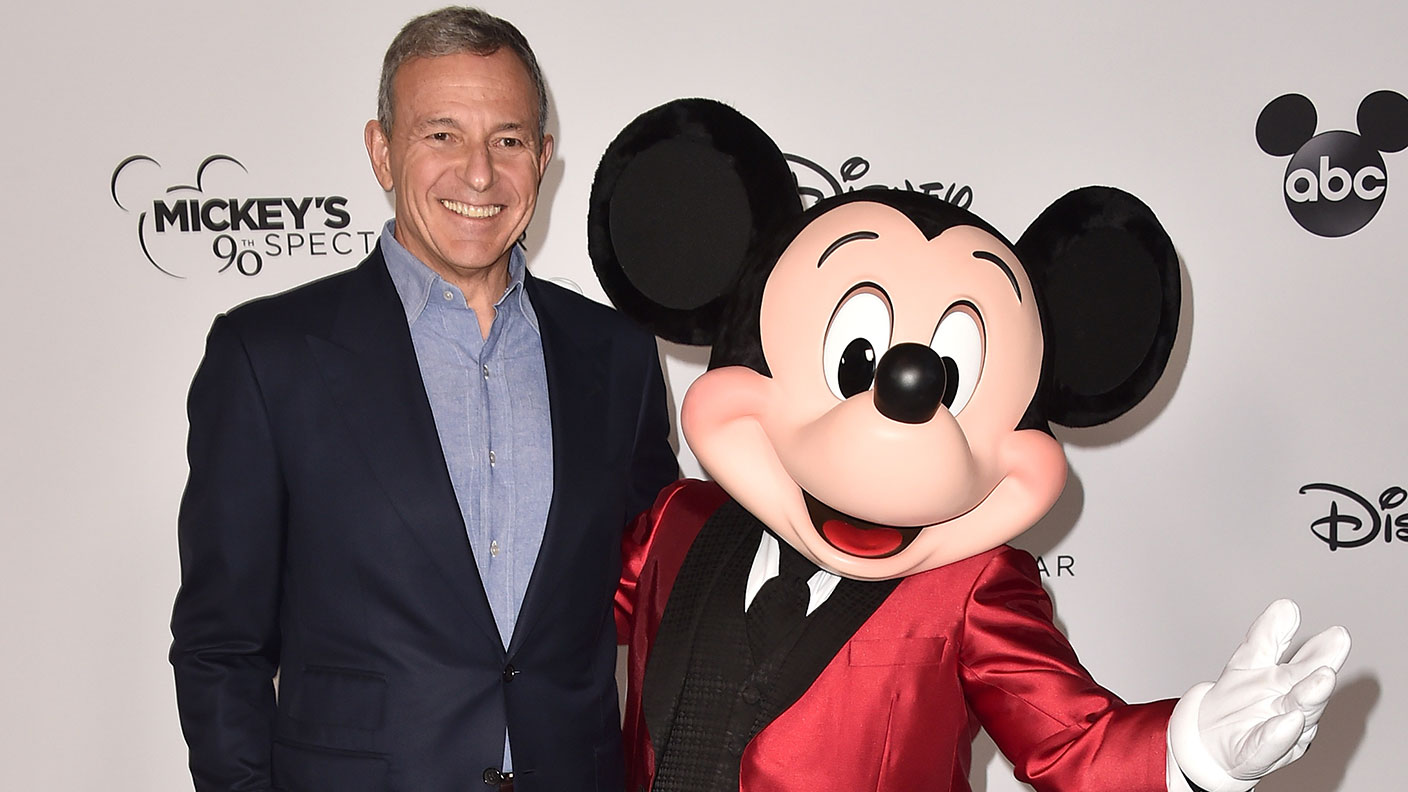

Bob Iger: the man who reinvented Disney

Bob Iger is stepping down as head of the entertainment giant after 15 years in charge. He leaves a far stronger company in prime position for the future of film and television.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Long before he became Disney’s “celebrated supreme leader”, Bob Iger was a humble weatherman, starting his career in 1973 at a cable station in Ithaca, New York, “doing that awkward talking-into-space thing while reciting temperatures”, says The New York Times. Last week, he “went out as he came in” – marking his retirement with an unannounced star-turn in front of the weather map on an early morning KABC newscast in Los Angeles. “There is a light rain falling,” he announced. “However, this is just a prelude to a big storm.” Disney fans, who have largely enjoyed an enchanted period in the Magic Kingdom under Iger’s 15-year watch, will be hoping there’s no significance in that.

