The boom in second-hand pumps

“Sneakerhead culture” has made old trainers newly desirable. Chris Carter reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Trainers, or “sneakers” as they’re called across the pond, have become prized collectable assets and the market is showing scant signs of slowing down. If anything, it’s booming. Arguably, the most coveted model is the distinctive red and white Nike Air Jordan 1. In May, a pair that had been worn and signed by basketball legend Michael Jordan, while still at the start of his long career, in 1985, set an auction record when they sold for $560,000 at Sotheby’s. The record that it broke had only been set the previous July at the auction house’s debut “Ultimate Sneaker” sale, in partnership with Stadium Goods, a leading online marketplace for collectable streetwear. At that sale, a scruffy pair of 1972 Nike Moon Shoes fetched $437,500, far out-pacing its $160,000 top estimate.

A sale with street cred

So it’s little wonder rival Christie’s is also keen to get in on the action – it has even taken to using the lingo. Its first “drop” (release) of highlights from the upcoming sale, which runs from 30 July to 13 August, includes a pair of Nike Air Ships (pictured), exclusively made for and worn by Jordan in 1984. A sort of precursor to the Air Jordan 1s of the following year, these Air Ships are “extremely rare”, says Christie’s. It has given them an estimate of between $350,000 and $550,000. A pair of Nike Air Jordan 7 “Olympics”, custom-made for Jordan when he played in the 1992 Barcelona Olympics as part of the US “Dream Team”, also forms part of the sale, valued at (a probably conservative) $70,000. And a pair of bespoke Nike Air Jordan 14 “Chicago” practice trainers, as seen in The Last Dance, the recent television documentary that helped spark a craze in all things Jordan, is valued at up to $8,000. Like Sotheby’s in its sale of last July, Christie’s has partnered with Stadium Goods to give the auction some authority, or in the parlance: “street cred”.

Again, small wonder. “In recent years, as sneakerhead culture” has gone mainstream, “a booming online resale market has emerged, attracting consumers more interested in trading the products than wearing them,” says Adam Wray in the Financial Times. “Enterprising sellers have turned big profits by acquiring coveted styles in bulk and flipping them quickly – at mark-ups often many times the retail price – to buyers eager either to peacock in the latest limited-edition designs or to speculate on further appreciation.” Stadium Goods offers one such space to do this. And so lucrative has it been that London-based digital fashion platform Farfetch bought the five-year-old US company for $250m in January 2019. After all, “we’re the new luxury” (see right), Stadium Goods’s co-founder Jed Stiller tells The Wall Street Journal’s Howie Kahn. StockX, Goat and Kent-based The Sole Supplier are other big names.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But why choose between peacocking and speculating when you can do both? “When you own a pair of sneakers which exist only in limited numbers, not only do you get ‘street cred’ as the owner, you also own a pair of shoes that many people would buy at a higher price just because they are so rare,” George Sullivan, the boss of The Sole Supplier, tells Nicole Mowbray in The Daily Telegraph. Investor-collectors can now be both savvy and fashionable.

A royal tie-up

At the beginning of July, the lucky winners of an online prize draw were invited to spend £1,800 on a pair of new Air Jordan 1 OG Dior trainers (pictured below). “Even by the hype standards of the sneakerhead world, the buzz around the luxury take on basketball’s most iconic hi-top… [broke] pre-pandemic decibel records,” says Jess Cartner-Morley in The Guardian. Fans were obsessing over nothing less than the coming together of “two blue-chip bloodlines of sportswear and luxury”. In terms of collectable fashion, this was “a royal wedding”. So, it was no surprise that, come the big day, shoppers queued round the block in the early morning pouring rain in London to get their eager hands on one of 13,000 pairs available worldwide. At the time of writing, one such pair was for sale on StockX, priced at £15,996.

The less fortunate have been turning to the shadowy market of “replicas”. “In sneaker world, the term ‘replicas’ connotes the tippy-top class of ‘fake’ sneakers, copies of the original so meticulous they can fool all but the most fastidious collectors,” says Jacob Gallagher in The Wall Street Journal. These often Chinese-made “careful clones” can sell for $150, “making them roughly as expensive as many authentic sneakers at retail”. The trade in these counterfeits is, of course, illegal. But whole communities devoted to trading replicas have sprung up online. Buyers after the genuine article should beware.

Auctions

Going

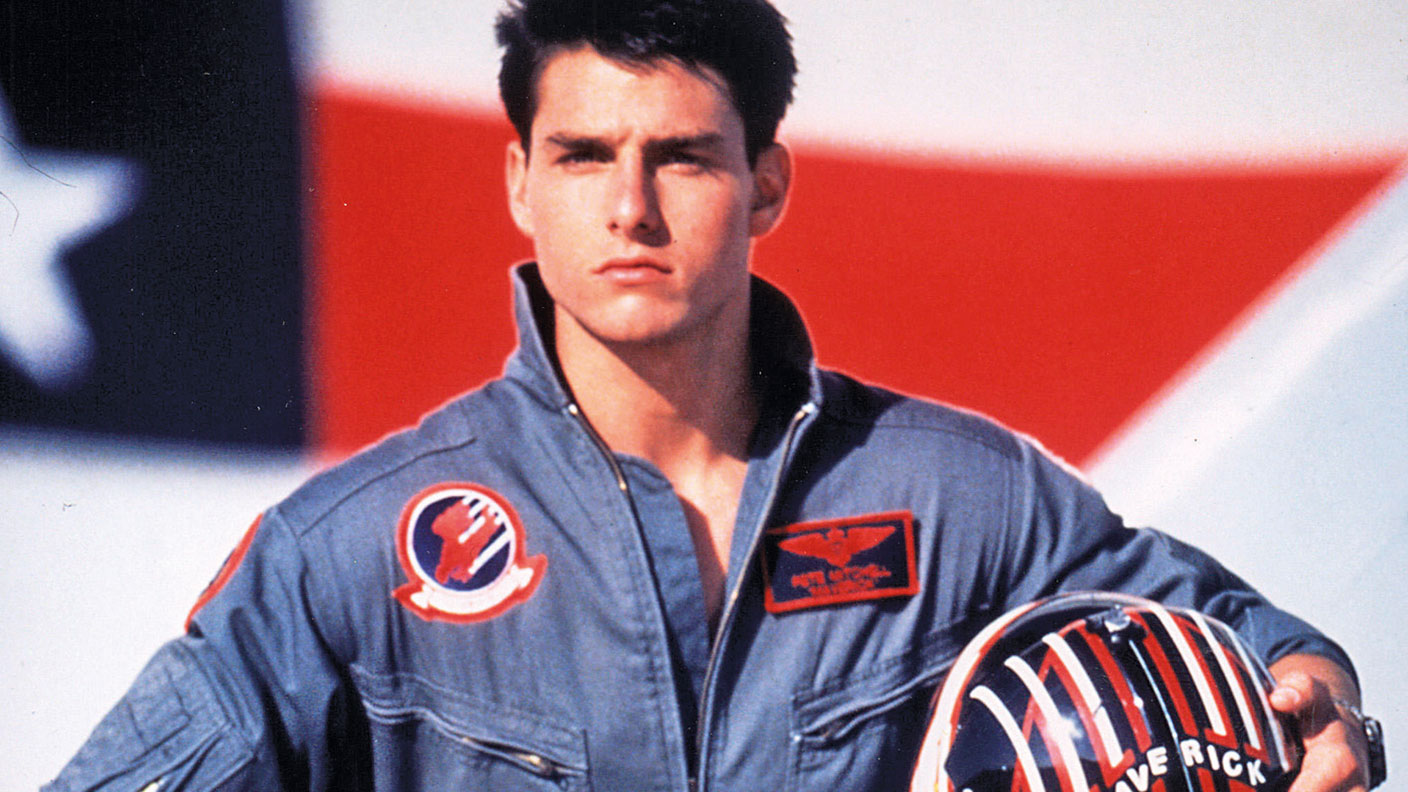

A huge online auction of some of the best-known film props from Hollywood history is set to take place on 26 and 27 August with the Prop Store. The 11-foot Nostromo space ship model, used in Alien (1979), has been given the highest valuation of the 850 items. It is expected to sell for up to $500,000. Other recognisable memorabilia include the Darth Vader costume from the original Star Wars film (1977 – $250,000), the Ra staff headpiece from adventure film Indiana Jones and the Raiders of the Lost Ark (1981 – $200,000), and Tomcat fighter pilot Pete “Maverick” Mitchell’s helmet ($70,000) from 1986 blockbuster Top Gun, starring Tom Cruise (pictured). The sale is expected to make around $6m in total.

Gone

Entertainment and celebrity memorabilia belonging to the late music producer and television personality David Gest went on sale in Liverpool with Cato Crane Auctioneers earlier this month. An early signed photograph of Michael Jackson fetched the highest price among the 800 items, at £1,900; another, inscribed “To David Gest my friend” by the pop star, sold for £1,700. A picture of the Queen raised £640, and a Christmas card from Charles and Diana, the Prince and Princess of Wales, sold for £480. A silver-plated caviar serving dish that had belonged to Gest and his former wife, actress Liza Minnelli, made £200. Gest died in London in 2016 at the age of 62 from a stroke. “He genuinely loved pop memorabilia,” says auctioneer John Crane.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive