Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

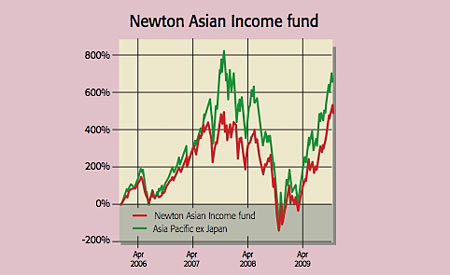

Investors rarely look to Asian stocks for income. "But it's not that difficult to find them," says Jason Pidcock, manager of the Newton Asian Income fund. The FTSE All World Asia (Ex Japan) index yields 2.7%, "and we look for stocks that yield more than that. There are literally hundreds to choose from"." With the fund yielding 4.9%, and up 62% over one year, he seems to be doing a good job.

Guided by themes such as rising domestic consumption and population growth in the East, Pidcock "will only consider a stock if its prospective yield is 35% higher than the FTSE AW Asia Pacific ex-Japan Index", says Andy Parsons at the Share Centre. Current favourites include CNOOC, the Chinese state oil company, and Macquarie Airports, which yields 9.5%. Its biggest asset is a large stake in Sydney airport, but it also owns parts of Copenhagen and Brussels airports. "Flight numbers to Sydney will continue to grow and it has recently refurbished the airport so retail sales will be better."

Pidcock is also taking an interest in high-yield, low-growth companies, such as telecoms stocks, which are yielding 8% but have underperformed the index this year. "If we get an 8% dividend yield and they offer 5% earnings growth plus we get some currency growth, we could see a 15% annual total return."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

"Historically, investors have been reluctant to seek income from regions they are unfamiliar with," adds Parsons. However, for those prepared to accept some risk, the potential for an attractive income yield and the possibility of growth mean Asia and the Newton Asian Income fund should not be overlooked.

Contact: 020-7163 2802.

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

NewtonAsia Income top ten holdings

| Macquarie Korea Infrastructure Fund | 6.4 |

| Telstra Corporation | 5.7 |

| CNOOC | 5.0 |

| APA Group | 3.7 |

| QBE Insurance Group | 3.3 |

| Keppel Corp | 3.3 |

| Hong Kong Land Holdings | 3.2 |

| Advanced Info Service Public Co | 3.2 |

| AMP | 3.2 |

| Macquarie Airports | 3.0 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.