Lego: building profits from plastic bricks

The popularity of Lego boomed as bored workers twiddled their thumbs at home. Chris Carter reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When a video meeting got “a little boring” for Richard Weston, the 44-year-old from Birmingham did what many of us did during lockdown, says Shan Li in The Wall Street Journal. He watched a YouTube clip on his laptop, scanned Facebook and played with his Lego sets.

Thousands of Lego-builders went even further, BBC News reported in May, “taking advantage of lockdown… to create stop-motion movies and models of real-life constructions”. It’s little wonder, then, that sales of the colourful plastic bricks rose by 14% in the first six months of the year, and the addiction seems to be setting well and truly in. “We’ve seen momentum continue into the second half, even after people started going back to work and to school,” says Niels Christiansen, CEO of the Danish toymaker. (Note who appears first in that sentence – Lego’s not just for kids.)

Still others have had their eye on profits. Investment-related online searches for Lego jumped by 53% during lockdown in Britain, according to research commissioned by investment platform eToro. Over time, Lego sets can make serious money on the secondary market. “Dealers around the world trade the plastic bricks like any other asset,” says Adam Williams in The Daily Telegraph. “Some buy brand-new sets and keep them in pristine condition; others scour the planet for vintage models.” Over time, these sets can fetch significantly more than their original retail prices, with some going on to sell for thousands of pounds.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

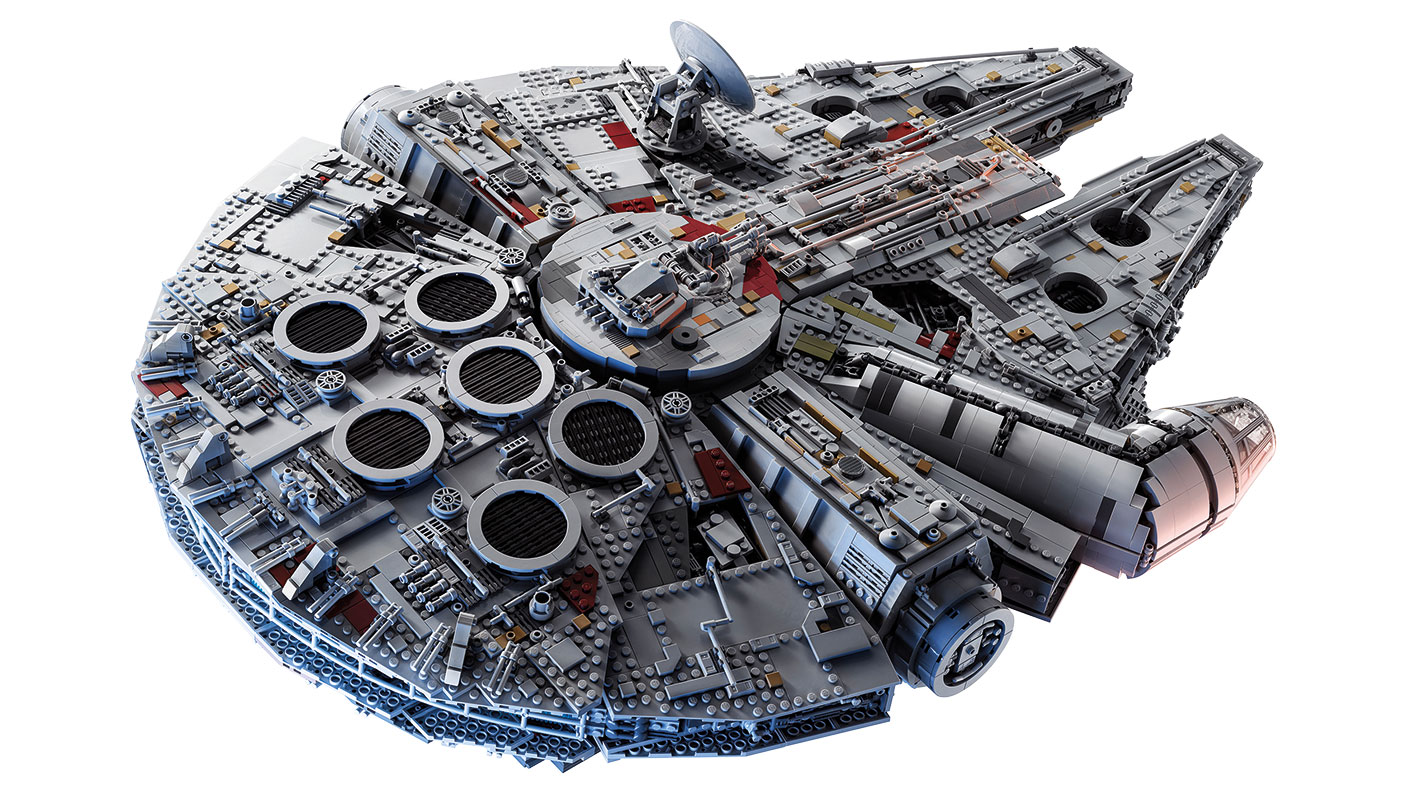

It’s no surprise, then, that some “Afols” (adult fans of Lego, in the lingo) have turned their hobby into money-making opportunities. The original 2007 edition of the Star Wars Millennium Falcon, for example, was available on Amazon this summer for more than £7,000, 20 times its original value, according to self-storage firm Space Station.

But collectors should be careful, says Tim Auld in the Financial Times. When Lego released the Millennium Falcon, it was the biggest Lego set ever produced, consisting of 5,195 pieces and costing £342.49. After two years, it was discontinued. Five years later, an unopened set in a sealed case sold for $15,000, setting a record for Lego. “Admittedly, that’s Las Vegas prices,” Gerben van IJken, a toy expert at auction site Catawiki, tells Auld. But even elsewhere, that set would have fetched a lot of money. Then, in 2017, Lego reissued an updated version of the toy– good news for fans, “not so good for those who had squirrelled away their 2007 set unopened for a rainy day”, says Auld. It may not be worth as much, but it is at least still valuable. Last Thursday, a used set in the US was sold to a buyer in Britain for almost $2,000 (including postage) on Ebay.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton