Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"It's pretty amazing what passes for good news these days," says Barry Ritholtz on Ritholtz.com. The Dow has risen by 12% in two weeks, its best fortnight in nine years. The FTSE 100 has climbed for 11 days on the trot, matching a record established in 2004.

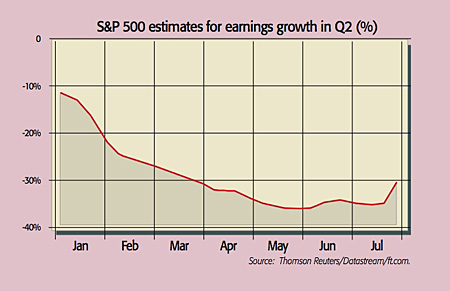

It's all because analysts, having consistently overestimated US earnings in past quarters, had drastically slashed second-quarter estimates, which many firms are now beating. There was, for example, an outbreak of good cheer when Goldman Sachs, Intel and Caterpillar exceeded their forecasts.

But a closer look at recent results shows it's far too soon to crack open the bubbly. "The bottom line of this earnings season is that the top lines are coming in rather light," says Barron's.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So far just over half of the S&P 500 has reported, according to David Rosenberg of Gluskin Sheff. While 61% have beaten their "low-balled" profit estimates, this is being driven by aggressive cost-cutting.

That isn't sustainable. Long-term earnings growth depends on revenue growth, but revenues are down by 10.1% year on year.

The final figure is likely to be worse since retailers and housebuilders have yet to report. When the 2001 recession ended, sales growth was running at an annual 1%, ten times better than the current figure. Yahoo's earnings inched up but revenues slid by 14%, while Caterpillar, despite hiking its full-year earnings outlook, reported a 41% fall in revenue.

Meanwhile, Microsoft announced its first dip in full-year sales since it went public in 1986, undermining hopes of a recovery in IT spending, notes Lex in the FT.

A rise in spending by US businesses and consumers that would boost revenue "doesn't look imminent", as Robert Cyran points out on Breakingviews.com. A recent survey shows businesses are planning further staff and capital spending cuts, while consumers are "squirreling away" cash.

What's more, their incomes are dropping, unemployment is soaring and even the fiscal stimulus, now set to be withdrawn, has had scant impact on retail sales, says Rosenberg.

So you shouldn't expect a consumer recovery anytime soon. Yet analysts are still pencilling in a V-shaped recovery. They expect the S&P's earnings to jump by 25% next year. This is "a faith-based rally, pure and simple".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King