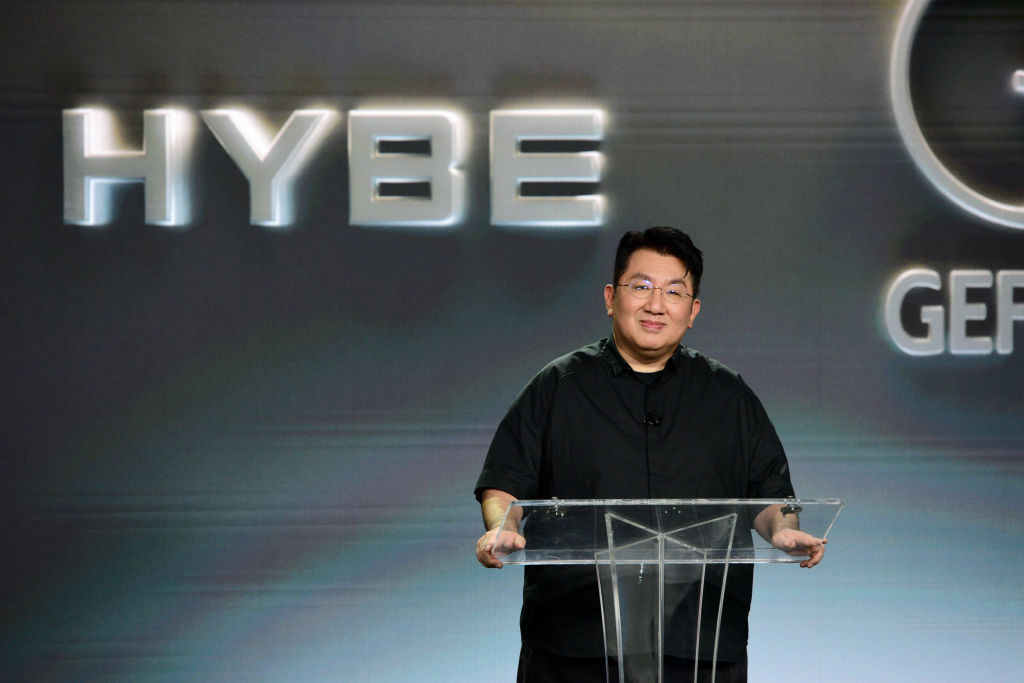

K-pop hitman Bang Si-hyuk aims to repeat BTS phenomenon

Bang Si-hyuk created the world’s biggest boy band, BTS, making K-pop music a global sensation and himself very rich. Can he repeat the trick with a girl band?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Vintage groups, from The Monkees to The Spice Girls, bear witness to the power of the manufactured pop band. Mix it up with K-pop, bang it out on TikTok and YouTube, sit back, and take the profits. That, at any rate, is the hope of South Korean music mogul Bang Si-hyuk, who for the past two years has been sifting through more than 120,000 applications to form a new girl group in partnership with one of the world’s largest record labels, IGA.

The hype surrounding the joint venture – dubbed “The Debut: Dream Academy” – is so intense that a documentary charting its twists and turns is already slated to air on Netflix next year.

Bang’s proposed formula, says Billboard, is “to form an international group based on the K-pop methodology” and “develop them into a global girl group” by way of a gripping contest all available to watch on YouTube.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The action started at the end of August, when 20 finalists from a dozen countries were introduced at an event in Santa Monica, California. The wholesome aim, explained an executive, is to celebrate an “interconnected” world in which music “breaks down the barriers across languages and culture”. The final members of the group will be selected – and their names revealed – in a live finale on November 17.

The Hitman’s fortune has been put at around $2bn

You can understand the interest from both pop fans and the suits at Geffen Records (a subdivision of IGA, itself owned by Universal Music), says Bloomberg Businessweek. After all, Bang and his label Hybe are the driving force behind BTS (aka the Bangtan Boys) – “the world’s biggest boy band” credited with making K-pop into a global phenomenon. They were the first South Korean act to top the Billboard charts in the US and sell out stadiums across the world. BTS’s winning combination of catchy beats, delivered by seven attractive young men with a message of empowerment, has helped make Bang, nicknamed “Hitman” and now 51, very rich. Bloomberg Billionaire’s Index puts his fortune at around $2bn. Not bad for a kid whose parents once pooh-poohed his musical ambitions.

Bang grew up in Seoul, the son of a government official, and cut his teeth “listening to hip-hop and British synthpop and forming bands with classmates” – he played guitar. Under pressure to study something more serious, his big break came in 1994 when he won a national song contest and committed himself to a career in music. Teaming up with fellow musician Park Jin-young, he became a founder producer of the latter’s JYP Entertainment. The pair quickly found success in Korea with solo artists and a boy band and moved to Los Angeles in hopes of making it big there. Though unsuccessful, the contacts made would later prove very useful.

In 2005, Bang formed his own company, Big Hit Entertainment. Then, in 2010, a promising demo tape landed on his desk from a 15-year-old artist later known as RM. “Big Hit started a nationwide search for young hip-hop performers to join their new star”, subjecting hopefuls to “a multi-year training process”. Like many Korean media moguls, Bang is concerned that the “hallyu” – or “Korean Wave” – is now ebbing. Even Bang admits “there may never be another BTS”. But the pronounced internationalism of the Dream Academy project reflects a new drive. “To prevent against a dip and to satisfy growth-hungry investors – he wants to transform Hybe into “the first Asian music company with a global footprint”.

The industry began waking up to Bang’s empire-building when he bought Ithaca Holdings, run by the famed music manager Scooter Braun, in 2021 for $1.05bn, says Music Business Worldwide – following it up this year with the acquisition of “rap powerhouse” QC Media. He’s also been rounding out his tech portfolio. Weverse, a Hybeowned app that lets fans interact with each other and musicians, is at the heart of Dream Academy. He’s also bought an AI company specialising in vocals.

Can this combo catapult the “Global Girl Group” to superstardom? Don’t bet against it.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

Anthropic’s Dario Amodei: The AI boss in a showdown with Trump

Anthropic’s Dario Amodei: The AI boss in a showdown with TrumpAnthropic’s CEO Dario Amodei was on an extraordinary upward trajectory when he found himself on the wrong side of the American president. He is about to be severely tested.

-

The downfall of Peter Mandelson

The downfall of Peter MandelsonPeter Mandelson is used to penning resignation statements, but his latest might well be his last. He might even face time in prison.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example

-

Michael Moritz: the richest Welshman to walk the Earth

Michael Moritz: the richest Welshman to walk the EarthMichael Moritz started out as a journalist before catching the eye of a Silicon Valley titan. He finds Donald Trump to be “an absurd buffoon”

-

David Zaslav, Hollywood’s anti-hero dealmaker

David Zaslav, Hollywood’s anti-hero dealmakerWarner Bros’ boss David Zaslav is embroiled in a fight over the future of the studio that he took control of in 2022. There are many plot twists yet to come

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The political economy of Clarkson’s Farm

The political economy of Clarkson’s FarmOpinion Clarkson’s Farm is an amusing TV show that proves to be an insightful portrayal of political and economic life, says Stuart Watkins