US technology firm AOTI chooses UK instead of US for record Aim listing

The health technology brand raised £35.1 million on the Alternative Investment Market in a boost for London’s listing credentials

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Technology stocks may be dominated by US-listed companies but the latest firm to go public has actually chosen London’s Alternative Investment Market (Aim).

American health technology brand AOTI chose to jump across the pond for its initial public offering (IPO), raising £35.1 million after going public on Aim this morning (18 June).

This is the largest IPO raise on Aim since 2021, giving AOTI a market capitalisation of £140 million – the largest Aim IPO since February 2022.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It comes as the Magnificent 7 technology stocks in the US have helped the S&P 500 make record gains, with a lack of technology exposure cited as a reason for the UK stock market lagging behind.

“Although this is a very small company, which has raised a tiny amount of money - £35 million – that it chose to list on a UK market will help ignite some long overdue optimism that the dearth of UK IPOs may be coming to an end,” says Jason Hollands, managing director of Bestinvest.

What is AOTI?

AOTI is by no means a household technology brand like Apple or Amazon but it has been around since 2006.

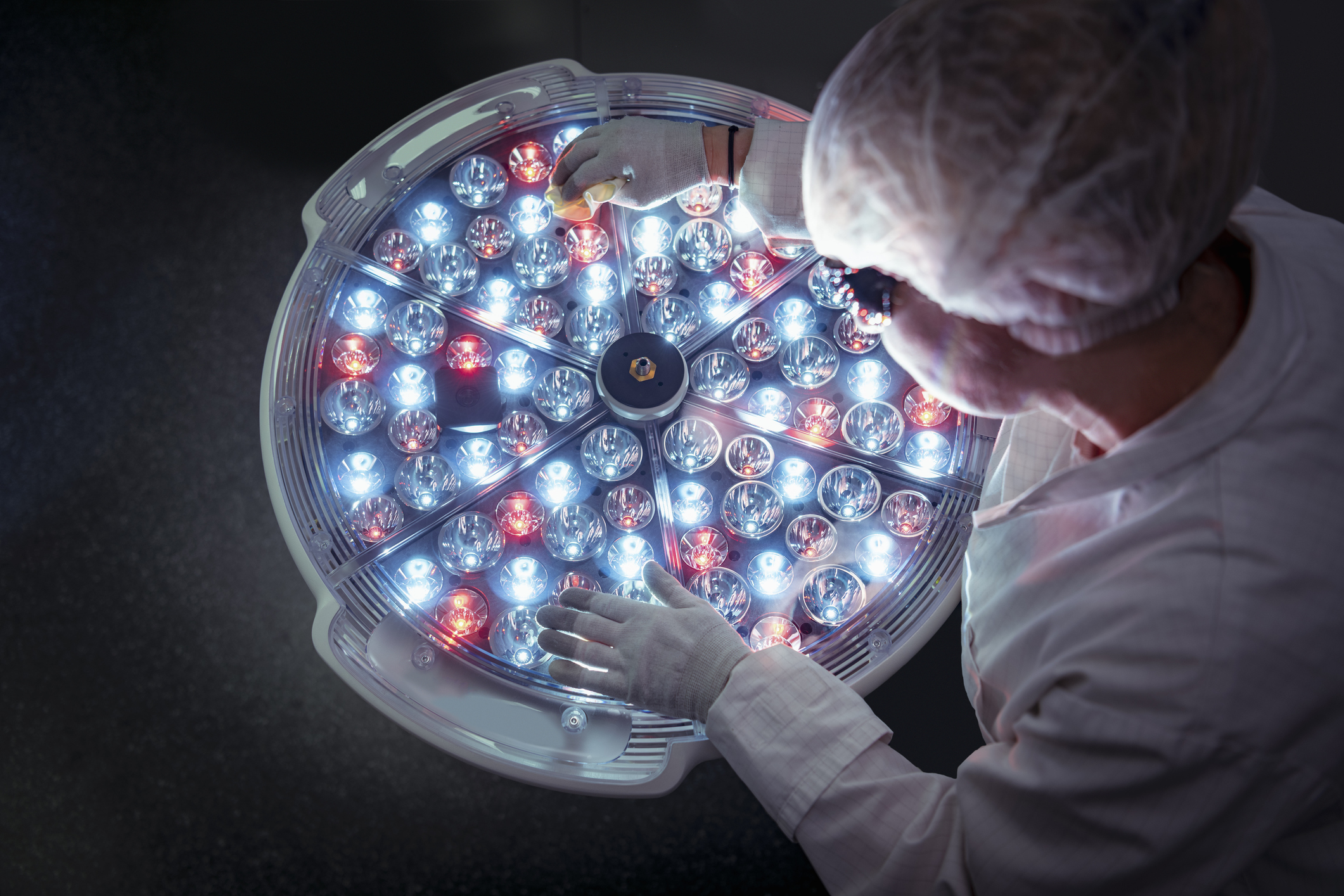

It supplies medical technology to support people with chronic conditions, particularly focusing on durable healing of wounds where its topical oxygen therapy is a market leader.

The brand’s shares rose by almost 4% in early trading during its debut at 137p.

London v New York listings

The London Stock Exchange has struggled to attract technology firms, with plenty of brands opting for the New York Stock Exchange or NASDAQ.

Hollands says the decision to list in London is especially notable, because AOTI is a US based medical technology company, “operating in a sector that might more naturally fit with the US markets which have global dominance in healthcare".

Hollands also suggests the US technology market may be getting crowded.

“Aim is an attractive exchange for small companies where the founders wish to retain substantial shareholdings, as there is a no minimum free float requirement, and that may have been a factor partially at play here along with a flexible and inexpensive set of rules,” he adds.

“Another point is, artificial Intelligence is such a dominant theme on the US markets currently and this is heavily focused around the so-called Magnificent Seven mega-cap stocks, which now account for a third of the market cap of the entire S&P 500.

"This may be starting to crowd out demand for other sectors and very small companies in particular.”

This UK listing follows microchip maker Raspberry Pi, which chose to list in London rather than New York last week.

Shein is also reported to be planning a London listing.

Ben Yearsley, director at Fairview Investing, suggests AOTI may have chosen the UK as it’s medtech rather than pure tech.

“Alternatively, maybe it’s just too small for the US?” he says.

“How many US investors buy anything under $1bn? With most executive compensation paid in shares it’s no wonder most companies list in the US as shares typically trade on a premium to most other markets.”

Yearsley says AOTI may be attracted to the UK as we are pretty good at health and pharma and they could be looking at future buyers.

Top UK technology stocks

Beyond AOTI and Raspberry Pi, there are other technology stocks listed on the UK stock market, many of which will be cheaper than the major US brands.

Yearsley highlights Sage, which he says is a market leader in software.

Its share price is up 22% over the past year but has struggled in 2024 and is so far down 8.37%.

UK equity fund manager Nick Train recently said he had gained exposure to property website Rightmove and credit reference platform Experian to boost the UK technology exposure of his Finsbury Growth & Income Trust.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how