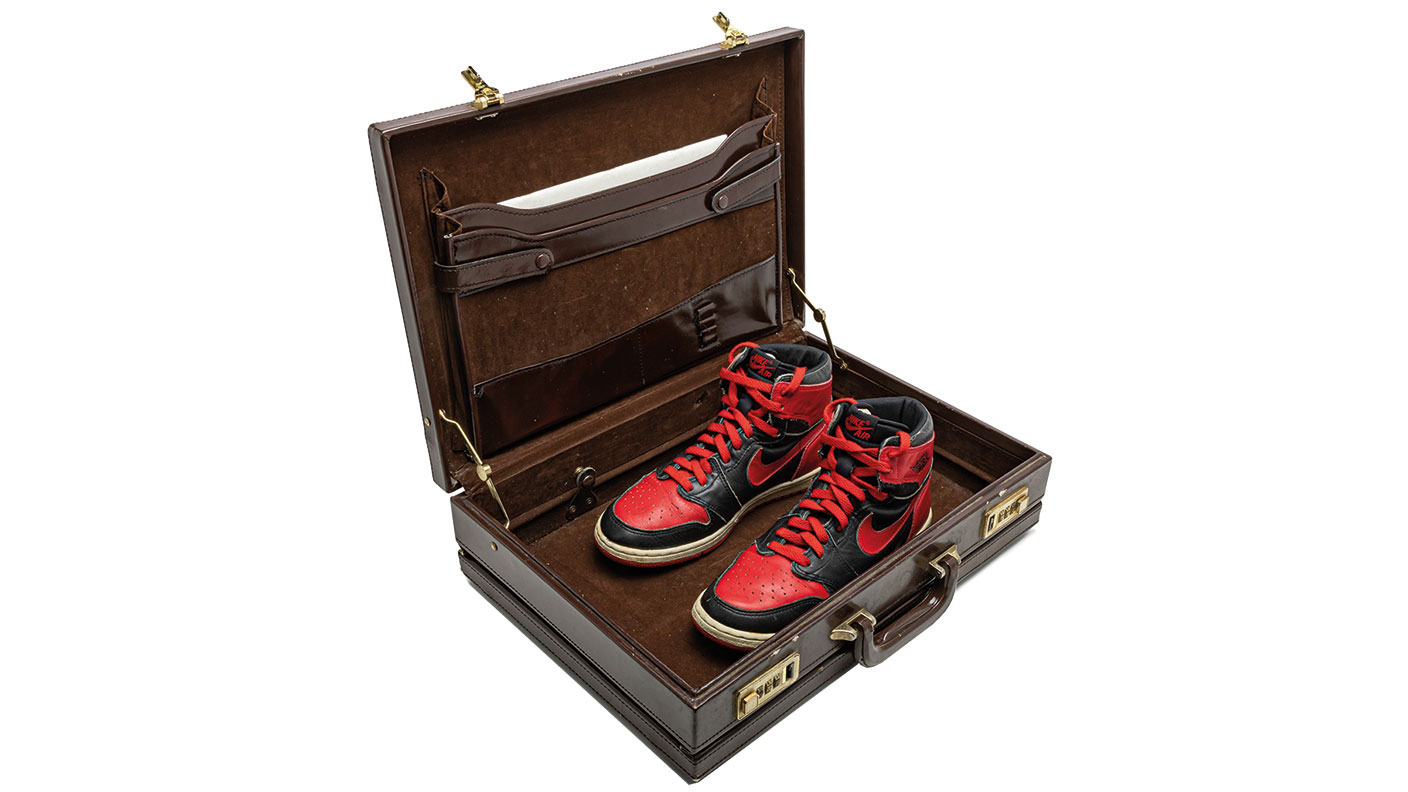

The sale now moves online until 14 July with a further 300 items, including the 2014 Air Jordan Nike trainers that Federer designed with basketball legend Michael Jordan (see below). Federer wore the trainers, branded with Federer’s “RF” logo, at the US Open that year. “You really don’t want to lose when Michael’s sitting in the stands,” he joked afterwards, according to Christie’s magazine. “The pressure was on.” The shoes are expected to sell for upwards of £40,000. Not all of the lots have such high estimates, however. A signed “RF” tournament cap from Brisbane, Australia, in 2016 had a starting bid of just £100.

NFTs: an auction of moments

Another tennis-related charity auction will be taking place in November in aid of the foundation set up in 2014 in memory of Elena Baltacha, the late British number one, who died from cancer, aged 30, says BBC News. Proceeds from the Love All auction will go towards cancer research and screening as well as helping to bring disadvantaged children into the sport. The Murray Play Foundation, set up by Baltacha’s tennis coach, Judy Murray, will be one of the beneficiaries, setting up tennis programmes for disadvantaged communities from around Dunblane, in Scotland.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Murray’s son, two-time Wimbledon champion Andy, is behind the sale of what is perhaps the oddest piece of tennis memorabilia this week – “the moment” he won the tennis championship for the first time, in 2013, as a non-fungible token (NFT). The buyer won’t own the copyright of the video footage, “but a crypto asset that refers to a video of the moment”, says Elizabeth Howcroft for Reuters. The auction is being hosted today on Wenew, the online NFT marketplace set up by Mike Winkelmann, AKA Beeple, the artist, who in March sold his digital artwork, Everydays: The First 5000 Days, for $69.3m with Christie’s. But that’s not all the buyer is getting. Also included with the lot are a pair of VIP Centre Court tickets to next year’s Wimbledon men’s final, a chance to play tennis with Andy Murray and signed souvenirs. If that sounds like too much of a stretch, the auction also includes 20 NFTs of the moment Murray lifted his trophy at $4,999 each, 50 of his post-win interview for $499 each, 100 of his interview after his 2012 Wimbledon loss for $99 each, and 500 of a video of 2013 Murray highlights at $49 each. Buyers can even pay in cryptocurrency ether.

Sniffing out the best trainers

In April, a pair of rapper Kanye West’s “Grammy Worn” Nike Air Yeezy 1 Prototypes sold for $1.8m in a private sale with Sotheby’s. That was almost three times the previous record for the most expensive pair of trainers, set last year when a pair of Michael Jordan’s first-ever Air Jordan 1s, from 1985, sold for $560,000 with Christie’s. Sherlina Nyame, the biggest “influencer for sneakers” on the internet, is paid up to £10,000 a post on social media by brands Nike, Puma and Adidas, according to The Times. She has already made £100,000 so far this year, and if she were to sell her collection of 500 pairs of trainers, the 31-year-old says she could raise the deposit on a four-bedroom house in London.

The Air Jordan 1 High “Black/Red” trainers from 1984 were a Nike salesman’s sample used to sell the design, worn by Michael Jordan the following year, and were up for auction this week. Given how much those later pairs sell for, “it’s hard to imagine there was ever a time when a retailer would have had to be convinced to carry Nike’s Air Jordans”, says Christie’s. The trainers are in a “lightly worn condition”, suggesting they were tried on by employees and customers in the mid-1980s. Any who did slip them on but didn’t buy will be wishing they had. The pair were expected to sell for at least $22,000. Another early development sample pair in the sale was valued at up to $160,000. Meanwhile, eBay has hired a team of trainer-sniffers in London for shoes sold for over £150. They can establish whether a cheap glue has been used, a sure sign of a fake pair. As Grace Gausden notes on This Is Money, with the market in trainers worth $6bn globally forgeries “can be problematic for collectors who treat sneakers as an investment piece”.

Auctions

Going…

In a further sign of cryptocurrencies’ entry into the mainstream, Sotheby’s has said it will accept bitcoin or ether, not for some abstract piece of digital art, but “for one of the earth’s rarest and greatest treasures”. The 101.38-carat pear-shaped D Flawless diamond (pictured) for sale is the second-largest pear-shaped diamond to appear on the public market. It is expected to fetch over HK$78m (£7.2m) at auction on 9 July in Hong Kong, as part of Sotheby’s inaugural “Luxury Edit” sale series in Asia. Sotheby’s, working with cryptocurrency exchange Coinbase Commerce, notes that it is the first physical object with a valuation of at least $10m to be offered at auction in exchange for cryptocurrency. Although, not surprisingly, Sotheby’s will also happily take boring, old cash.

Gone…

A 54.03-carat brilliant-cut pear diamond, dubbed the Chrysler Diamond, fetched just over $5m at the Christie’s Magnificent Jewels sale in New York last month. The diamond had belonged to socialite Thelma Chrysler, the daughter of the railroad and car magnate Walter Chrysler. A year after her early death in 1957, jeweller Harry Winston purchased what was then known as The Louis XIV Diamond, and cut the diamond down from 62 carats. Although its exact provenance is unknown, it was thought to have been mined inIndia and may have been brought to France by famed gem merchant Jean-Baptiste Tavernier. Today, the gem sits as the centrepiece of a pendant of 43 brilliant-cut diamonds.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward