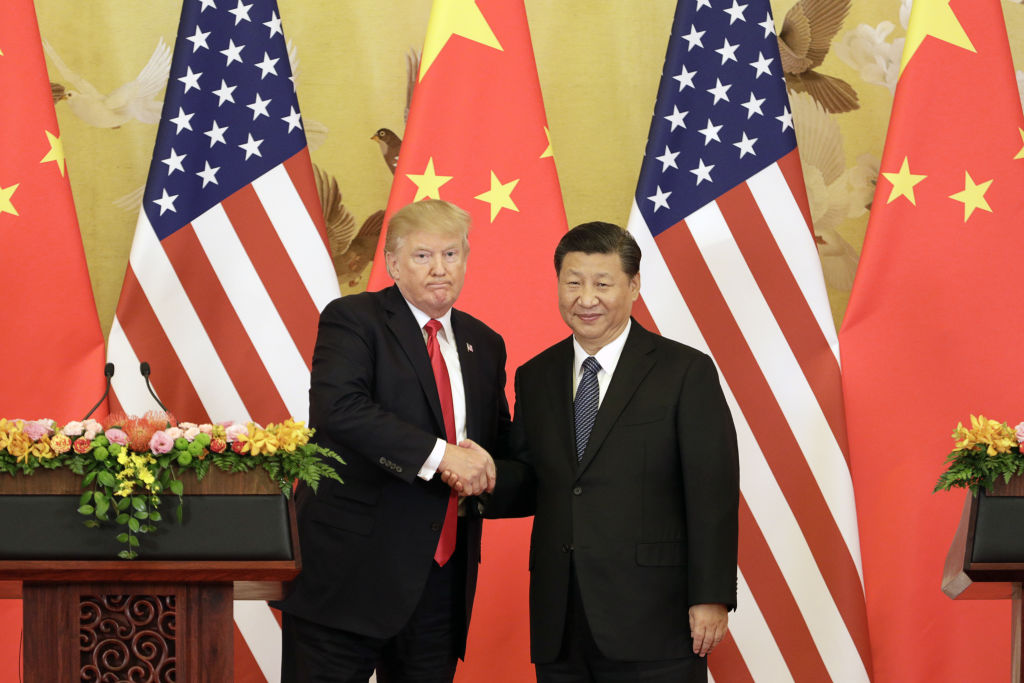

Is Xi Jinping ready for Donald Trump's tariffs on China?

The ascent of Donald Trump as the 47th US President will bring new challenges for President of China Xi Jinping

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Last year was a “relatively quiet if depressing” one for China, says James Palmer in Foreign Policy. This year could be “a lot stormier”, especially when it comes to relations with the US. With Donald Trump about to start a second term as US president and threatening to saddle China with tariffs of 60%, the “leadership in Beijing is readying for a ferocious economic struggle”.

It is not in a good place for a trade war, says William Pesek in Nikkei Asia. Although China under Xi Jinping has made progress in transitioning from cheap exports to higher-value sectors, Xi has “slowed things down by prioritising control over change”. Cracks in the economy include manufacturing overcapacity, the ongoing property crisis, “shaky” local government finances which are hindering investment, record unemployment and falling confidence.

Xi Jinping's three-pronged US strategy

China has plenty of leverage – the US imports roughly $430 billion annually from China and exports close to $150 billion – and it is sending a clear signal that it is ready to strike back, says Alexandra Stevenson in The New York Times.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On 2 January, China added 28 American firms to an export control list. It has also announced an antitrust probe into Nvidia and banned the export of rare minerals to the US.

Xi’s planned three-pronged US strategy – “retaliation, adaptation and diversification” – is defined by “clarity and determination”, adds Evan Medeiros in the Financial Times. Though the effects have been patchy, “vigorous fiscal and monetary stimulus to help businesses and now consumers” began in late 2023 with a “possible trade war in mind”. Beijing is considering unilateral tariff cuts on imports from non-US partners. Nevertheless, China’s economic crisis hasn’t changed Xi’s “commitment to a directed economy and officials’ unwillingness to tell him no”, says Palmer. He has reportedly said that he “doesn’t see what’s so bad about deflation”. If Trump’s tariffs don’t lead to a “rethink”, they could ironically help Xi by providing a “convenient scapegoat” for public anger.

This stand-off couldn’t come at a worse time, says Thomas Friedman in The New York Times. The world faces “three epochal challenges” – “runaway artificial intelligence, climate change and spreading disorder from collapsing states”. The US and China are the world’s two AI superpowers, two leading carbon emitters and have the two largest navies – in other words, they are the only powers that offer any hope of addressing these challenges. We need an “updated Shanghai Communiqué” (the Nixon-Zedong era document which set out the principles for the normalisation of US-China relations).

That would help govern the new realities and ensure that AI cannot be “used for destructive purposes by bad actors”. Strategies to get the world to net zero by 2050 are also needed to reduce the effects of climate change, which will increase disorder in failing states, an issue that constitutes a “big common enemy”. From Syria to Venezuela, “more and more nation-states are falling apart” with migrants “scrambling to get to zones of order”. “If competition and collaboration give way entirely to confrontation, a disorderly 21st century awaits.”

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Emily has worked as a journalist for more than thirty years and was formerly Assistant Editor of MoneyWeek, which she helped launch in 2000. Prior to this, she was Deputy Features Editor of The Times and a Commissioning Editor for The Independent on Sunday and The Daily Telegraph. She has written for most of the national newspapers including The Times, the Daily and Sunday Telegraph, The Evening Standard and The Daily Mail, She interviewed celebrities weekly for The Sunday Telegraph and wrote a regular column for The Evening Standard. As Political Editor of MoneyWeek, Emily has covered subjects from Brexit to the Gaza war.

Aside from her writing, Emily trained as Nutritional Therapist following her son's diagnosis with Type 1 diabetes in 2011 and now works as a practitioner for Nature Doc, offering one-to-one consultations and running workshops in Oxfordshire.

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?