Bitcoin has just “halved” again – what does that mean, and should you buy in?

Cryptocurrency bitcoin has just hit a milestone, where the rate of new coins being produced halves. Dominic Frisby explains what that means.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Bitcoin was born in reaction to the bailouts of 2008. When the first digital coins were mined, a headline quotation from The Times that day was left embedded in the genesis block: “Chancellor on brink of second bailout for banks”.

Bitcoin’s creator, Satoshi Nakamoto, resented the iniquities of a fiat money system, in which certain favoured bodies (governments and banks) have the ability to create money at no cost. “Escape the arbitrary inflation risk of centrally managed currencies,” he later declared.

With Covid-19 money printing at full throttle, the case for bitcoin has got even stronger. Today, we consider bitcoin in the wake of this week’s halving – and don’t worry, I’ll explain what that means in a moment.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The philosophy and practicalities behind bitcoin

When Satoshi Nakamoto first designed bitcoin, one of his key ideas was that money should have a cost of production to it. What’s more, the supply of money should be finite – nobody should have the power to create more of this money when it suits them.

Money should have value, because of its scarcity. Unlike fiat money, which is inherently inflationary because its supply never stops growing, Satoshi wanted to create a deflationary system, the purchasing power of which increases over time.

Satoshi’s plan was for a maximum of 21 million coins. But he couldn’t create those 21 million coins all at once. It had to be gradual. So how to create coins? How to disseminate them? And how to maintain the system?

Satoshi’s ingenious solution to it all was what he called mining. Just as gold and silver cost money to mine, so do bitcoins. However, you don’t mine bitcoins with picks, shovels and drills, but with computers.

You can set up a gold mining company and start digging – in your back garden if you like – but there is no guarantee you‘ll find anything. So with bitcoin can you rig up some computers and start bitcoin mining, but there is no guarantee you will get some coins out of it.

But there is a chance you will strike gold – or successfully mine coins. The better your gold or bitcoin mining operation – the more powerful your drills, or you geological mapping, or your computers – the better the chance you’ll strike gold or bitcoin. And the potential reward is such that people take the risk.

Every ten minutes, a block of new bitcoins is mined. And thousands of bitcoin mining operations around the world – thousands of powerful computers – compete with each other to mine the block and get the bitcoin reward. It is the combined power of all these computers that processes all the transactions and maintains the network.

So, the dynamic is that people are acting out of their own self-interest (the potential reward of coins), but the result of that self-interest is that the system is maintained.

Early bitcoins were easy to mine. There was not much competition, the network was small. But, as bitcoin evolved, the mining process grew more intense. The more intense the mining process, the more resilient bitcoin becomes.

Again, we see this digital replication of the gold mining process. Surface gold is easy to mine, but as the mine goes deeper underground, it gets more expensive and labour intensive.

Just as precious metals miners sell their produce soon after they mine it in order to fund future mining – that is their business model – so bitcoin miners sell their coins soon after production. Thus do coins get disseminated.

What is this “bitcoin halving” stuff all about then?

Satoshi coded a production rate into the design. “Coins have to get initially distributed somehow,” he said, “and a constant rate seems like the best formula.” Initially, coins were produced at a rate of 300 per hour.

Between bitcoin’s inception in 2009 and November 2012 a total of 10.5 million bitcoins were created – half the eventual supply. But then the first scheduled “halving” took place, and the production rate fell from 300 to 150 per hour.

Four years later, in July 2016, we saw the second scheduled “halving” and, with almost 16 million coins now in circulation, the production rate fell from 150 to 75 per hour. Yesterday, now with 18 million bitcoins in circulation, we saw the third halving and production rate has come down to 39 per hour (so not quite a halving).

This process will continue every four years until some time around 2140, when the 21-millionth coin is mined.

What does this mean for the value of bitcoin?

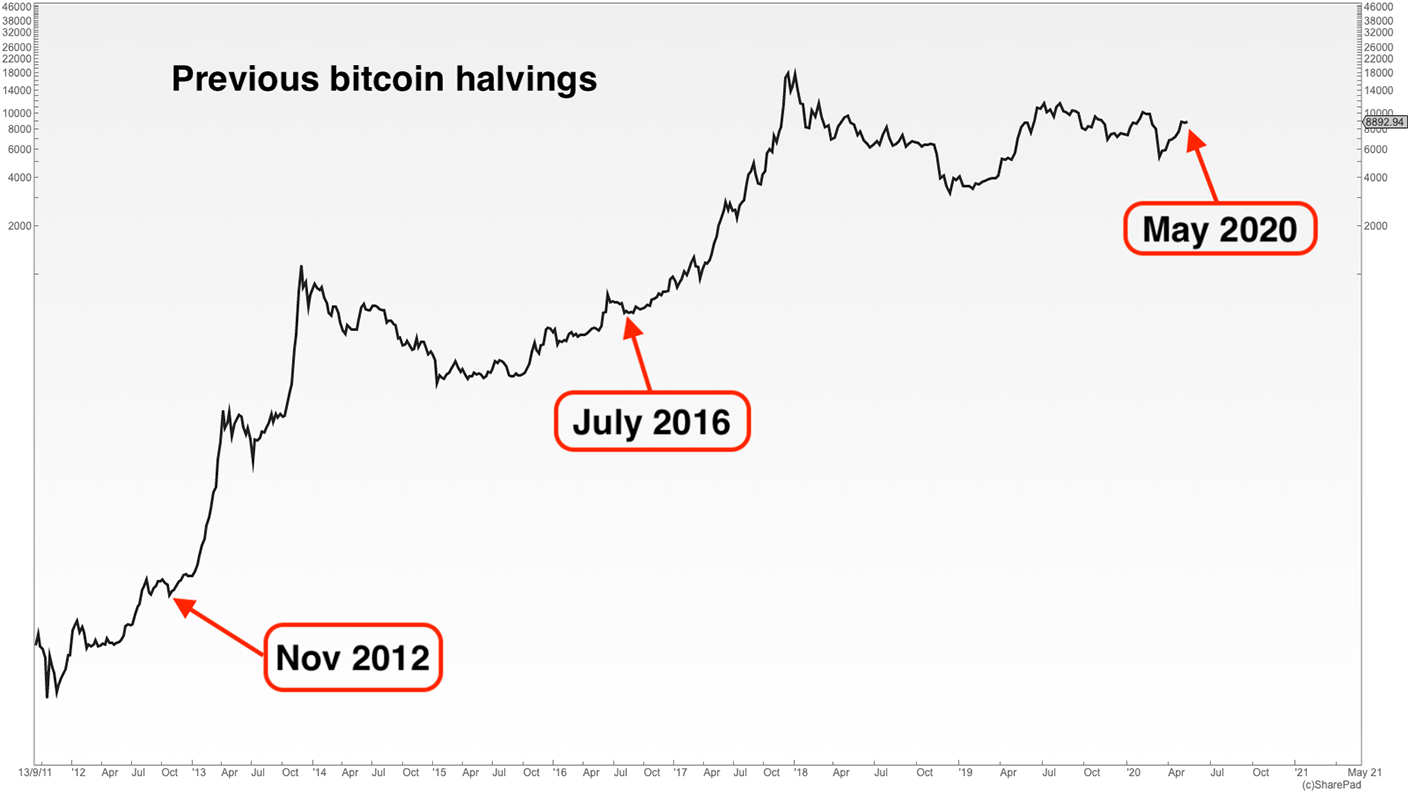

In theory, if you reduce the inflation rate of money by half, the value of that money should rise. The same applies to a commodity – reduce the supply by 50% and the price should go up. And the evidence of the two previous halvings is that bull markets of the change-your-life variety have followed, as the chart below shows.

In November 2012, bitcoin was trading below $10. One year later it was over $1,000. In July 2016 bitcoin was around $500 – 18 months later it was at $20,000.

But that story has been baked into this halving for many months.

If you ‘ve been following me for any amount of time, you should by now own some bitcoin. In which case my advice would be “enjoy the ride”.

If you don’t own any, I cannot advocate enough, as I have said so many times, that you should: first, familiarise yourself with the tech; and second, own some, even at today’s price of $8,800. The potential of the thing is too huge not to have a position. (Here's how to buy if you haven't already done so.)

What is that potential? I’m not one of those that argue that bitcoin will replace the US dollar. But I do suggest it has the potential to become the default cash system of the internet. That gives it a scalability that fiat currencies do not have.

A national currency is limited by its borders. No such limitation exists with bitcoin.

I’m not saying bitcoin will become the default cash system of the internet (and I choose the word “cash” carefully). There are all sorts of reasons why it could happen, and as many why it won’t.

But, wherever you stand on this divisive subject, you cannot deny that the potential is there. And when something has that extraordinary potential, why would you not take a position?

And, of course, with all the money-printing that is going on to bail out economies in the wake of Covid, the case for non-government money is all the stronger. But that is an argument for another day.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is available at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere. If you want a signed copy, you can order one here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.