Why we should scrap the Budget

The yearly Budget, big set-piece of British politics, encourages the very worst from the government, says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Budget has always been one of the big set-piece occasions of the British political calendar. The chancellor sets out his plans for tax and spending for the year, determining the fate of departments, and usually coming up with one or two headline-grabbing new policies. It defines the government’s agenda for the year and the chancellor gets his chance to shine.

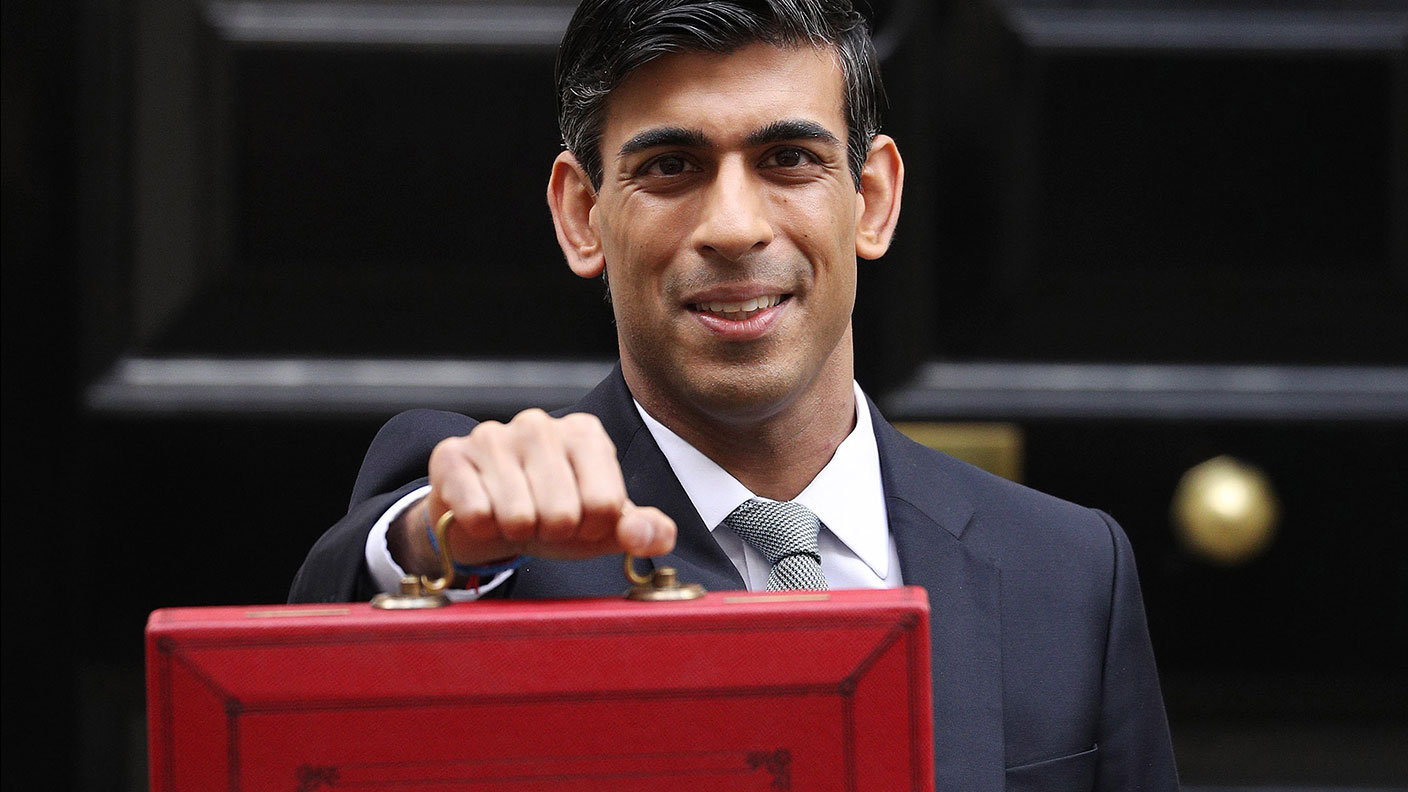

Rishi Sunak’s Budget speech is scheduled for next week and there is already plenty of speculation on what it might contain. But there is something the chancellor could do that would be far better for the economy than delivering a two-hour speech to the House of Commons: just take the day off instead.

Enough already with the tax fiddles

First, we have had enough major changes to the tax and spending regime already for one year. It has been a massive 12 months for tax and fiscal policy, unprecedented outside of wartime. We have seen corporation tax pushed up to 25%, reversing 40 years of steady reductions in the levy on company profits. We have seen a whole new social charge introduced, the “health and social care levy”, which is, in effect, an extra form of national insurance. We have seen the deficit pushed up to the highest level outside of wartime, while vast new spending programmes, such as the furlough scheme that ended up costing £70bn, were launched in the blink of an eye.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It is, to put it mildly, a lot. It is hard to see that the Budget really has anything else to accomplish. We have seen that the political system is capable of responding quickly as the economy changes, and policy changes with it. Is it really necessary to wait until the chancellor’s big Budget speech to make any reforms?

Second, the Budget encourages the very worst form of government. Every chancellor feels he needs to do something to grab some headlines: an extra tax on petrol lawn mowers for generating greenhouse gases; a levy on tanning salons because they might be bad for our skin; a subsidy for anyone developing electric planes.

A Budget can very quickly turn into an hour of high-profile virtue-signalling with the chancellor dishing out rewards and punishments according to whatever fad is dominating the headlines that week; it makes for easy politics and guarantees some positive coverage. The trouble is, it clutters up the tax system with endless fiddly tax rules. It is very easy to introduce a subsidy for something, but once it is in place it is very difficult to repeal it. The result is a tax system so complex even expert accountants can hardly understand it anymore.

Replace it with a Great Repeal Statement

True, we have made some progress. In his pomp, Gordon Brown introduced what was in effect two Budgets a year: the main one, plus the Autumn Statement, both of which came with his trademark round of fiddly gimmicks and stealth taxes that no one really noticed for a few years. Philip Hammond, who, looking back, was a far better chancellor than we realised at the time, did everyone a huge favour by finally getting rid of that abomination.

We could go further: the one thing the British tax system needs right now is less clutter. And it definitely doesn’t need yet more interference from the government and more rule changes. It would be a lot healthier if we simply left it alone for a while.

If Rishi Sunak wants to have a big day with lots of TV cameras following him around then he could try a Great Repeal Statement – a one hour speech that ripped up lots of small and fiddly taxes that hardly anyone pays any more anyway. That would be a bold signal of intent, would still generate some headlines, and would remind everyone that amid all the industrial strategies, subsidies and interventionism this was still a Conservative government.

But a full-scale Budget? We definitely don’t need another one this year. And if we scrapped it for this year, perhaps it could be quietly consigned to the history books for ever – if chancellors did a little less for a few years, the economy might even end up in better shape.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?