Collectables: the Pokémon craze lives on

The generation that got hooked on Pokémon are now collecting. Chris Carter reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

“Gotta catch ‘em all!” was the war cry sung to children in the late 1990s by American singer Jason Paige. It was the theme song to the Pokémon cartoon television series and those lyrics appear to have become ingrained in a generation. The generation that grew up collecting the cards that accompanied the series have since become investors in those very same cards.

Although Pokémon cards have been increasing in value for years, the market is now hitting new highs, thanks in part to YouTube-star-turned-Pokémon-collector Logan Paul. “The celebrities jump-started it a little bit, but you could see it happening already, especially when the pandemic hit,” Sasha Tamaddon, the 22-year-old founder of the US-based collectable investment adviser Cardhops, tells Archie Bland in The Guardian. “All these people were going to their basements and looking at their cards and buying and selling because they didn’t really have anything else to do.”

The hype and the tedium

Given the hype (and the boredom), perhaps it’s no surprise that a $375,000 cash deal for a sealed box of rare first-edition Pokémon cards, broadcast live on YouTube, ended in disaster. As The Guardian reports, the buyer, Chris Camillo, a “social arbitrage investor” and one of the hosts of a YouTube channel called Dumb Money, opened the “booster box” to find it full of cards that were “commonplace, damaged, or otherwise worthless”. The three sellers, led by “blockchain entrepreneur” and Logan Paul’s “personal Pokémon consultant” Jake Greenbaum, had themselves bought the box from another seller, and vowed to secure a new box within days. Both Camillo and Greenbaum denied the transaction had been a stunt. “I don’t want exposure like this, it’s the last thing I want,” Greenbaum told the paper. “This is my reputation.”

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

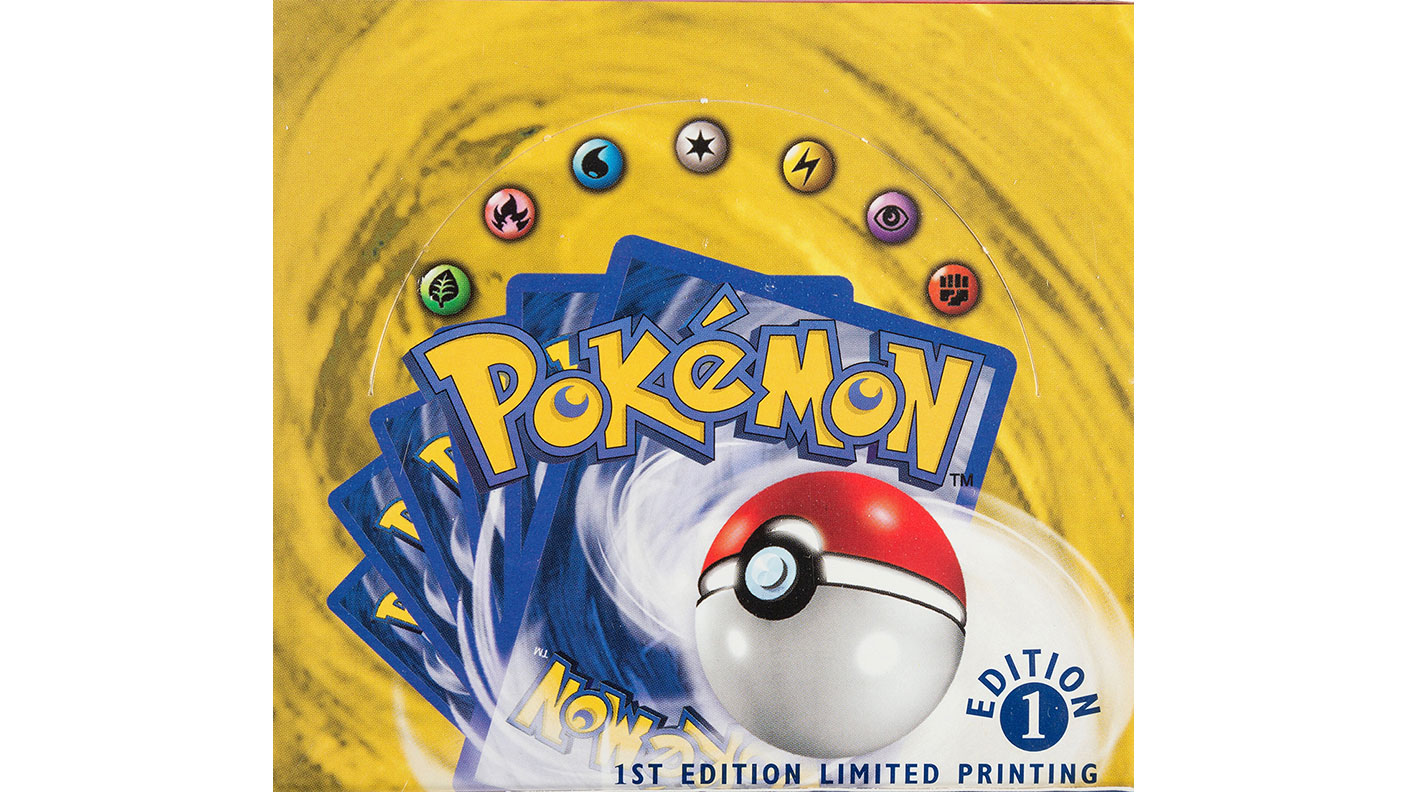

Because the cards and the booster boxes tend to be unopened to keep them pristine, authenticating them can be tricky. That’s doubly true for a collectable that’s still quite niche, even if the market for Pokémon cards is growing strongly. As always, to put the odds of buying the genuine article in your favour, it pays to buy through a reputable auction house. Dallas-based Heritage Auctions (HA) is offering a still-sealed first edition Wizards of the Coast booster Pokémon box from 1999, as part of its online Comics & Comic Art Auction from 19-21 November. It carries an estimate of $300,000.

That might seem like a lot for a box of playing cards, but a similar booster box fetched $198,000 in September, also with HA. The box contains 36 “booster packs”, each with 11 cards for a total of 396 cards. “This is an unquestionable prize for any serious Pokémon collector,” says HA’s Jesus Garcia. “This set comes from a very low print run, and to find one that is still sealed and in such great condition is extraordinarily rare.”

A £250,000 Star Wars hoard

The Pokémon craze started in the 1990s. But a decade or so before that you had Star Wars figures. This suggests that collectable children’s toys have a habit of resurfacing years down the line once the children have grown up and become nostalgic adults.

One elderly couple from Stourbridge in the West Midlands seemingly became the beneficiaries of this trend last week when a collection of Star Wars toys left to them by a neighbour sold for £250,000 with Aston’s Auctioneers. The neighbour, Peter Simpson, had spent several decades collecting the plastic figures and spacecraft before his death in December last year, says Neil Johnston in The Times. They had no idea how much the toys were worth, so their son invited in an expert to value the hoard.

Inside the dozens of bin bags Chris Aston, of Aston’s Auctioneers, found hundreds of unopened items. “A lot of them were a bit damp because of how they’ve been stored, but generally it’s the best Star Wars collection I’ve ever seen,” says Aston. The haul contained a rare Palitoy Jawa figure with a rare vinyl cape, which fetched £22,000 (before fees). The auction as a whole made £410,000 (before fees) in total – “our best sale ever in 15 years”, says Aston. Sadly, it was also the last sale for the auction house, which is closing “having been badly affected by the lockdown earlier in the year”.

Auctions

Going…

An ancient British gold stater coin, dating from 43AD, just prior to the Roman invasion of Britain, is expected to fetch at least £24,000 with Chris Rudd of Norwich on Sunday. It depicts Caratacus, a ruler of the Catuvellauni tribe, riding naked on horseback with a shield and javelin, and bears the inscription “CARAT”, for his name. The other side is inscribed with “[C]VNO”, short for Cunobelinus, Caratacus’s father, with an ear of barley. The coin was found last November in a field near Newbury, Berkshire, 20 miles from where it was minted at Calleva Atrebatum (Silchester) and it has been described as “the most important single Iron Age coin ever found” in Britain. Caratacus and his brother, Togodumnus, fought the Romans in modern-day southern England, before retreating to what is now Wales. He was eventually captured and taken to Rome.

Gone…

A Roman gold aureus coin (left), struck in 42BC, broke the record for an ancient coin when it sold for £3.2m before fees late last month. The coin marks the assassination of Julius Caesar and depicts two daggers – one each for Brutus and Cassius, the co-conspirators – a liberty cap, and the words “EID MAR” for the Ides of March (15 March), the date Caesar was killed. The coin also bears the face of Brutus. Caesar had been condemned for breaking the taboo of placing the image of a living Roman (himself) on a coin and so for Brutus to do it was “especially compelling”, says Richard Beale of auction house Roma Numismatics. Only three such coins still exist.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton