The ideal trading system for the lazy investor – 12 trades in 19 years

Dominic Frisby's MACD histogram trading system has a history of keeping you out of the market during crashes and in for the great bull markets. And you barely have to lift a finger. Here's how it works.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Are you the sort of person that wants to be invested in the stockmarket, or any other asset that is rising, but don't have the time or the wherewithal to be picking out specific companies, or to be looking at charts and making trades on a daily basis?

The sort of person that only really wants to make trades once or twice a year?

Well, do I have a system for you

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How to make money from the stockmarket with just 12 trades in 19 years

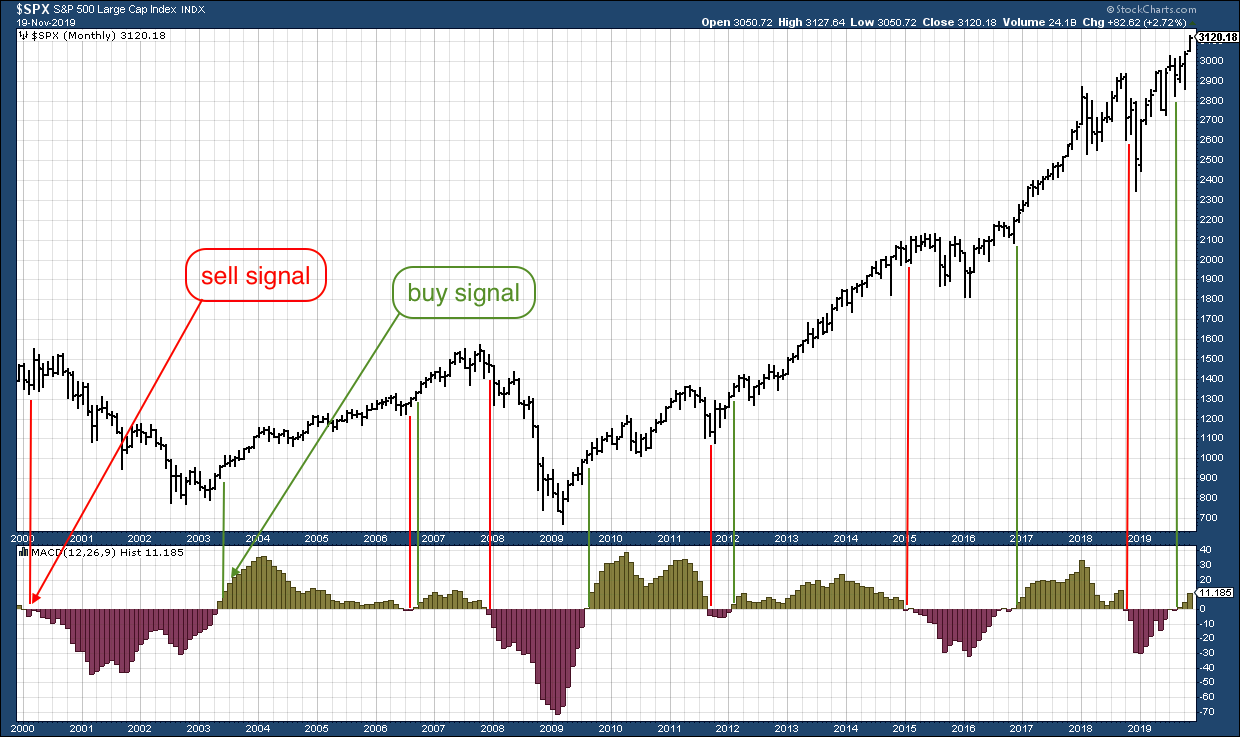

I'm going to outline today what is perhaps the simplest trading system I know. Looking at the S&P 500, since 2000, it has given off just six "buy" signals and six "sell" signals. So you would have only had to make 12 trades this century.

It did not catch the bottom or the top of the market; it is a lagging indicator. But it kept you out (or short) during the crashes of 2000 and 2008 and it kept you long during the great bull markets.

You need to look at a monthly chart. This is a long-term trading system and we are not interested in daily or even weekly gyrations.

The indicator we are going to use in addition to the monthly chart is called MACD histogram. MACD stands for "moving average convergence divergence". It is a trend-following system an indicator that shows the relationship between two moving averages of a security's price.

MACD histogram is a development of MACD, invented by one Thomas Aspray in 1986. But you don't need to understand what it is or how it works to use it. You just need to know when you have a buy signal and when you have a sell signal.

So below we have a monthly chart of the S&P 500 since the year 2000. Beneath the price I have plotted the MACD histogram. Most charting software packages have this function. Here I am using stockcharts.com.

You will see that sometimes the MAC (moving average convergence) is red (or claret to be more specific) and sometimes it is green. You want to be long when the market is green and in cash (or short, if you are that way inclined) when it is red.

Note that through the middle of the MACD histogram there is a zero line. Below it the bars are coloured in red and above it in green. Your sell signal occurs when it crosses down through the zero line and goes red. Your buy signal occurs when it crosses up and turns green.

I have marked each of the six buy and sell signals with a vertical line red for sell and green for buy.

The system got you out of the market in 2000 nice! and kept you in cash until 2003, when it issued another buy signal again nice! You got a sell signal in 2006 that reversed to a buy two months later annoying, but you only missed out on a couple of months' worth of gains. And you stayed long until the end of 2007, when another sell signal came again very nice.

You then get a buy signal in mid-2009; a sell in 2011; followed by another buy that kept you long in what was an epic bull market. A sell in early 2015, followed by a buy in late 2016 you were in cash for nearly two years.

That late 2016 buy worked really well. The sell signal came in late 2018. And then here's the good news we got another buy signal four months ago. The system is telling us to be long the S&P 500 (and I have been saying the same thing).

All you need to do to make this system work is get up a monthly chart, and then plot the MACD below. You need then only look at this chart on a monthly basis.

Pretty good huh?

