Spring Budget: a very British affair?

Hunt announces the launch of a British ISA as he boasts the growing investment opportunities in the UK. But will savers buy into it?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Dubbed the ‘world’s next Silicon Valley’ or ‘second only to Hollywood globally by the end of 2025’, who wouldn’t want to invest in the UK?

It’s a no brainer as far as chancellor Jeremy Hunt is concerned, so much so, he today confirmed rumoured plans to launch a brand new British ISA in today’s Spring Budget.

But will the British ISA take-off?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What is the British ISA?

The new British ISA will be for investments in UK equities, giving savers the opportunity to take advantage of UK growth.

And to help encourage savers, Hunt slapped on an extra £5k tax free savings allowance for saving in a British ISA - taking the full allowance to £25,000 per tax year.

Great news for those who have maximised their ISA allowance and have a bit more they want shielded from the tax man - as long as they are happy for £5k to be dedicated to UK stocks.

Hunt said the British ISA means “British savers can benefit from the growth of the most promising UK businesses as well as supporting them with the capital to help them expand”.

At the same time, Hunt also said he wanted to see defined contribution pension plans to invest more in the UK, including private assets.

While it’s a clear move to boost UK economic growth, is an additional £5k enough to encourage savers to invest in the UK and where can we expect to see growth?

British investment opportunities

Nuclear technologies

If you're wondering where these opportunities in the UK may come from, then according to Hunt the UK is well placed to develop cutting-edge nuclear technologies and as such he announced that the Great British Nuclear will begin the next phase of the Small Modular Reactor (SMR) selection process, with companies now having until June to submit their initial tender responses.

According to the government, SMRs could transform how nuclear power stations are built and result in billions of pounds of investment in the UK

“Our brilliant Energy Security and Net Zero Secretary will also allocate up to £120m more to the Green Industries Growth Accelerator to build supply chains for new technology ranging from offshore wind to carbon capture and storage,” Hunt said.

Creative industries

With Idris Elba, Keira Knightley and Orlando Bloom all filming their latest productions in the UK, the UK can consider itself Europe’s largest film and TV production centre "and we will be second only to Hollywood globally by the end of 2025", Hunt said.

The sector, which includes high-end TV, will be boosted by tax reliefs and additional funding.

Life sciences

Hunt also flagged the growth in life sciences as the UK continues to support research by medical charities into diseases such as dementia, cancer and epilepsy with an additional £45m including £3m for Cancer Research UK.

However, Hunt said the UK should also be manufacturing and developing medicines and has announced a brand new investment by Astrazeneca, “led by mon ami, the irrepressible Sir Pascal Soriot”.

In support of the life sciences sector, £650m will be invested to help expand the UK’s footprint on the Cambridge Biomedical Campus and fund the building of a vaccine manufacturing hub in Speke in Liverpool.

Is a £5k incentive enough for a British ISA?

It’s no secret - UK equities have been unloved for some time, so much so, they were shunned by the MP’s pension scheme last year.

And experts have been quick to jump on the news, suggesting there may still be some work to be done to help attract more cash into UK businesses and that the British ISA will do little to stem the failing of the FTSE.

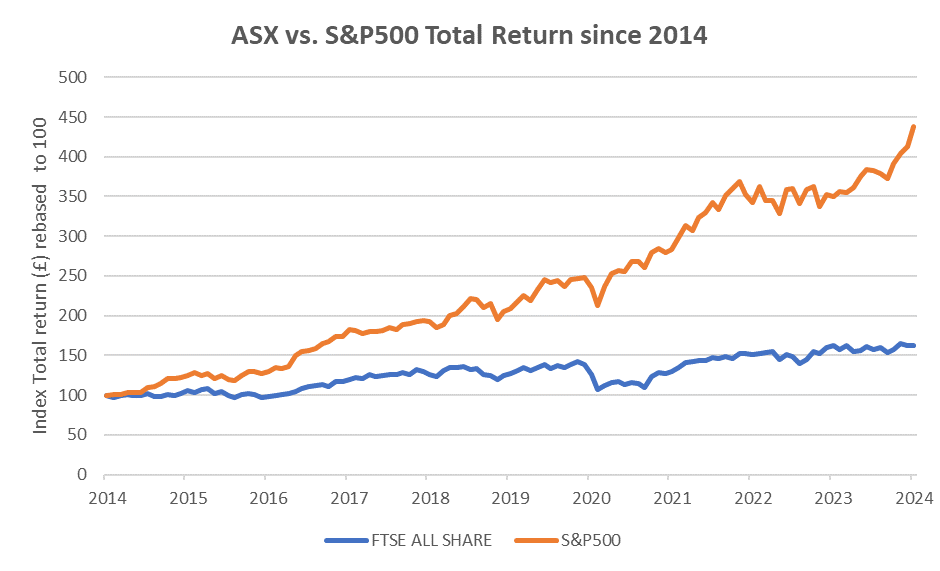

Barry Norris, manager of the VT Argonaut Absolute Return Fund, points out: “If you had invested £1 in the FTSE All Share Index a decade ago you would currently have 64p of profit, including dividends. But that same £1 invested in the S&P500 - the most representative index of American stocks - over the same time would have made a profit of £3.38p (over 5 times your money).

FTSE All Share Vs. S&P500 Total Return (in £ terms)

ISA simplification?

Eager savers may well argue that they would have preferred to have seen an overall increase to the annual ISA allowance rather than segregating £5k for UK investments.

Plus, does a British ISA just add to the complexity and could it result in a lower take up? Will savers really engage with a British ISA?

When will the British ISA launch?

We don't yet know when the British ISA will launch but it will be subject to a consultation first. In the meantime, from April 2024, ISA savers will be allowed to hold as many ISA subscriptions as they want as long as they stay in the current allowance of £20,000.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kalpana is an award-winning journalist with extensive experience in financial journalism. She is also the author of Invest Now: The Simple Guide to Boosting Your Finances (Heligo) and children's money book Get to Know Money (DK Books).

Her work includes writing for a number of media outlets, from national papers, magazines to books.

She has written for national papers and well-known women’s lifestyle and luxury titles. She was finance editor for Cosmopolitan, Good Housekeeping, Red and Prima.

She started her career at the Financial Times group, covering pensions and investments.

As a money expert, Kalpana is a regular guest on TV and radio – appearances include BBC One’s Morning Live, ITV’s Eat Well, Save Well, Sky News and more. She was also the resident money expert for the BBC Money 101 podcast .

Kalpana writes a monthly money column for Ideal Home and a weekly one for Woman magazine, alongside a monthly 'Ask Kalpana' column for Woman magazine.

Kalpana also often speaks at events. She is passionate about helping people be better with their money; her particular passion is to educate more people about getting started with investing the right way and promoting financial education.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how