Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

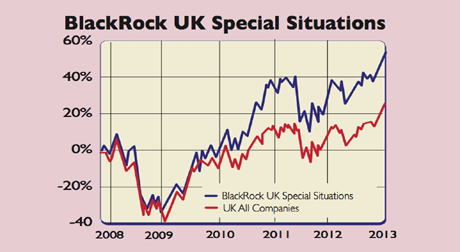

A fall in the pound is bad news for holidaymakers, but it has its advantages too. "Rather than bemoaning your holiday cash," says Mark Dampier in The Independent, why not look for funds, such as BlackRock UK Special Situations, which invest in leading global businesses? Many of these firms earn their money in different currencies, so when sterling falls, overseas profits rise.

Manager Richard Plackett claims many of his stocks, such as Unilever and Shell, have considerable overseas earnings power and could see revenues boosted by sterling's weakness. He certainly has the right track record, with 22 years of investment experience that has included successes at M&G and with BlackRock's smaller-companies and income funds.

Plackett's aim is to visit 1,000 firms a year, looking for stocks that are undervalued against their projected cash generation, or are recovery plays. Preferring to avoid firms with high debt levels, he favours those with strong balance sheets and significant cash reserves.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Plackett has free rein to invest in small-and mid-cap stocks, which make up around 65% of the fund's total holdings. The strong performance of smaller firms, as well as a fillip from takeovers, says Dampier, has helped the fund return 153.4% during Plackett's tenure compared to a sector average of 77.1%.

According to Trustnet.com, the fund generated a return of 17.5% over one year and 54.6% over three years. Currently 24% of holdings are in industrial stocks, 15.8% in financials and 13.1% in oil and gas stocks. It's for risk-tolerant investors looking for British firms with a focus on overseas profits. The total expense ratio is 1.67%.

Contact: 0800-445522.

BlackRock UK Special Situations top holdings

table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 2px 1px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9; }th.first { border-left: 0; padding: 2px 1px;text-align: left; }

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 2px 1px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center; }td.alt { background-color: #f6f5f9; }

td.bold { font-weight: bold;}

th.date { font-size: .7em;}td.first { text-align: left; }

td.left { text-align: left; }

td.bleft{ text-align: left; font-weight: bold; }

| HSBC Holdings | 5.10% |

| Rio Tinto | 4.50% |

| Royal Dutch Shell | 4.50% |

| BHP Billiton | 4.40% |

| Aveva Group | 3.80% |

| Rotork | 3.10% |

| Victrex | 3.10% |

| Vodafone Group | 3.10% |

| Unilever | 3.00% |

| Senior | 2.90% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Pitch to Portfolio: Lioness Jill Scott's investing game plan

Pitch to Portfolio: Lioness Jill Scott's investing game planPodcast After bringing football home as a Lioness, Jill Scott discusses how she transformed her finances and became an investor in this latest episode of MoneyWeek Talks.

-

UK unemployment hits highest level since 2021 – will interest rate cuts follow?

UK unemployment hits highest level since 2021 – will interest rate cuts follow?UK unemployment reached its highest rate in almost five years by the end of 2025. Is AI to blame and will the Bank of England step in with an interest rate cut in March?