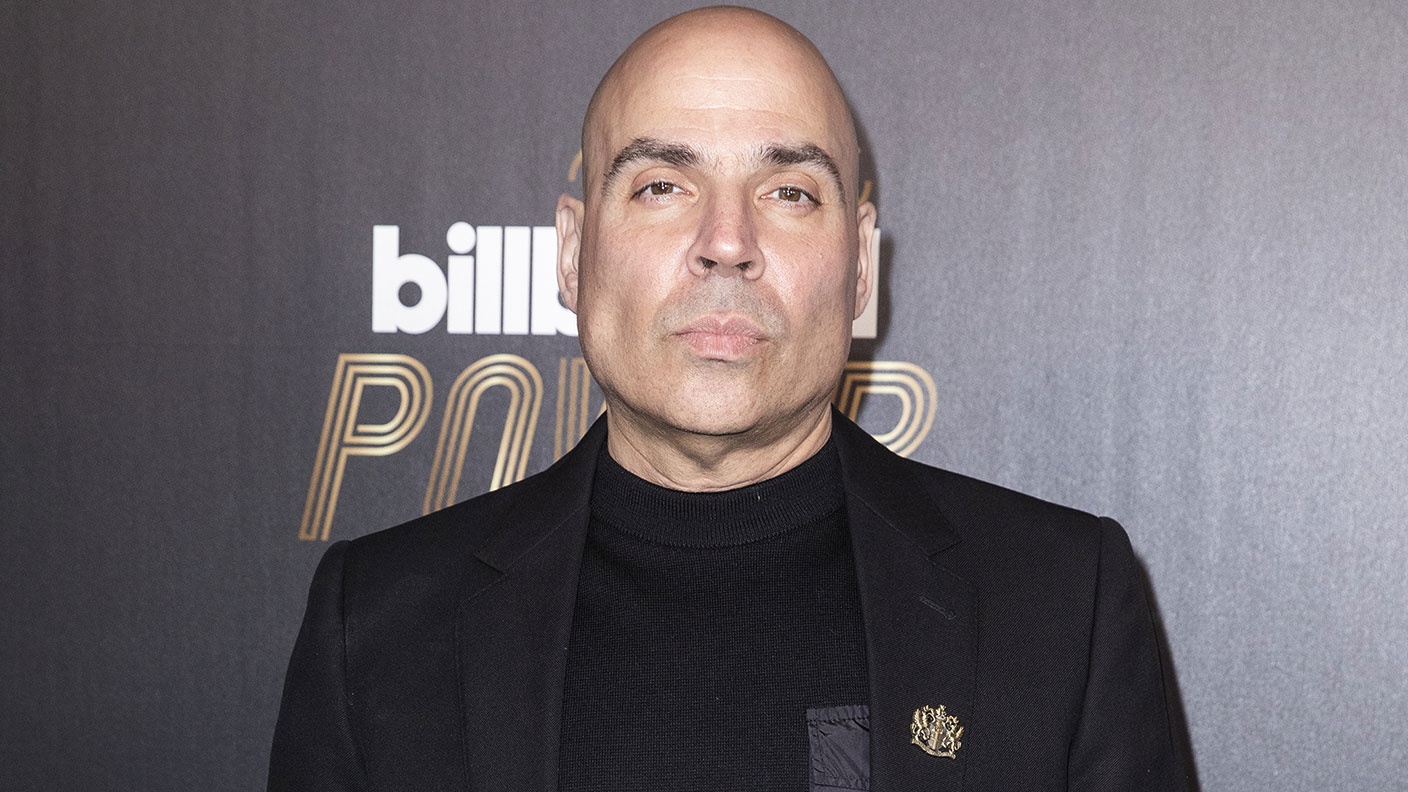

Merck Mercuriadis: the mogul shaking up the music business

Merck Mercuriadis has been spending millions snapping up the rights to hit songs and turning them into an income stream for investors. Can the good times last?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Few have shaken-up the music industry quite as effectively as Merck Mercuriadis, says The Guardian. In less than three years, the 57-year-old Canadian behind the Hipgnosis Songs Fund has become “the most disruptive force” in the business. London-listed Hipgnosis has been at the vanguard of the music rights gold rush – raising money from investors to acquire the intellectual property to popular songs.

After a barnstorming year of acquisitions in 2020, Mercuriadis’s portfolio of “evergreen” hits now stands at around 61,000 – encompassing artists from Bon Jovi to Barry Manilow. Investors have bought into the idea, says The Times, and a “flood of capital is heading for song funds”. In December, Hipgnosis – which has a market cap of around £1.26bn – announced plans to raise a further £1bn to spend on its Songs Fund.

Predictable income in a changing world

A classic song, says Mecuriadis, is a source of predictable income in an unpredictable world – a “more reliable” asset class than oil or gold because demand is unaffected by economic and political upheavals. And in the streaming economy, it keeps on giving – particularly when the value is maximised via “synching” arrangements with films and TV shows and so on.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In a fast-growing market, what sets the former Elton John manager apart from a growing army of competitors is his “bona fides” as a veteran A&R man, says The Guardian. He’s also a music nut. His father was a former professional footballer from Greece who moved to Northern Quebec to work in the iron-ore industry – later relocating to Nova Scotia, where the family opened a diner. Mercuriadis, born in 1963, spent his formative years helping out there while the jukebox played.

He landed his first job in the marketing department of Virgin Records in Toronto at 19 after pestering the label with letters, says the Evening Standard. Quickly emerging as an energetic executive with an “encyclopedic knowledge of music”, Mercuriadis honed a reputation that has stuck as “a champion of the artist”. In 1986, he moved to London to work for Sanctuary, the label founded by Iron Maiden’s managers, and stayed for the next 21 years, before moving to New York in 2000 where he helped relaunch the Rough Trade label. He teamed up with a musician – the disco pioneer and producer Nile Rodgers – to launch Hipgnosis in 2018.

A paradigm shift

Unlike the stereotypical music mogul, Mercuriadis has spartan tastes, says The Guardian. “The only material thing I really care about is vinyl…and Arsenal football club,” says the buff, teetotal vegan. He may look like a bouncer, but, according to Mark Ronson, Mercuriadis is “the smartest guy in the room”. He’s certainly prepared to take on all comers when it comes to arguing the merits of a model that many believe could end in tears, says Music Business Worldwide. Hipgnosis’s rapid growth has drawn considerable “behind-the-curtain industry sniping”.

There’s good reason to be sceptical about Hipgnosis’s seductive tune, says The Times. The Song Fund’s “annuity-type returns” look fabulously appealing, but songs “are extremely difficult to value” and Hipgnosis’ valuations could prove “ludicrously optimistic”. Mercuriadis is defiant. “I think we will see 40-times multiples in this business before the next five years are over,” he told Music Business. “The paradigm is already shifting”; that “scares some people.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example

-

Michael Moritz: the richest Welshman to walk the Earth

Michael Moritz: the richest Welshman to walk the EarthMichael Moritz started out as a journalist before catching the eye of a Silicon Valley titan. He finds Donald Trump to be “an absurd buffoon”

-

David Zaslav, Hollywood’s anti-hero dealmaker

David Zaslav, Hollywood’s anti-hero dealmakerWarner Bros’ boss David Zaslav is embroiled in a fight over the future of the studio that he took control of in 2022. There are many plot twists yet to come

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The political economy of Clarkson’s Farm

The political economy of Clarkson’s FarmOpinion Clarkson’s Farm is an amusing TV show that proves to be an insightful portrayal of political and economic life, says Stuart Watkins

-

The most influential people of 2025

The most influential people of 2025Here are the most influential people of 2025, from New York's mayor-elect Zohran Mamdani to Japan’s Iron Lady Sanae Takaichi

-

Luana Lopes Lara: The ballerina who made a billion from prediction markets

Luana Lopes Lara: The ballerina who made a billion from prediction marketsLuana Lopes Lara trained at the Bolshoi, but hung up her ballet shoes when she had the idea of setting up a business in the prediction markets. That paid off