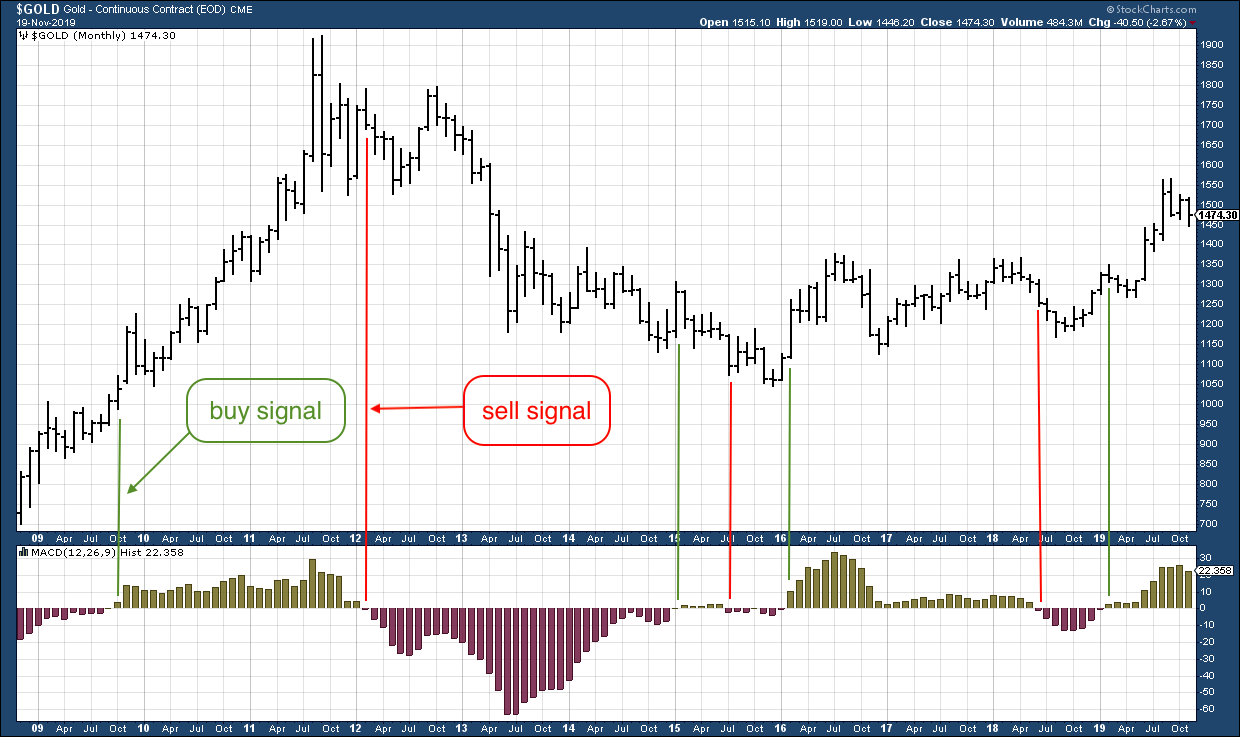

Here's how the system has worked on gold

You can use the same system on a weekly or even daily basis if that is your thing. However, you will get signals much more frequently and, as a result, a higher portion of the signals will not work.

By way of interest, here is the same system but with gold. This is a ten-year chart, and in that time there have been four buys and three sells.

We got a beauty of a buy signal in October 2009, with gold around $1,000, and that kept you long until February 2012 when we got the sell with gold at $1,700. And what a sell signal that was it got you out before gold crashed.

The 2015 buy signal did not work out and the sell came six months later for a losing trade of $75. Not the end of the world. Early 2016 saw another buy around $1,100 and the sell came in June 2016 at $1,250. In early 2019, we got another buy at $1,320.

That buy has worked out we are now at $1,475 and technically we are still on a buy signal. But let's just say that that buy signal is looking a little mature. The trade point is the cross through the zero line.

So there you go. A long-term trading system, for those of you who prefer going to the beach.

Dominic will be at MoneyWeek's Wealth Summit this Friday come along too! Book your ticket now.

Dominic Frisby's new book Daylight Robbery How Tax Shaped The Past And Will Change The Future is available at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere. If you want a signed copy and what could make a nicer Christmas pressie? you can order one here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Are UK house prices set to fall? It’s not so simple

Are UK house prices set to fall? It’s not so simpleAnalysis Figures suggest UK house prices are starting to slide, but we shouldn’t take these numbers at face value, explains Rupert Hargreaves.

-

Tesco looks well-placed to ride out the cost of living crisis – investors take note

Tesco looks well-placed to ride out the cost of living crisis – investors take noteAnalysis Surging inflation is bad news for retailers. But supermarket giant Tesco looks better placed to cope than most, says Rupert Hargreaves.

-

It may not look like it, but the UK housing market is cooling off

It may not look like it, but the UK housing market is cooling offAnalysis Recent house price statistics show UK house prices rising. But John Stepek explains why the market is in fact slowing down and what this means for you.

-

Think the oil price is high now? You ain’t seen nothing yet

Think the oil price is high now? You ain’t seen nothing yetAnalysis The oil price has been on a tear in recent months. Dominic Frisby explains why oil in fact is still very cheap relative to other assets.

-

What can markets tell us about the economy and geopolitics?

What can markets tell us about the economy and geopolitics?Sponsored Markets have remained resilient despite Russia's war with Ukraine. Max King rounds up how reliable the stockmarket is in predicting economic outlooks.

-

The tech bubble has burst – but I still want a Peloton

The tech bubble has burst – but I still want a PelotonAnalysis Peloton was one of the big winners from the Covid tech boom. But it's fallen over 90% as the tech stock bubble bursts and and everything else falls in tandem. Here, Dominic Frisby explains where to hide as markets crash.

-

The market is adjusting to a new “short dreams, long reality” world

The market is adjusting to a new “short dreams, long reality” worldAnalysis As interest rates rise, things are starting to change, says John Stepek. Reality is biting back. Gone are the fanciful ideas built on hope – a business now needs a solid foundation.

-

Are UK house prices heading for a fall?

Are UK house prices heading for a fall?Analysis UK house-price growth is slowing as interest rates rise. But interest rates aren’t all that matters for house prices, says John Stepek.