Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

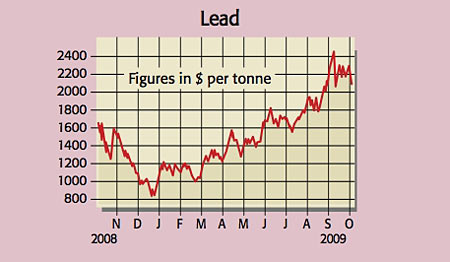

Lead has been the best performer in the metals complex this year, gaining 130% to a 16-month high in September. A key driver has been supply disruptions culminating in China's suspension of some of its lead-smelting capacity after allegations of lead poisoning.

But concern over supply looks overdone for now, given that demand has slid and stocks in warehouses are at a six-year high. Despite that, the long-term outlook for lead is positive, says BNP Paribas Fortis. China is now "pivotal" to the global supply of refined lead; its share of production has risen to 40%.

"China has taken on this dirty and dangerous industry shunned by other countries". As it "inevitably" gradually tightens environmental standards, higher production costs are likely to filter nito higher lead prices.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, the pipeline of mine production set to come onstream after 2010 is thin, and lead-acid battery demand from the automobile sector 70% of total demand is set to rocket as emerging markets' consumption of cars and lorries grows to Western levels.

"The days of lead being a cheap metal" look over. RBS expects the annual average lead price to hit a new record high of $2,750 a tonne in 2013.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how