Investing in football clubs: how you can profit from the beautiful game

Football clubs may often be money pits for oligarchs, but they are also huge global brands, says John Chambers – and investors are now starting to recognise their potential

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Owning football clubs has long been considered an effective way of separating rich men from their fortunes. But if they are just vanity projects for sheikhs and oligarchs, why are shrewd investors such as Nick Train of fund manager Lindsell Train and bankers from JPMorgan getting involved in the business of football?

The past 18 months have been a struggle for all football clubs, owing to the virus-induced absence of fans from grounds – Europe’s top clubs have missed out on some €2bn of revenue over this period. Still, with a return to near-normality this season, that shortfall is likely to prove a relatively small blip in otherwise strong revenue growth over the past few years.

If any proof were needed that football has become a huge business opportunity, then look no further than last spring’s ill-fated European “Super League”. While the notion was quickly squashed following a dramatic rebellion by fans and opportunistic politicians, it clearly signposts the direction of travel for the industry.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

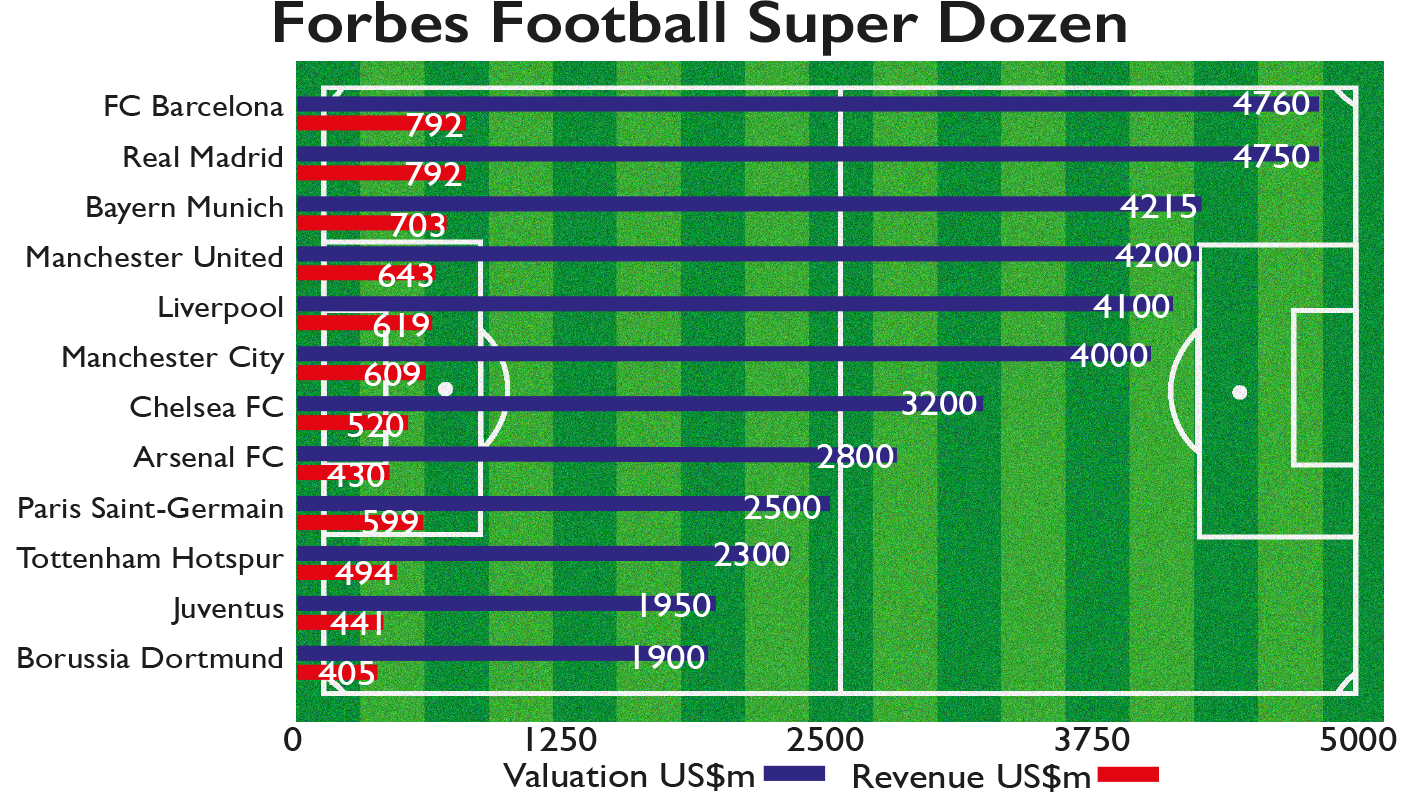

Forbes, the financial media company, produces an annual list of the world’s most valuable sports teams, traditionally headed by the Dallas Cowboys NFL franchise. Forbes estimated that had the Super League proposals gone ahead, the two leading Spanish football teams – Barcelona and Real Madrid – would have taken over at the top of the table. Forbes’ analysis clearly shows that the dozen top football teams are breaking away from the rest in terms of revenue and valuation. The 2021 analysis is summarised in the table below.

Clubs are becoming brands

These days a relatively small proportion of the revenue for the leading clubs comes from matchday receipts – typically around 15% of the total. Even the huge revenues from broadcasting of games throughout the world are being dwarfed by the commercial rights from sponsorship and merchandising. The club is becoming the brand.

