The juicy yields on offer in European fintech

With interest rates still at historic lows, income seekers should consider looking beyond traditional asset classes. Here are three ideas.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

When digital bank N26 announced last month it would leave the UK, there were fears that Brexit was going to trigger a fintech exodus. But it hasn’t – in fact, the bigger story is that many successful British fintechs such as Monzo, Revolut and Starling Bank have their sights set firmly on conquering the continent.

There is also no shortage of interesting, originally European online platforms still open for business to British investors and savers. Some such as Scalable Capital (originally German) and MoneyFarm (Italian) have been around for many years. But there are also less well known platforms worth exploring.

Raisin: a one-stop shop for smaller banks

One is Raisin, which started out in Germany but launched here a few years ago. Raisin has come up with what is effectively a shop window for smaller banks who offer notice accounts and fixed-rate bonds for savers. It is an aggregator or online marketplace for savers who want internet-only access to better deposit rates.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The underlying providers tend to be smaller outfits that you won’t find on the high street. They are, however, protected by the Financial Services Compensation Scheme (FSCS), whereby if the institution fails you get back up to £85,000.

In fixed-rate bonds, for instance, you’ll come across the likes of Aldermore and ICICI Bank, while an outfit called Gatehouse Bank offers the best deal: 1.5% for a one-year bond.

When it comes to notice accounts the best deal I’ve seen was also from ICICI Bank which boasts a 1.6% rate for a 95-day notice account, well above the rate offered by market leaders such as Marcus (from Goldman Sachs), which offers a 1.3% rate.

Safety in numbers

Platforms such as Raisin in effect allow wealthier savers to spread out their cash between different providers while accessing them via one online account. One could have four different accounts with different providers and still get £340,000 of FSCS protection. The bad news, of course, is that these interest rates are puny.

Peer to peer (P2P) lending offers one alternative for investors, with mainstream providers such as Zopa, Ratesetter and Funding Circle offering returns in the 3% to 6% range. New regulations have had the effect of consolidating the market position of the major platforms. And one new rule has proved an inadvertent incentive to invest.

The Financial Conduct Authority (FCA), the City regulator, has suggested that investors should not have more than 10% of their investable wealth in P2P platforms. At first, this seemed onerous, especially as it requires the platforms to check with the investor.

But the 10% level could also tempt people into the sector. Many platforms tell me that investors now wonder whether they should have 10% exposure even if their current investment allocation is much lower. Yet for now even the established platforms struggle to provide income much above 5% per annum after costs and likely long-term defaults.

Mintos: higher risk, higher reward

If you want to venture further up the risk scale, consider some European platforms open to British investors. Top of that list is probably Mintos, where income returns have historically been around 10%-11%. This Latvian-based platform doesn’t issue loans itself.

It effectively lends your money to other specialist lenders around the world. To date investors from across Europe have put over €4.8bn to work on the platform with the biggest category being personal loans; car loans are also very popular.

Some of the intermediary platforms Mintos works with are based in the UK. They include lenders 1pm, Moneyboat, Cash4UNow and Peachy. If we take the first of these, 1pm, we can see from the site that it has lent out over €950m, is deemed by Mintos to have an A rating, and currently has a loan portfolio of €122m, with 10% “skin in the game”, which implies that the lender will absorb the first 10% of losses. The average yield on loans is around 11%. 1pm is far from a complete unknown in the UK as it is listed on Aim, specialises in small business lending and has received backing from the UK government-owned British Business Bank.

Returns to date from Mintos’s lenders have been well above what you’d get in the UK. The average investment per person is around €4,000 and so far around 266,000 investors from across Europe have put money to work on the platform.

As for default risk, Mintos says that out of the €722m of loans outstanding, about €150m-worth is one day or more in arrears, with a large bulge around the 16 to 60 days bracket. So far, however, most arrears seem to have been recovered.

Mintos also offers a secondary market in loans which should enable you to sell out a position you are not happy with. Unlike most UK P2P sites, Mintos lets individual lenders pick their own loans manually or go for a fully diversified basket of loans.

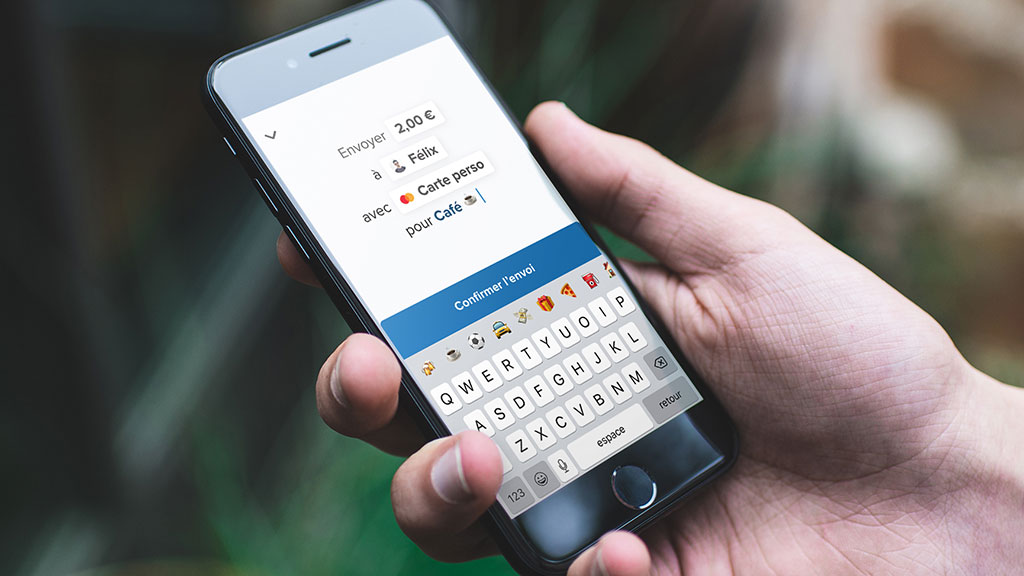

Lydia: a wallet worth opening

One last European fintech starting to make its presence felt in the UK is up-and-coming digital wallet app, Lydia. This French product allows you to set up an online wallet, fund it from your bank account or credit cards and then send money effortlessly to friends and family. It’s very easy to use and works a treat for moving money to lots of different places without setting up a bank mandate to each and every recipient. The Stevenson family are big users, allowing the Bank of Mum and Dad to offer instant capital funding lines to its poverty-stricken customers.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

One million more pensioners set to pay income tax in 2031 – how to lower your bill

One million more pensioners set to pay income tax in 2031 – how to lower your billHundreds of thousands of pensioners will be dragged into paying income tax due to an ongoing freeze to tax bands, forecasts suggest

-

Stock market circuit breaker: Why did Korean shares pause trading?

Stock market circuit breaker: Why did Korean shares pause trading?The fallout from the conflict in the Middle East hit the Korean stock market on 4 March, with shares forced to temporarily stop trading. What is a stock market circuit breaker, and why did the KOSPI trigger one?

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.