What does Rachel Reeves's visit to China mean for the UK?

The Chancellor Rachel Reeves faced criticism for her visit to China as gilt yields surged.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

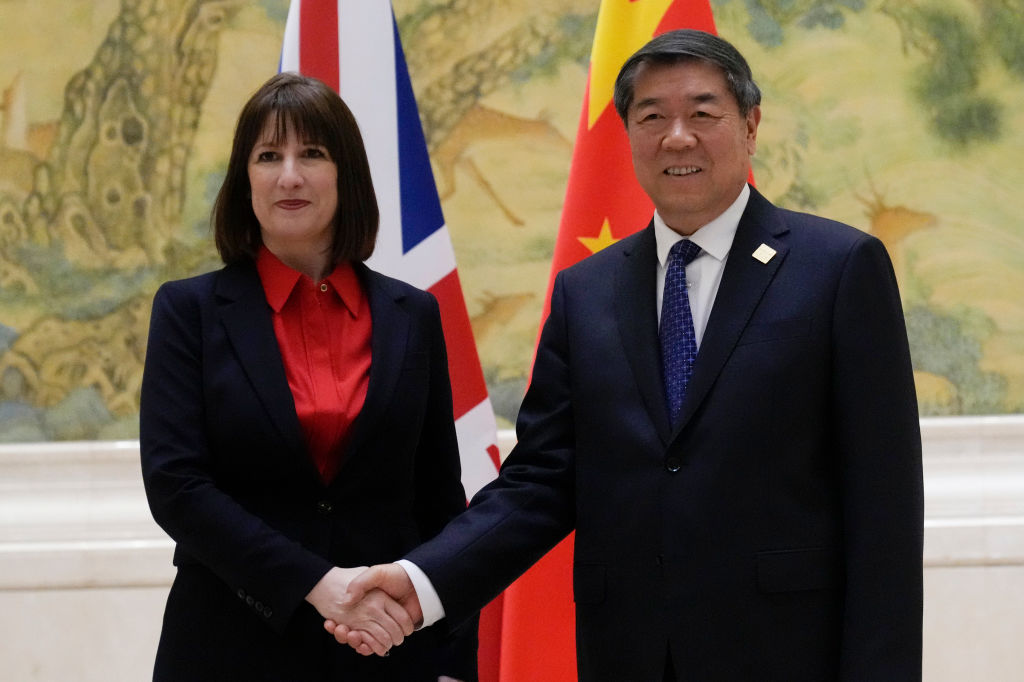

In the face of criticism for travelling to China amid domestic “financial market turmoil”, chancellor Rachel Reeves insisted at a press conference in Beijing on 11 January that she would stick to the fiscal rules set out in the Budget in October, says Politico. Reeves wants to revive economic ties with China after “years of tension” with the previous Tory government over security concerns and human rights issues.

A healthy relationship with Beijing is “squarely in our national interest”, she said, as she announced agreements “worth £600 million to the UK economy over the next five years”. Writing in The Times, Reeves said, “We cannot ignore the fact that China is the second-largest economy worldwide and our fourth-largest trading partner, with exports supporting close to half a million jobs in the UK… Choosing not to engage with China is therefore no choice at all”. Both sides agreed to deepen cooperation across areas including financial service, trade, investment and the climate. Anglo-Chinese trade is currently worth more than £87 billion a year.

What does the chancellor's China visit mean for the UK?

Critics “poured scorn” on Reeves’s puny deal, says Greg Heffer in the Daily Mail. At a time when the US and Europe are “toughening up on China”, this visit has made us “the laughing stock of the Western world”, former Tory leader Iain Duncan Smith told The Sun. By “courting” our “worst adversary”, this government risks “making a massive strategic blunder”, says Matthew Henderson in The Telegraph. The US and other democratic governments realise that China increasingly poses a risk to their national interests. Central to this risk is that the ruling Communist Party “uses economic engagement as a geostrategic weapon” to compete unfairly with its democratic rivals. Its aim is to achieve “not only economic, but also political, security and military hegemony”. In this context, it seems “distinctly imprudent” for Reeves to “parrot” China’s language about a “consistent, respectful relationship”. And all for a “notional” £600 million, “less than a thousandth of NHS expenditure over the same period”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

An area of particular concern is UK energy generation, says Max Kendix in The Times. Energy secretary Ed Miliband is also due to visit China to “expand and deepen” partnerships. Chinese firms have funded or provided parts for at least 14 of the 50 offshore wind-farm projects in operation or late in development; firms owned by the Chinese government have large stakes in three of these. Up to 40% of our solar panels were made by Chinese firms linked to forced labour. Richard Dearlove, former M16 chief, warned that China’s involvement allows it to “reprogram” any components connected to the energy grid “without our control”.

It is “alarming” that “cosying up to China” in this way “may genuinely be the best idea for growth that Labour has to offer”, says The Telegraph. At a time of a hawkish US, an increasingly aggressive Russia and a China that is on the rise, it looks “less like a thought-out plan and more like an act of desperation. For the good of the country, we should hope that Labour finds new ideas soon”.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Emily has worked as a journalist for more than thirty years and was formerly Assistant Editor of MoneyWeek, which she helped launch in 2000. Prior to this, she was Deputy Features Editor of The Times and a Commissioning Editor for The Independent on Sunday and The Daily Telegraph. She has written for most of the national newspapers including The Times, the Daily and Sunday Telegraph, The Evening Standard and The Daily Mail, She interviewed celebrities weekly for The Sunday Telegraph and wrote a regular column for The Evening Standard. As Political Editor of MoneyWeek, Emily has covered subjects from Brexit to the Gaza war.

Aside from her writing, Emily trained as Nutritional Therapist following her son's diagnosis with Type 1 diabetes in 2011 and now works as a practitioner for Nature Doc, offering one-to-one consultations and running workshops in Oxfordshire.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?