Stadium assets, too, are being worked harder. Long gone are the days of opening them up for 20 Saturdays a season. They are often open daily for tours, conferences, events and other sports matches. The new Tottenham Hotspur stadium, for example, was designed with NFL (American Football) matches in mind as much as soccer.

The NFL games hosted there are sell-outs, with the supporters putting soccer fans to shame in terms of the merchandise they buy. The stadium can also host boxing matches and other sports. It is open for away matches so fans can watch the game and drink at the longest bar in Europe. The rapidly growing popularity of the women’s game is also helping to fuel sales.

The leading fan of football clubs as an investment opportunity is Nick Train. Lindsell Train has major stakes in at least four clubs. It is the number-two shareholder in Manchester United after the Glazer family with a 26% holding, and number-two again in Juventus with an 11% stake. It also has stakes in Borussia Dortmund and Glasgow’s Celtic. Train highlights the scarcity value of listed football teams. Many are owned by individuals or, in Spain and Germany, fan-controlled trusts.

Putting a financial value on clubs is difficult, given that so many are in private hands. Revenue from trading players can dwarf underlying profits and result in volatile earnings from year to year. Accounting can also throw up anomalies. For instance, if a club buys a player for £50m, that sum will show up in the balance sheet, whereas a home-grown player who has risen from the club’s academy will not feature even if he has a similar valuation. Kieran Maguire, who teaches a football industries MBA at Liverpool Management School, has written a fascinating book, The Price of Football, on the topic.

Both Forbes and the consultancy Deloitte publish annual analyses of the value of football clubs. They have tended to use revenue as the key metric on which to base their valuations, although Deloitte is also starting to record the number of social-media followers each club has, which is key to gauging the size of the fan base.

The amount a club can achieve for sponsorship deals is ultimately a function of the number and passion of their fans. Keith Wilson, a director at Lindsell Train, points out that “sports franchises in particular have the power to draw the largest number of eyeballs, making them among the most valuable of intellectual properties”.

Europe has gone global

European football is a worldwide industry. The major teams have fan clubs all over the world. In most countries you will see children playing in Manchester United or Barcelona shirts. Train believes that the widespread Italian and Scottish diaspora is valuable for Juventus and Celtic. If you go to an Italian suburb in any North American city, the locals will be passionate about the Ferrari Formula One team – and Juventus.

The major clubs are all looking for ways to grow their global popularity and brand recognition, especially in the lucrative Asian market. For example, Son Heung-min is arguably a more valuable player to Tottenham than Harry Kane. The South Korean is hugely popular in Asia and has helped to raise the club’s profile there, greatly facilitating a shirt-sponsorship deal with Hong Kong-based life-insurer AIA.

Ryan Hughes, head of fund selection at investment platform AJ Bell, agrees with Nick Train that if you are considering an investment in a football team you must think big: “In the world of sport, it is very much a case of the big get bigger, and the big get stronger because of the power of the global brand.” With the growth in social media and streaming the spoils will increasingly go to the biggest brands. If you fancy taking on the billionaires and oligarchs, here are some ideas.

Three potential winners

Football clubs can be volatile, with share price movements tracking the performance on the pitch over the short term. But over the longer term, valuations have increased greatly. There are ten European football clubs listed on recognised stock exchanges. For the reasons outlined above I would ignore any club outside the top 12 in the Forbes list, as the revenues drop off very quickly.

It is difficult to look past Manchester United (NYSE: MANU) as it is one of the ultimate global brands with widespread recognition even outside the game. It has 141 million followers on the main social-media platforms; only Barcelona and Real Madrid boast more. The stock is not cheap, with the highest price relative to turnover of the listed clubs, but it is 30% below its pre-Covid-19 peak and on a discount to the Forbes valuation.

Juventus FC (Milan: JUVE) dominates Italian football. Following an unbeaten season in 2011-2012, it went on to win the next nine seasons. Some 34% of Italian football fans support the club, while there are many more international supporters. It has over 100 million social-media followers. The club is controlled by their Turin neighbours, the Agnelli family of Fiat Motors, through Exor NV, the family-run holding company with a 64% shareholding. Andrea Agnelli is the club chairman.

Unlike other billionaire football-club owners, the Agnellis run Juventus as a profit-making business: witness the recruitment of Cristiano Ronaldo for €100m at the relatively mature age of 33 in 2018. The strategy behind this was not so much his potential impact on the field but the huge rise it led to in terms of merchandising and brand awareness. Following Ronaldo’s recent move to Manchester United, shirt sales smashed all previous records in a few hours.

Institutional investors cannot add shares in Tottenham Hotspur to their portfolio as they are only available on the informal share-trading platform Asset Match (assetmatch.com) and trading volumes are very low. For the patient private investor, however, it might be worth a look.

It is very cheap compared with its listed peers. Based on the last trade, the company is valued at less than its annual sales. The two major shareholders are billionaire currency trader and investor Joe Lewis and the club chairman Daniel Levy, but there is a small rump of private shareholders, mostly fans – a legacy of its past life on the Aim market. Levy is considered one of the finest brains in football and has run the club on a self-funding basis without external finance.

You would need to be prepared to hold onto it for the long term, given the lack of liquidity, but there might be some potential catalysts that could boost the share price in the not-too-distant future. Firstly, if Tottenham were ever to get an NFL franchise it would be a complete game changer. Alternatively Lewis, who is now 84, might decide to hang up his boots. (The author is a shareholder.)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how