Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Oil is the energy resource that captures public attention nearly all of us need its products to drive around every day, and feel the pain of prices of $130 a barrel, or thereabouts, when we fill our cars at the pumps.

But its poor cousin natural gas could be the one now offering more interesting investment opportunities:

Global consumption is growing almost twice as fast as for oil, so natural gas is set to overtake oil in importance before the middle of the century.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It is the cleanest-burning of the fossil fuels, giving it a particular advantage at a time when curbing generation of greenhouse gases has become a major political issue.

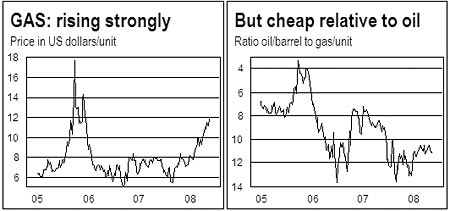

And it's comparatively cheap, as it currently trades at about half the cost of crude oil on an energy-equivalent basis.

In an energy-hungry world, it's therefore not surprising that there's now a mad scramble to procure long-term supplies and bring them to market.

Some current major developments in natural gas

Pipelines

Russia, which has the world's biggest reserves of natural gas, is building a direct link between its territory and Germany beneath the Baltic Sea, and planning others to China and Italy.

These are enormous undertakings. The 3,000-kilometre Italian link, for example, is expected to cost $15 billion. The ConocoPhillips-BP pipeline to bring North Slope gas from Alaska to Canada's oil sands industry and the lower 48 US states will be the largest private-sector construction project in North America.

The pipeline China is building from Turkmenistan in Central Asia to Shanghai will stretch for 9,000 kms.

Liquefaction

An alternative means of moving gas from where it's found to where it's needed is to liquefy it by freezing, ship the liquids across oceans, then turn it back into gas.

The technology is not new, but LNG (Liquified Natural Gas) facilities are hugely expensive, with each "train" costing billions of dollars. For years this limited its use to transporting gas to countries not accessible by pipeline, mainly Japan.

But high energy prices have now made LNG viable on a large scale. And there are other advantages. European nations, for example, nervous about their increasing dependence on Russian gas, are looking to alternative sources such as North Africa, using LNG. China signed a $60 billion deal last month to buy 3 million tons of LNG a year from Qatar over 25 years from 2011.

With its volumes growing 7% a year, LNG is the fastest-growing of the fossil-fuel industries. Because of the massive investments required, it is dominated by a handful of very large multinationals.

New reserves

Oil majors are boosting efforts find and tap hydrocarbon deposits that are primarily gas, with oil as a side-product.

The newly-discovered Sugar Loaf field under the Atlantic off Brazil, claimed to be one of the world's biggest, is primarily a natural gas resource. The Shtokman development in the Barents Sea off Russia's Arctic coast, and several projects off the coast of Northwest Australia, focus on production of gas, not oil.

There is also increasing interest in exploiting hard-rock resources that have been neglected in the past because it's difficult to tap their gas. On the western slopes of the US Rockies, Exxon Mobil is starting to employ an explosive fracturing technique three times more effective than conventional technology to unlock the riches of the Piceance Basin.

Coal-bed methane

The "fire-damp" found in coal deposits and the curse of miners throughout the ages is almost pure methane and an excellent substitute for natural gas, which is about three-quarters methane.

It may be recovered from worked-out collieries or from coal deposits left unexploited because they are so gassy they are too dangerous to mine, and already accounts for a tenth of natural gas production in the US.

TABLE.ben-table TABLE {BORDER-BOTTOM: #2b1083 3px solid; BORDER-LEFT: #2b1083 3px solid; FONT: 0.92em/1.23em verdana, arial, sans-serif; BORDER-TOP: #2b1083 3px solid; BORDER-RIGHT: #2b1083 3px solid}TH {TEXT-ALIGN: center; BORDER-LEFT: #a6a6c9 1px solid; PADDING-BOTTOM: 10px; PADDING-LEFT: 5px; PADDING-RIGHT: 5px; BACKGROUND: #2b1083; COLOR: white; FONT-WEIGHT: bold; PADDING-TOP: 10px}TH.first {TEXT-ALIGN: left; PADDING-BOTTOM: 5px; PADDING-LEFT: 2px; PADDING-RIGHT: 2px; PADDING-TOP: 5px}TR {BACKGROUND: #fff}TR.alt {BACKGROUND: #f6f5f9}TD {TEXT-ALIGN: center; BORDER-LEFT: #a6a6c9 1px solid; PADDING-BOTTOM: 5px; PADDING-LEFT: 2px; PADDING-RIGHT: 2px; COLOR: #000; PADDING-TOP: 5px}TD.alt {BACKGROUND-COLOR: #f6f5f9}TD.bold {FONT-WEIGHT: bold}TD.first { BORDER-LEFT: #a6a6c9 1px solid; TEXT-ALIGN: left}

The Big Numbers of Natural Gas

| Row 0 - Cell 0 | Row 0 - Cell 1 | Row 0 - Cell 2 | Row 0 - Cell 3 | Row 0 - Cell 4 | Piped | Row 0 - Cell 6 | LNG |

| Russia | 26% | Japan | 100% | Russia to Europe | 151 | Indonesia to Japan | 19 |

| Iran | 16% | France | 100% | Canada to US | 100 | Australia to Japan | 16 |

| Qatar | 14% | Italy | 86% | Norway to Europe | 84 | Malaysia to Japan | 16 |

| Saudi Arabia | 4% | Germany | 82% | Netherlands to Europe | 49 | Qatar to Japan | 10 |

| USA | 3% | Ukraine | 72% | Algeria to Europe | 36 | Qatar to South Korea | 9 |

BG Group, the global specialist in the discovery, extraction and supply of natural gas, plans to build the world's first plant to produce LNG from coal-bed methane piped 400 kms from fields in the interior of Queensland, Australia.

Liquid fuels

Although currently used as gas to fuel central heating, industrial furnaces and power stations, natural gas can be converted into liquid fuels. In Qatar, the Mideast sheikdom that has the world's third largest gas reserves, they're building plants to do just that.

Worldwide demand for natural gas has been growing at an average rate of nearly 3% a year, compared to oil's 1.7%. China's gas consumption is forecast to triple over the next 12 years, India's to double. Yet between them they have less than 2% of global reserves, so they will be forced to look to imports from the Mideast, Russia and Australia.

Major role in power stations

The strongest demand growth area for natural gas is in electricity generation. Dirk Beeusaert, chief executive of Suez, the world's biggest operator in the field, says the investment cost per kilowatt of power from gas turbines is "half that of a coal plant, and a third of that from a nuclear plant of the same capacity."

Such power stations can be built quickly, are flexible in operation, reduce dependence on other resources such as coal, oil and nuclear and have particular attractions in these times of ecomania.

Not only do they produce less greenhouse gases than other fossil fuel, but they can be used efficiently to generate intermittent power, to fill the gaps when turbines driven by wind and water shut down because of calms or droughts.

A couple of decades ago, gas accounted for little of the world's electricity generation. Now it fuels almost one-fifth.

Although the oil majors are giving increasing attention to finding and producing natural gas, most of the world's resources are closed to them or politically high-risk.

Russia seeks to use its gas supplies as a strategic weapon in its dealings with Europe and is squeezing out foreign companies. Iran is a different kind of political minefield. Qatar is happy to partner international oil firms, but is also right in the middle of the potentially explosive Mideast.

One country that is benefiting from all this is Australia, which has reserves almost as large as those of the US, production that is likely to continue expanding for the next quarter-century, and a business-friendly environment. Chevron's Gorgon project alone, which got its go-ahead from regulators a few months ago, expects to produce more than a trillion cubic metres of gas over its 60-year life.

How can you invest in natural gas?

There are several exchange-traded funds that track gas prices listed in the US, the UK and Canada. They are: US Natural Gas Fund, iPath DJ AIG Natural Gas TR ETN (US), ETFS Natural Gas in the UK (dollar and sterling versions), and Horizons BetaPro NYMEX Natural Gas Bull Plus ETF (Canada).

Although all major oil companies have substantial and increasing gas interests, only a handful of listed firms are gas specialists:

Gazprom, the Russian company whose shares or depositary receipts are listed in Moscow, New York, London and Frankfurt, is THE giant. It owns one-third of the world's proven and probable reserves and accounts for a fifth of global production.

Trouble is, the enterprise is clearly viewed by the Russian government as its political instrument, so the interests of foreign shareholders have low priority.

Also, it has no spare productive capacity and a poor record for developing additional capacity.

BG Group is the leading international natural gas specialist. Although originally British Gas, the North Sea now only accounts for about a third of its production, the rest coming from wells in Trinidad, Egypt and Nigeria.

It is a front-runner in LNG, owning several liquefaction and regasification plants, including one of only four operating in the US. It has landed a long-term contract with Singapore for 3 million tons of LNG that it plans to supply from a new Australian venture.

It has a 25% share in Tupi, the first field to be brought into production in Brazil's newly-discovered and massive deep-water Sugar Loaf resource. And it has part of a promising prospect in Kazakhstan.

Analysts expect its production to increase twice as fast as its giant rivals BP and Shell over the next few years.

Other gas exploration/production companies of interest

Woodside is Australia's leading independent with a strong focus on LNG. It operates two projects tapping the enormous gas reserves off the Northwest coast and has stakes in other sea-bed gas ventures off Australia and in the Gulf of Mexico.

North America offers the Canadian natural gas specialist EnCana, several producers with a strong focus on gas such as XTO Energy, EOG Resources and Cimarex, as well as trusts distributing income from gas royalties such as San Juan Basin and Hugoton.

European Gas is an interesting speculation. This Australian specialist in coal-bed methane has tied up the rights to tap gas from a large area of coalfields in France and Italy. It is drilling test wells at several sites this year.

If you remain positive about prospects for energy resources generally, as I do, because growth in supply will continue to struggle to keep pace with growth in demand, especially from China, then it's a good idea to have some related holdings in your portfolio.

Natural gas looks even better than oil because of its superior attractions in particular its relative price.

The Canadian analyst Kurt Wolff, reporting recently that demand for natural gas in the US electricity generating industry surged by 11% last year, said that sign of strength "bolsters our confidence that natural gas price in million BTUs is headed to oil price in barrels divided by five equivalent to twice today's level."

This article was written by Martin Spring in On Target, a private newsletter on investment and global strategy. Email Afrodyn@aol.com to be included on the recipient list.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify