Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Sometimes it can take a long time for a top to complete. Such seems to be the case for the developed world's stock markets, particularly the FTSE. However, the technical story gets more imposing by the day and the fundamentals supporting the logic of a new bull market for equities becomes, dare we say, more preposterous by the day.

The rally from March, we contend, is no more than a secondary reaction in a primary bear market, but the clarity of that observation has been muddied by extraordinary central bank and government behaviour.

In 2003 the central banks, led by Alan Greenspan, lowered short term lending rates, they created a liquidity boom of historical proportions causing the first bear market postponement. That lack of willingness by the authorities in 2003 to face the facts generated the gigantic credit bubble that finally burst spectacularly in 2007, following which trillions in stimuli were injected into economies, delaying for the second time the bear's journey.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

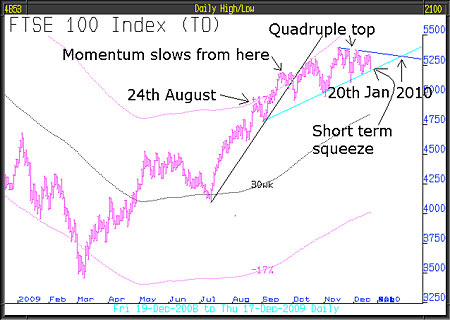

The up-to-date chart for FTSE is not a double top, not a triple top but a quadruple top. It has also morphed into a short-term squeeze of declining tops and rising bottoms, offering a confined and narrowing space for price action that must end by 10 January 2010. As we have explained before, this top is forming at an extreme overbought level of 17% deviation above the 30-week moving average. FTSE hit that in August, following which the uptrend decidedly moderated and more recently stalled entirely.

For some weeks the Informed Buyers Index has been sending a clear signal that the big players are selling. If they are, and the stock market has stalled not declined, it means that small investors are picking up the slack. There is no clearer signal of a top.

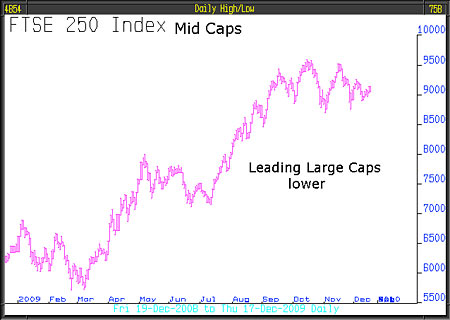

Another signal, that the next direction for FTSE is down, can be garnered from the mid caps (FTSE 250) and the small caps. It is customary, at important turning points, to expect these to lead the way, and that they certainly are.

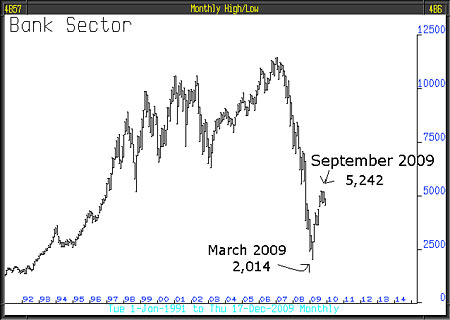

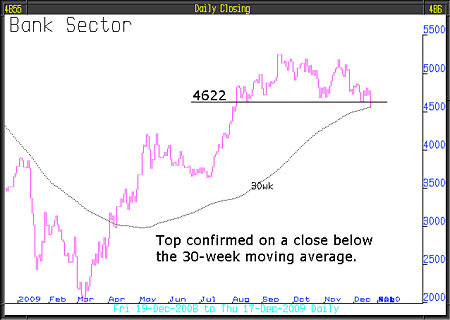

The fundamental change that in March arrested the stock market's decline was the rescue of the banks. Subsequently, the bank sector rose over 250% leading the UK stock market higher. From its March low of 2,014 it peaked in September at 5,242, since then it has headed lower! For the past three months share prices of key UK banks have suffered. RBS is down 45%, Barclays down 22% and Lloyds down 19.6%. Technically, the banking sector is sitting on a knife's edge.

The one year chart shows that a short term top has formed which will be confirmed on a close below both the 30-week moving average.

Following that, the banking sector, like the "Grand Old Duke of York", having marched his men up to the top of the hill, will march them down again.

We suspect Ben Bernanke lies awake at nights worrying about how this is all going to pan out. He periodically punctuates the developing conditions with statements which point clearly to his state of unease.

Recently, to the Economic Club of Washington, he said: "Though we have begun to see some improvement in economic activity, we still have some way to go before we can be assured that recovery will be self sustaining."

He also said: "The Fed's own view was that recovery would be sustained with modest, and implicitly slightly above trend, growth, sufficient to bring down the unemployment rate but at a pace slower than we would like."

Coupled with the technical story is the realisation by informed buyers that current levels of the stock market are unsustainable, unless, that is, next year brings very robust revenue growth. So far, earnings growth has been achieved mostly by cost-cutting.

Revenue growth (rising gross sales) is a whole different ball game, because if cost cutting by companies and retrenchment by consumers continues, increased revenue is impossible. This will trigger the undoing of the excessively good sentiment that has caused the irrational bear market rally to rise faster and further than was ever likely.

This article was written by Full Circle Asset Management, and was published in the threesixty Newsletter on 18 December 2009.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

One million more pensioners set to pay income tax in 2031 – how to lower your bill

One million more pensioners set to pay income tax in 2031 – how to lower your billHundreds of thousands of pensioners will be dragged into paying income tax due to an ongoing freeze to tax bands, forecasts suggest

-

Stock market circuit breaker: Why did Korean shares pause trading?

Stock market circuit breaker: Why did Korean shares pause trading?The fallout from the conflict in the Middle East hit the Korean stock market on 4 March, with shares forced to temporarily stop trading. What is a stock market circuit breaker, and why did the KOSPI trigger one?