Four options for the sale of Chelsea FC

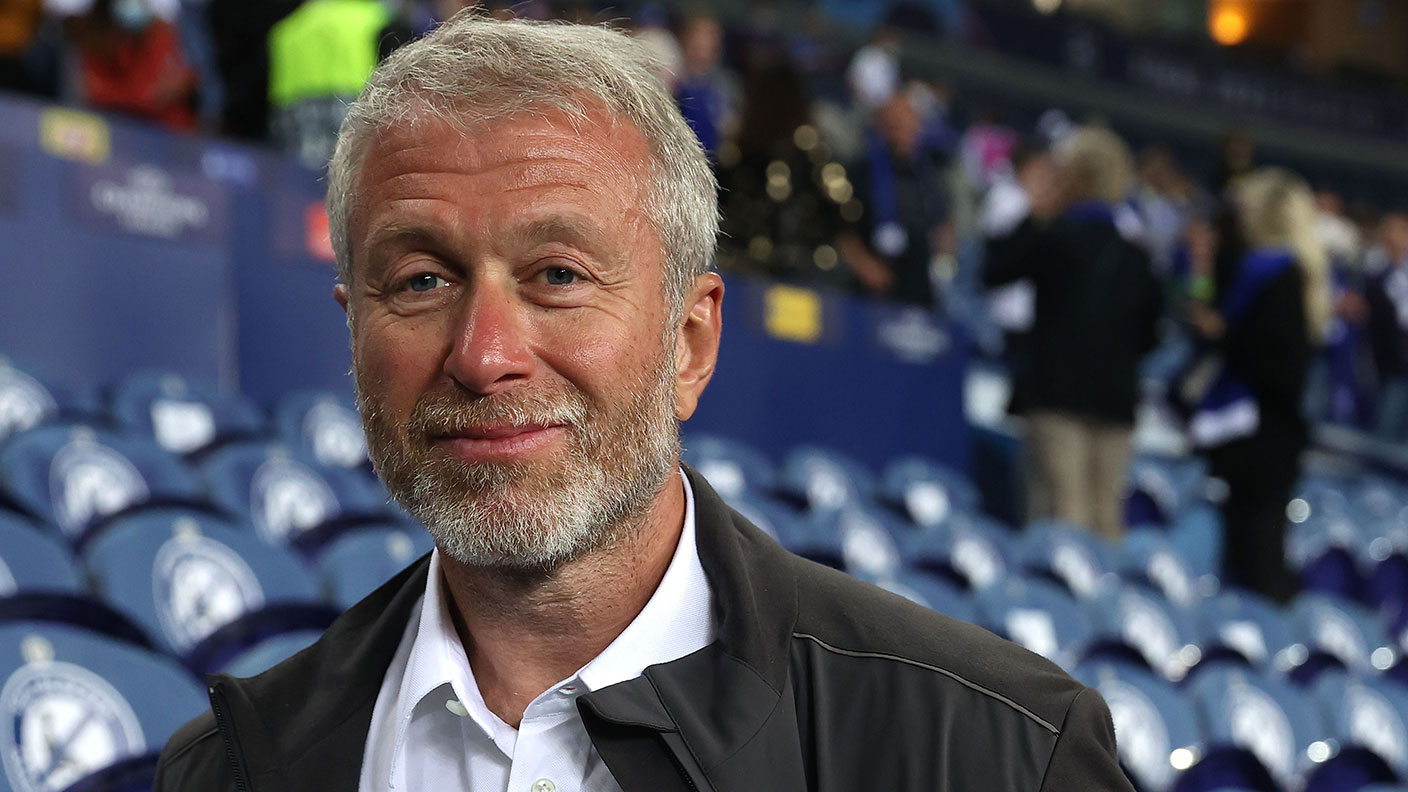

The UK's sanctioning of Chelsea owner Roman Abramovich resulted in Chelsea going up for sale. Matthew Lynn explains four options that should be considered.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The sanctioning of Roman Abramovich, the Russian oligarch who has controlled Chelsea football club for nearly 20 years, and who started the flood of foreign money into the game, resulted in the club going up for sale. By the time you read this we might know who has bought it.

Potential bidders for an asset that was expected to command well over £3bn included a consortium led by the owners of the LA Dodgers; another led by the Ricketts family who own the Chicago Cubs; a team led by the property developer Nick Candy; and one or perhaps two others who may yet make the final round. An offer from Amazon, Netflix, Disney, or Sky’s owner, Comcast, would really shake things up – there could well be a surprise before the deal is finalised.

But whoever ends up buying it, there was a missed opportunity here – this could have been the moment to reinvent the way one of the UK’s most successful industries is run.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Britain’s Hollywood

The UK government is, quite rightly, vetting all the bids. It has said that all the money from the sale will go to charity, with much of it ultimately dedicated to helping the refugees flooding out of Ukraine.

But why are we selling it to another foreign multinational sports franchise? The Premier League is a great UK commercial success. It is the most popular sporting contest in the world; in many ways it is an asset as valuable to the UK as Hollywood is to the US.

But its ownership is a mess, dominated by an odd mixture of Gulf States, absentee American sports conglomerates, or Asian or Russian billionaires. Only a handful of clubs still have British owners.

None of them have any links to the towns where the teams are based and many owners are using the clubs simply to improve their reputations.

They have no interest in the towns where they are located, or even the long-term success of the sport. The sale of Chelsea in such strange circumstances is a chance to try something new. Here are four options we should be thinking about.

First, give it away. The club could simply be placed in the hands of a supporters’ trust, with anyone who had held a season ticket for five consecutive years given a share. After that, it would be up to the fans to decide what to do with it. They could run it as effectively as they pleased. They could list it on the stockmarket, or if they really wanted to they could sell it to someone else. Sure, it would not have as much cash to spend on transfers as it might with another mega-rich owner. But there is plenty of money in football these days. Free of debt, there is no reason why Chelsea should not be self-sufficient financially and still do well.

Second, donate it to Chelsea. One share could be given to every resident in the Royal Borough of Kensington and Chelsea. With 156,000 of them, and a £3bn price tag for the club, that would come to almost £20,000 per person. Alternatively, why not give a share to everyone in London? Either way, the club would be owned by its local community.

Experimenting with ownership

Third, turn it into a national asset. The club could be put into a new company owned by the government and then floated. The money raised would be enough for at least a small temporary tax cut, which might help with the cost of living crisis. Finally, it could be placed in the hands of a broadcaster. Folded into the BBC, ITV or Channel 4, it could be the basis for a new sports streaming service, and at virtually zero cost. If streaming is the future, as many experts believe, that could create a powerful new UK company.

There may be other options, but the point is this: there is nothing necessarily wrong with foreign owners and global sports franchises. Over the last two decades they have brought a lot of money into the game and turned it from a domestic into a global contest. But the Premier League could use some different forms of ownership. The sale is a chance to try something new, creating models that might work better. We should take some time to debate that – not just flog it off as fast as possible.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?