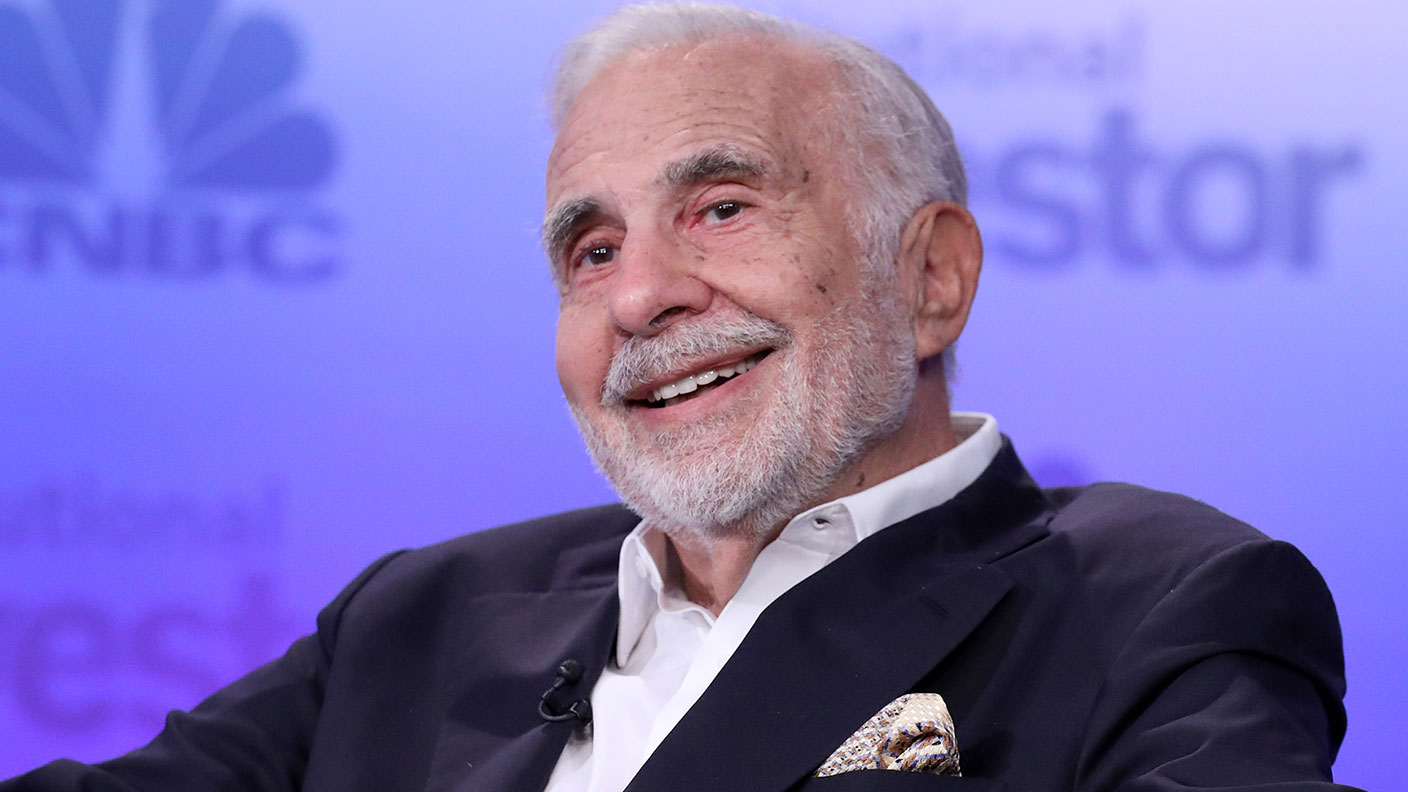

Carl Icahn: “King Kong” takes a bite of McDonald’s

Legendary corporate raider Carl Icahn is showing a softer side, taking a slice of fast-food giant McDonald’s to improve animal welfare. No doubt he is seeking to secure his legacy too.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In his terrifying heyday, the veteran corporate raider Carl Icahn went by the moniker “King Kong” on Wall Street. He was also known as “The Lone Wolf” and “The Great White Shark”. At 86, the fearless boardroom challenger is still predatory, says the Financial Times.

