Lego: building profits from plastic bricks

The popularity of Lego boomed as bored workers twiddled their thumbs at home. Chris Carter reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

When a video meeting got “a little boring” for Richard Weston, the 44-year-old from Birmingham did what many of us did during lockdown, says Shan Li in The Wall Street Journal. He watched a YouTube clip on his laptop, scanned Facebook and played with his Lego sets.

Thousands of Lego-builders went even further, BBC News reported in May, “taking advantage of lockdown… to create stop-motion movies and models of real-life constructions”. It’s little wonder, then, that sales of the colourful plastic bricks rose by 14% in the first six months of the year, and the addiction seems to be setting well and truly in. “We’ve seen momentum continue into the second half, even after people started going back to work and to school,” says Niels Christiansen, CEO of the Danish toymaker. (Note who appears first in that sentence – Lego’s not just for kids.)

Still others have had their eye on profits. Investment-related online searches for Lego jumped by 53% during lockdown in Britain, according to research commissioned by investment platform eToro. Over time, Lego sets can make serious money on the secondary market. “Dealers around the world trade the plastic bricks like any other asset,” says Adam Williams in The Daily Telegraph. “Some buy brand-new sets and keep them in pristine condition; others scour the planet for vintage models.” Over time, these sets can fetch significantly more than their original retail prices, with some going on to sell for thousands of pounds.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

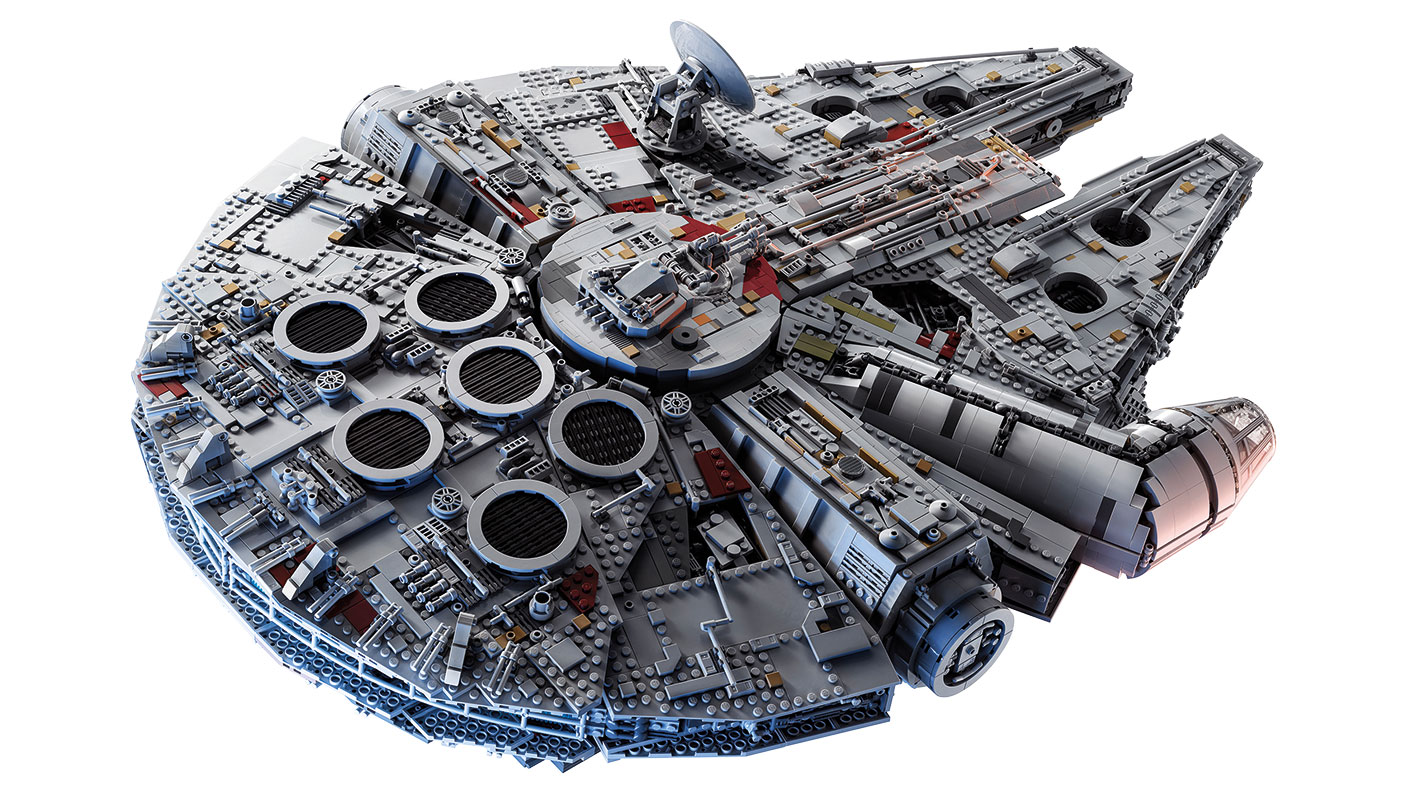

It’s no surprise, then, that some “Afols” (adult fans of Lego, in the lingo) have turned their hobby into money-making opportunities. The original 2007 edition of the Star Wars Millennium Falcon, for example, was available on Amazon this summer for more than £7,000, 20 times its original value, according to self-storage firm Space Station.

But collectors should be careful, says Tim Auld in the Financial Times. When Lego released the Millennium Falcon, it was the biggest Lego set ever produced, consisting of 5,195 pieces and costing £342.49. After two years, it was discontinued. Five years later, an unopened set in a sealed case sold for $15,000, setting a record for Lego. “Admittedly, that’s Las Vegas prices,” Gerben van IJken, a toy expert at auction site Catawiki, tells Auld. But even elsewhere, that set would have fetched a lot of money. Then, in 2017, Lego reissued an updated version of the toy– good news for fans, “not so good for those who had squirrelled away their 2007 set unopened for a rainy day”, says Auld. It may not be worth as much, but it is at least still valuable. Last Thursday, a used set in the US was sold to a buyer in Britain for almost $2,000 (including postage) on Ebay.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward