What makes a whisky – and can the process really be accelerated?

New technology may make the question of what makes a whisky a whisky trickier to answer, says Chris Carter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Silicon Valley is the spiritual home of the start-up “accelerator” – programmes that seek to support and advance early-stage companies. A Silicon Valley start-up has now given us the “spirit accelerator”. Earlier this month, Bespoken Spirits, a Californian company founded by materials scientist Martin Janousek and entrepreneur Stu Aaron, unveiled its proprietary technology, which, the company claims, can reproduce the taste of a barrel-aged whisky, rum or brandy in three to five days. The process involves exposing alcohol to “micro staves” of various woods under pressure, not unlike a “Nespresso machine on an industrial scale”. The results have been contested. Bespoken Spirits has won awards in blind tastings. But as Judith Evans notes in the Financial Times, “not all drinkers are convinced”. One reviewer at the Oregon-based Whiskey Wash publication said the bourbon was “not bad”, but that “there was very little that was exciting about this drink either”.

The older way to innovate

That, says the Scotch Whisky Association (SWA), should come as no surprise. Whisky that is sold in Britain and the European Union must be aged for at least three years. “Those quality definitions of whisky as a traditionally aged product, and other spirits produced with other techniques, should be labelled in a way which doesn’t take unfair advantage of that reputation,” the SWA said.

Three years is just the minimum. You can wait much longer and still call your whisky experimental – and the Singleton distillery has done just that. Just over a quarter of a century ago, the distillery’s master of malts, Maureen Robinson, sampled a 12-year-old single malt. She and her team decided to add a second maturation, placing the whisky in a number of experimental casks of used bourbon, Pedro Ximénez oloroso (sherry) seasoned casks and new American oak casks. Then Robinson left it for a while. After 26 more years, the longest second-maturation in the distillery’s history, she deemed it ready. Talk about patience. The Singleton 38-Year-Old has “a thick, creamy texture and a vibrant, sweet start in which rich opening notes of fudge lead smoothly into a lightly spicy, intense and fruity taste suggesting cinnamon-spiced baked apple, drying gently into an autumnal peppery warmth that envelopes the palate”, according to the tasting notes. Just 1,689 will soon be made available, priced at £2,100 (malts.com).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The rewards of patience

The 38-year-old whisky was “crafted in an era that was very exciting at The Singleton – a time of flavour experimentation and innovation across our whisky-making”, says Robinson. “I remember tasting... samples just three years into the secondary maturation and I was struck how, even at such an early stage, we could identify the richness of flavour the new casks had presented. To mature those casks for more than two decades further was an exploration of how it is possible to unearth exceptional flavour within whisky.” In other words, it pays to take your time when trying new things – even if it does take you 26 years.

Whisky gets a handbagging

Now’s an auspicious time to be bringing out a new whisky. After all, “drinkable investment asset classes have always done well in a downturn, perhaps as their owners have looked to drown their sorrows”, notes Andrew Shirley in the October update of Knight Frank’s The Wealth Report. “Both rare whisky and wine have shown reasonable gains over the past 12 months.” Rare whisky as a collectable asset, in particular, has appreciated by 12% in the 12 months to July. That was the second best of any collectable except for handbags, which have risen by a fifth in value, according to the Knight Frank Luxury Investment Index. Over the decade, whisky is still well out in front of the other sub-indices, with a 535% increase compared with 115% for handbags and 212% for cars, the next biggest grower after whisky over ten years.

But then, you could say the wheels have come off the classic car sector during the pandemic. “The auction market has always provided the razzamatazz for the sector and many sales, including the benchmark autumn Monterey sales [in California], were cancelled or downsized,” says Shirley. That’s not to say there haven’t been any big-ticket sales. A 1934 Bugatti Type 59 Sports set a new record for the marque last month when it sold for £9.5m at Hampton Court Palace. It’s a similar story for the high end of the art market, with the big three auction houses seeing their total sales fall by $2.8bn in the first six months of the year, according to data from ArtTactic. Online sales, at least, have stepped up somewhat, with Francis Bacon’s Triptych Inspired by the Oresteia of Aeschylus (1981 – pictured) selling for $85m in June with Sotheby’s in New York.

Auctions

Going…

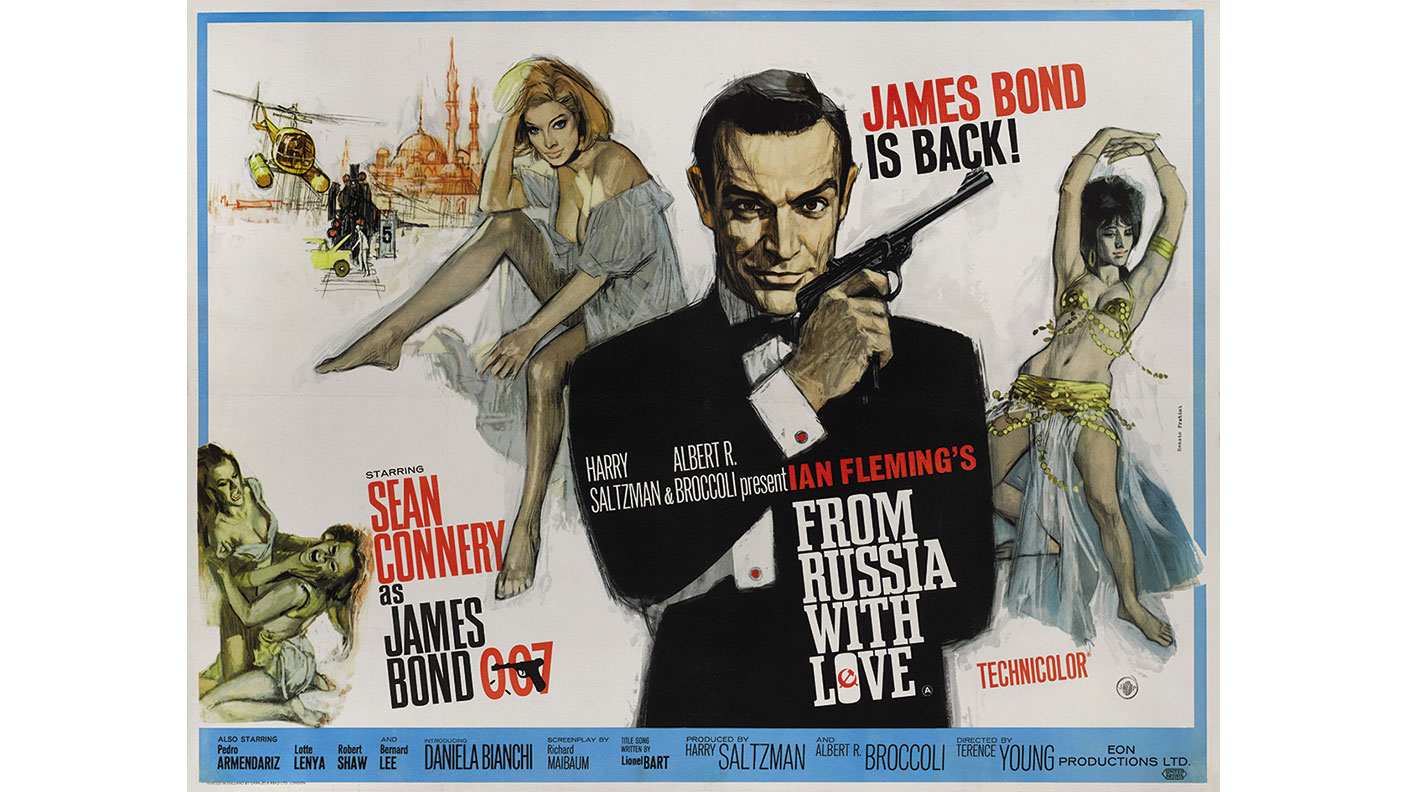

One of the world’s great collections of James Bond books is heading for online auction with Sotheby’s in London. An edition of From Russia with Love, inscribed to author Ian Fleming’s wife Ann, carries an estimate of up to £35,000. An edition of Live and Let Die presented to Winston Churchill with the acknowledgement “from whom I stole some words” is valued at up to £70,000. A copy of Diamonds are Forever, which was presented to real-life spy and Bond inspiration Biffy Dunderdale, is expected to fetch up to £20,000. And a first edition of the first Bond book, Casino Royale, from 1953, could make up to £30,000. From next Friday, the books, watches, film posters, and an Aston Martin DB5, are on display at the auction house.

Gone…

Banksy’s Show Me The Monet (2005), a reimagining of Claude Monet’s impressionist water lilies, complete with fly-tipped supermarket trollies and a traffic cone, sold for almost £7.6m at Sotheby’s in London last week. The nine minutes of bidding easily surpassed the £5m upper estimate and the sale price is now the second-highest at auction for a work by the anonymous artist – Devolved Parliament (2009) fetched £9.9m last year. The work forms part of a series by Banksy entitled “Crude Oils”, which “remixes” canonical works. Other pieces in the series include a vase of wilting sunflowers and a take on Edward Hopper’s Nighthawks, featuring an angry man in Union Jack boxer shorts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton