Why you should stock up on water companies

In a bid to boost the economy and repair damage caused by underinvestment, $6.4bn of Obama's stimulus package is earmarked for water projects. That's creating big opportunities for some American firms.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Exhausted and ageing, London's Victorian sewage and water system is one of the capital's biggest headaches. But it could be worse. New York's sewers regularly overflow with wastewater, while diarrhoea among children is a recurrent problem in Milwaukee.

The trouble is, investment in US water infrastructure has been falling for years. Yet water usage has tripled over the last 30 years, even as the population has grown by just 50%, says Goldman Sachs. Texas, for example, where the population is set to double by 2060, faces the prospect of water rationing unless there is an increase in government investment.

This is one reason why $6.4bn of the $787bn Obama stimulus package has been promised for clean water and drinking water projects, as the administration looks to boost the economy and repair damage caused by underinvestment. That's creating big opportunities for some American firms. Take Nalco Holdings (NYSE: NLC), which engages in water treatment and is up 107% so far this year, or Flowserve Corp (NYSE: FLS), which has risen 94.5%. It makes vital pumps and valves for several industries, including water firms.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

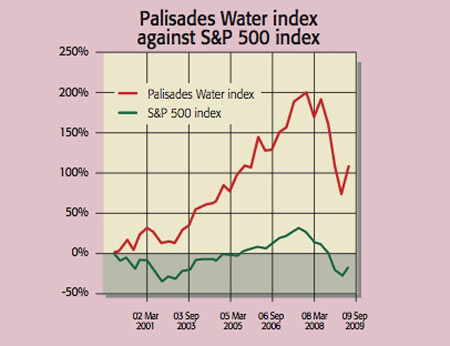

Investors looking for easy exposure to both, plus a range of other water stocks, can get it via the Powershares Water Resources Fund (NYSE: PHO). It tracks the Palisades Water Index and invests in firms providing portable water, water recycling, and technology and services directly related to water consumption.

Long term, the Palisades Water Index has stormed away. It's up 109% since 2000, against an 18% drop in the S&P 500. It has also managed a 25.45% return since 2004 versus the S&P's rather damp 4%. However, the one-year performance of the Powershares fund is less spectacular. Up 36%, it has only just mirrored the S&P 500's 37% return. But given that the full impact of federal spending won't be felt until 2010 and, as Motley Fool puts it, "this is a problem that is not going away", we agree with analysts at investment firm Janney Montgomery Scott (JMS), who point out that this water fund is set to keep on rising.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jody studied at the University of Limerick and was a senior writer for MoneyWeek. Jody is experienced in interviewing, for example digging into the lives of an ex-M15 agent and quirky business owners who have made millions. Jody’s other areas of expertise include advice on funds, stocks and house prices.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.