His latest prey is McDonald’s, where he has installed two new directors and is agitating for change. So far, so Icahn. What really surprised observers, though, was his stated rationale, which showed a distinctly “softer side”. He doesn’t like the way McDonald’s suppliers treat their pigs.

Activism in the blood

Icahn, who is known to have inspired Gordon Gekko’s “If you want a friend, get a dog” quote from the 1980s movie Wall Street, says he has felt “very emotional” about the pigs’ plight ever since they were brought to his attention by his vegetarian daughter, Michelle, says Forbes. Cynics reckon the “bigger mission” of the octogenarian billionaire (he is worth $16.6bn) is to set his legacy straight. Icahn’s new-found interest in sow husbandry coincides with a new HBO documentary, The Restless Billionaire – a retort against those who paint activist investors as “bad guys”, spliced with entertaining scenes of family life at his home in Indian Creek, Miami, an area known as the “Billionaire Bunker”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The film gives a full rundown of Icahn’s “greatest hits” down the decades – from Texaco to Apple, says The Wall Street Journal. He also expounds upon his “methods and philosophy”, outlining what he sees as a crisis in corporate governance that is feeding into America’s current economic predicament. “Part of the reason for inflation is [poor] productivity,” he says. “And that’s because [some] of these CEOs are inept. They don’t care a hell of a lot.” His calling in life has always been to make them care. “He has activism in his blood,” says one Wall Street analyst.

Born in 1936 and raised in Far Rockaway, Queens, his father was a synagogue cantor and his mother a schoolteacher, with whom he had a “stormy” relationship, says Bloomberg. He got to Princeton to study philosophy, funding himself from poker winnings; dropped out of medical school to join the US army, before heading for Wall Street in 1961. Icahn’s first hostile takeover campaign in 1978 targeted appliance-maker Tappan: he sold off its assets and ultimately doubled his initial investment, says Forbes. “The thrill of the hunt got him hooked.” Future targets included the airline TWA (a campaign funded with debt from junk-bond king Michael Milken), RJR Nabisco, Marvel, Time Warner and eBay.

The Icahn lift

Some campaigns bombed, but collectively they reshaped the landscape. CEOs lived in dread of the terrifying words, “Carl Icahn is on the phone”. Investors followed his every move. When Icahn bought into a company, the subsequent upswing of shares became a phenomenon known as the “Icahn lift”. In 2013, Apple’s market capitalisation jumped by $17bn on the back of one of his tweets. In the run-up to the 2016 presidential election, Donald Trump floated the idea of making Icahn his Treasury Secretary. The idea came to nothing, though, as Icahn’s biographer later noted, his cold-blooded smarts would have been the perfect foil to Vladimir Putin.

In recent years, Icahn has been stumbling, says the FT. His contrarian philosophy of buying something “when no one wants it” sat at odds with the momentum-driven, tech-led bull market. But he may have the last laugh as bets in energy companies such as Occidental start paying off big time. “As the famous saying goes,” Icahn says gleefully, “the trend is your friend, till the end.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example

-

Michael Moritz: the richest Welshman to walk the Earth

Michael Moritz: the richest Welshman to walk the EarthMichael Moritz started out as a journalist before catching the eye of a Silicon Valley titan. He finds Donald Trump to be “an absurd buffoon”

-

David Zaslav, Hollywood’s anti-hero dealmaker

David Zaslav, Hollywood’s anti-hero dealmakerWarner Bros’ boss David Zaslav is embroiled in a fight over the future of the studio that he took control of in 2022. There are many plot twists yet to come

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The political economy of Clarkson’s Farm

The political economy of Clarkson’s FarmOpinion Clarkson’s Farm is an amusing TV show that proves to be an insightful portrayal of political and economic life, says Stuart Watkins

-

The most influential people of 2025

The most influential people of 2025Here are the most influential people of 2025, from New York's mayor-elect Zohran Mamdani to Japan’s Iron Lady Sanae Takaichi

-

Luana Lopes Lara: The ballerina who made a billion from prediction markets

Luana Lopes Lara: The ballerina who made a billion from prediction marketsLuana Lopes Lara trained at the Bolshoi, but hung up her ballet shoes when she had the idea of setting up a business in the prediction markets. That paid off