Rare book collecting booms in lockdown

The trade in rare books has taken off during the pandemic, says Chris Carter.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The market in very rare books is doing a roaring trade in spite of the pandemic – or perhaps even because of it. “Rich people are still rich, and they’re still spending serious amounts of money on things that bring them joy – and, perhaps, a return on investment later,” says James Tarmy on Bloomberg. “[The] consensus among dealers is that the overall market has sustained itself even as the rest of retail has been thrown into turmoil, and that the peak of the market has soared past many participants’ expectations.”

The sale last month of a “first folio” edition of William Shakespeare’s collected plays from 1623, just seven years after Shakespeare’s death, is a case in point. Christie’s in New York had expected it to sell for at least $4m, but it ended up going for $10m. Granted, this was a particularly fine example of which only five complete copies are in private hands, as the auction house notes. The last time a complete first folio came onto the market was with Christie’s in New York in 2001, when it sold for $6.2m – a record until last month.

It’s not that Covid-19 took the rare-book trade online – that trend had already been going on for a while – but lockdowns have accelerated it. And that may be keeping a lid on some prices. “Take, for instance, a first printing of the first edition of William Faulkner’s As I Lay Dying,” says Tarmy. A Faulkner fan sees it in a shop for $11,000. They then go online and visit Abebooks, a specialist trader, where they find a dozen examples ranging in price from $1,500 to $12,500. “Not only does the $11,000 volume not sell, the potential buyer might question the logic of buying the book at all.” So, prices of “super-rare” books have been rising for some time, while “everything else had fallen off a cliff”. Then again, when something like a Shakespeare first folio sells for $10m, it encourages other rare works to come onto the market.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Witness Isaac Newton’s celebrated 1687 tome Philosophiae Naturalis Principia Mathematica. A hunt for forgotten copies, led by Mordechai Feingold, a professor at the California Institute of Technology, has just uncovered 386 copies, scattered across 27 countries. Previously, a copy had changed hands for $3.7m in 2016, making it the most expensive science book sold at auction. Others tend to sell for up to $600,000. But the newly discovered copies aren’t expected to soften the market, as Adam Douglas of Peter Harrington Rare Books tells The Times. “If anybody says, ‘I’m collecting science, the great works’ – well, they have to have the Principia.”

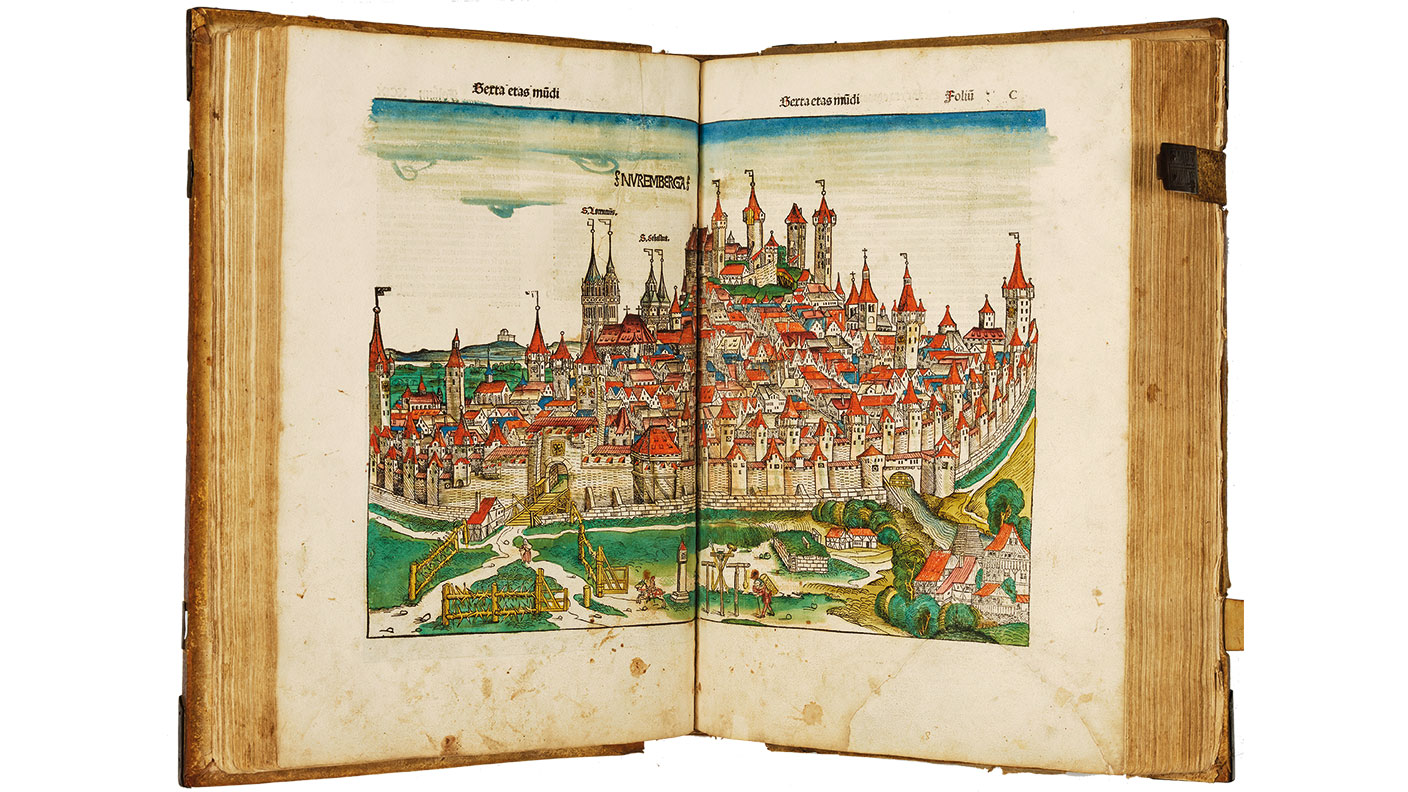

A rare book from 1493

Books dating from the dawn of printing in Europe, when Johannes Gutenberg introduced moveable type in 1439, to around 1500, are known as incunabula. The “most lavishly illustrated and beautiful” of these is the Nuremberg Chronicle (1493), says Bonhams. One rare hand-coloured first edition is expected to fetch $200,000-$300,000 at auction in New York on 11 December. “First editions of the Chronicle in their original binding with contemporary hand-coloured illustrations very rarely appear on the open market,” says Bonhams specialist Ian Ehling. “This wonderful copy is already exciting much interest among collectors.”

Selling the family silver

Rugby School in Warwickshire raised £775,000 last week from a sale of rare books. A second edition of Shakespeare’s Comedies, Histories, & Tragedies (1632) fetched the most with Forum Auctions in London – £48,000 before fees. And a fourth folio from 1685 fetched £38,000. The school’s head, Peter Green, said the decision to sell had been made to help preserve the books and raise money.

Not everyone agreed. “It’s terrible. I would never dream now of leaving anything to that school because they would just flog it,” A. N. Wilson, the writer and a former pupil, told the Daily Mail ahead of the sale. Professor Michael Dobson, director of the Birmingham University Shakespeare Institute, agreed: “[The books] are likely to go into a private collection and be treated as investments and will end up somewhere where other people are not able to look at them.”

The Royal College of Physicians (RCP) has put on hold plans to sell rare books to plug a £3m hole in its finances after meeting similar resistance. But what are Covid-19-hit institutions to do? “Certainly selling off the family silver… is not always judged beyond the pale,” says Vanessa Thorpe in The Observer. The Times takes a firmer line. “Institutions granted museum status are forbidden from selling assets to fund short-term deficits,” the paper points out in the case of the RCP. “Being stripped of such accreditation would be ignominious.”

Auctions

Going…

A hand-drawn costume design for the batsuit worn by Michael Keaton in Tim Burton’s Batman (1989) is expected to fetch up to £8,000 as part of the Prop Store’s huge auction of film memorabilia in London, beginning on Tuesday. Drawn by Oscar-nominated costume designer Bob Ringwood, the artwork has also been signed by Batman’s co-creator, Bob Kane. A painted sketch of Danny DeVito’s The Penguin for 1992’s Batman Returns, also by Ringwood, is valued at up to £6,000, while The Joker’s purple Fedora, worn by Jack Nicholson in the 1989 Batman film, is expected to sell for up to £30,000. The two-day sale’s roughly 900 iconic props and costumes should make over £4m in total.

Gone…

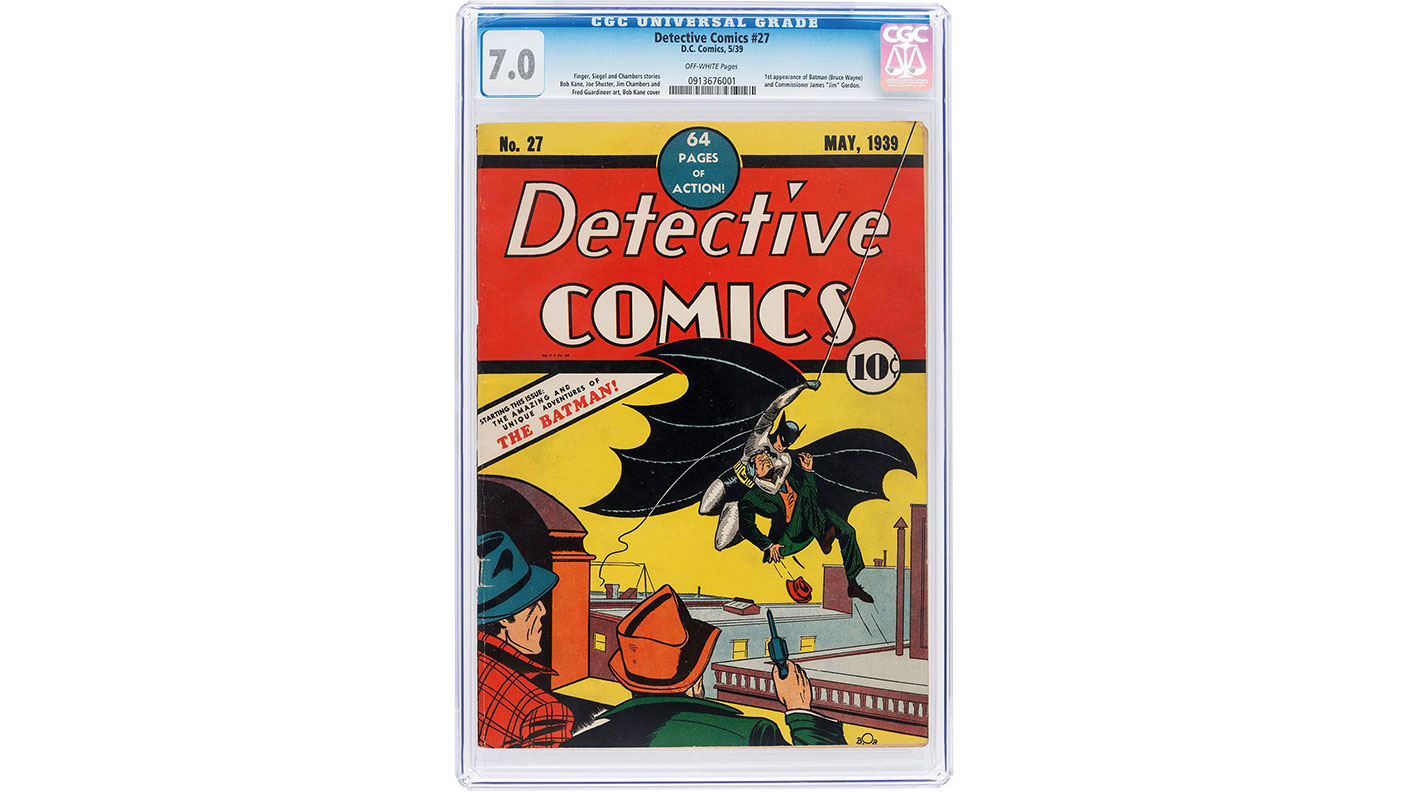

A copy of 1939’s Detective Comics No. 27 set a new record-high price for a Batman comic at auction. The issue, containing the Dark Knight’s debut, sold for $1.5m last Thursday as part of Heritage Auctions’s four-day Comics & Comic Art sale. In 2010, a copy of the same issue, in slightly better condition, fetched almost $1.1m. Last week’s sale also set a record for the most-expensive comic sold by the Dallas-based auction house, which is a specialist in the market for comics and comic art. Last November, it sold a copy of Marvel Comics No.1 from 1939 for nearly $1.3m. “I’m not at all surprised at the result,” says Barry Sandoval, Heritage Auctions vice-president. “After all, this is one of the best copies you will ever see of one of the most important comic books ever published.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward