Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Sovereign debt may be the new worry, but we haven't heard the last of banks' losses. The IMF recently estimated that there are another $1.5trn of write-downs in the pipeline. Austria's nationalisation of Hypo Bank last week suggests problems have been swept under the carpet, due partly to relaxed accounting rules, says Divyang Shah of IFR Markets.

In America, another wave of mortgage resets, whereby the low initial interest rates on certain mortgages jump after a few years, is due in 2010 and 2011. The $750bn of resets the same sumas in 2007 and 2008 combined are concentrated in self-certified and Alt-A (one step above subprime) mortgages. Get set for "the sequel" to the subprime drama, says Lombard Odier Darier Hensch.

Meanwhile, the Bank of England is worried about dodgy loans to the commercial real estate sector, where outstanding loans have reached £260bn. Moreover, £1trn of British banks' wholesale funding matures over the next five years. Credit is set to remain tight "for the foreseeable future", says Capital Economics.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

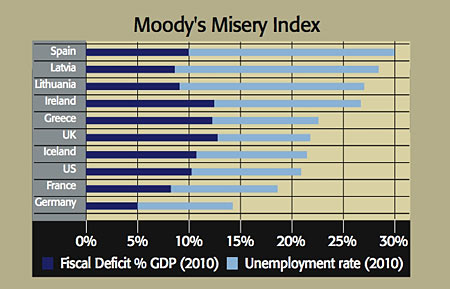

The big picture: a new 'misery index'

In the stagflationary 1970s, the 'misery index', which combined the unemployment level and the inflation rate, became a popular indicator. Debt ratings agency Moody's has updated the concept for the post-crunch era of massive sovereign debts.

The group has combined the unemployment rate and budget deficit estimates for 2010. Those countries faring worst are the ones whose economies were artificially inflated by rocketing private sector debt so that the crunch caused a sharp slide in tax revenues opening a gaping hole in the public finances as well as causing high unemployment.

Statistic of the week

To see just how expensive school fees have become, consider their price in gold, says Lex in the FT. A century ago, a private education at a secondary school cost around seven guineas (£7.35 in today's money), or about 1.5 ounces of gold. Now the average bill for a term is £4,000, and Eton costs £9,000. With an ounce at £690, five years at the latter will set you back £135,000 or 196 ounces of gold.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.