Iger’s four big deals

Iger’s big achievement has been to leave “a much stronger company than he inherited”, thanks to four key acquisitions, says the Financial Times. In 2006, he bought Pixar Animation (Toy Story, Finding Nemo) from Apple, following that up with Marvel Entertainment and Star Wars creator, Lucasfilm. His 2019 deal to buy 21st Century Fox from Rupert Murdoch for $71bn “sealed his reputation as a master dealmaker” – not least because it paved the way for Disney’s big push into streaming. The timely launch of Disney+ in 2019 not only took the battle to Netflix and Amazon, but saved his firm from catastrophe when Covid-19 struck, forcing the closure of cinemas and entertainment parks worldwide. Within 18 months, the service notched up 100 million subscribers (a feat that took Netflix more than a decade to achieve) ensuring Disney shares rebounded to record highs “even after other sources of revenue evaporated”.

The accepted wisdom in Hollywood is that this success couldn’t have happened to a better man. In a town of sharks, Iger is so renowned for his gentlemanly good manners and “honourable” dealings, that Variety dubbed him “The Cashmere Prince”. The worst his critics can come up is that he has cultivated “a cult of nice”. Perhaps the most inspiring thing, says the Los Angeles Times, is that no-one expected it to happen. Long “under-estimated” in the industry, few expected Iger to land the top job at Disney when his “larger-than-life” predecessor, Michael Eisner, stepped down – he was typecast as “a loyal drone”. And having got the job, expectations were low. As one top Hollywood player told The New York Times: “Nobody expected Bob Iger to be Bob Iger.”

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Getting things done

Iger, who these days comes across as “effortlessly elegant”, attributes his success to the hard work and discipline required to get on in life if you view yourself as “unexceptionable”. From early on in his career, “people started relying on me because they knew if they asked me to get something done… I would get it done”.

That sense of obligation and “sang-froid when things go wrong” dates back to his childhood, says The New York Times. Born in 1951, to a Jewish family in Oceanside, Long Island, his father – a trumpet player who became an advertising executive – suffered from “dark moods”. Bob’s role as the oldest son, as he relates in his memoir, The Ride of a Lifetime, was to be “a calming influence in the house”. As a teenager, he worked as a stock boy in a hardware store, and later as a janitor for his school district. When he started in TV, he dreamed of being the next Walter Cronkite, but “was something of a flop, lasting only a year”, says The New York Times. He took an executive job with ABC, rising steadily up the ranks – a trajectory that continued when ABC was bought by Disney in 1995. Within ten years, he landed the top job.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example

-

Michael Moritz: the richest Welshman to walk the Earth

Michael Moritz: the richest Welshman to walk the EarthMichael Moritz started out as a journalist before catching the eye of a Silicon Valley titan. He finds Donald Trump to be “an absurd buffoon”

-

David Zaslav, Hollywood’s anti-hero dealmaker

David Zaslav, Hollywood’s anti-hero dealmakerWarner Bros’ boss David Zaslav is embroiled in a fight over the future of the studio that he took control of in 2022. There are many plot twists yet to come

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The political economy of Clarkson’s Farm

The political economy of Clarkson’s FarmOpinion Clarkson’s Farm is an amusing TV show that proves to be an insightful portrayal of political and economic life, says Stuart Watkins

-

The most influential people of 2025

The most influential people of 2025Here are the most influential people of 2025, from New York's mayor-elect Zohran Mamdani to Japan’s Iron Lady Sanae Takaichi

-

Luana Lopes Lara: The ballerina who made a billion from prediction markets

Luana Lopes Lara: The ballerina who made a billion from prediction marketsLuana Lopes Lara trained at the Bolshoi, but hung up her ballet shoes when she had the idea of setting up a business in the prediction markets. That paid off