Currency Corner: the Romanian leu – a currency that has fallen even harder than the pound

In this week's currency corner, Dominic Frisby takes look at the Romanian leu, which has, over the years, been something of a dog. Much like the pound, in fact.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I'm heading to Romania this weekend for the Transylvanian Crypto Conference surely the number one cryptocurrency conference in the whole of Transylvania so I thought it might be fun, and indeed interesting, to look at Romania's currency, the leu, in this week's Currency Corner.

At first glance I thought the roots of the word leu' might be the same as those of lira' and livre' once upon a time the currencies of France and Italy, and the former still the currency of Turkey today. That is to say, derived from the Latin word for pound, in these cases referring to a pound weight of silver.

But in fact leu' means lion. Unusual for a currency to be named thus. Normally a currency name derives from a weight as in "pound". Or it derives from something solid to do with the issuer "krona", "crown" and "franc" (meaning "from the king"). Or it derives from the metal in some way "guilder" means golden, "yuan" and "yen" both mean coin shaped.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lion means something else. But there has long been a symbolic relationship between royal power and the king of the beasts, so I guess it's not that surprising.

Indeed, the old Dutch thaler was the "leeuwendaalder", which means "lion thaler". The name thaler lives on in the US dollar today. It'd much cooler if they were "lion dollars". I'll send a tweet to @realdonaldtrump.

Anyway, back to the matter in hand. There are 100 bani to a leu bani itself means money and roughly five leu will buy you a pound.

Perhaps the Transylvanian obsession with silver is related to the fact that the leu has over the years been a bit of a dog. I know this because I began the research for this article by comparing the leu to that other dog of a currency, the Great British pound.

In the three years since the Brexit vote, the pound has fallen by roughly 20% against the US dollar, going from circa $1.50 to $1.20. But over the same period the pound and leu have been more or less flat, trading in a narrow range between lei5 and lei5.50 to the pound. If anything the leu is a little down which takes some doing.

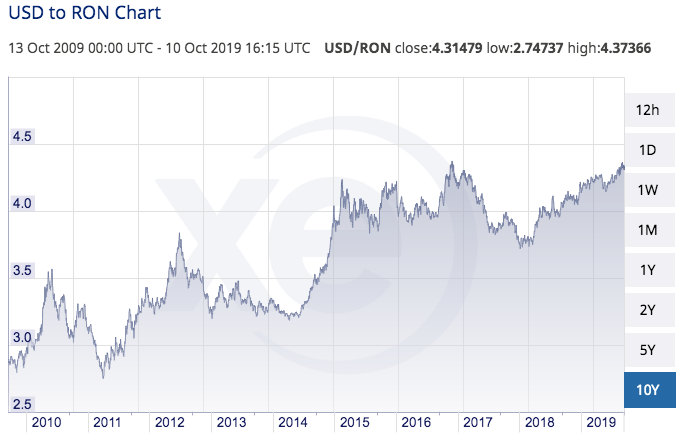

Here's the leu against the US dollar over the last ten years (the currency code for the leu is RON). In 2009 it took less than three lei to buy a dollar, but is has steadily depreciated so that today that number is closer to 4.4 lei.

The dollar has, of course, been in a secular bull market, but all the same the leu has lost over a third of its value (when the chart is rising the dollar is appreciating).

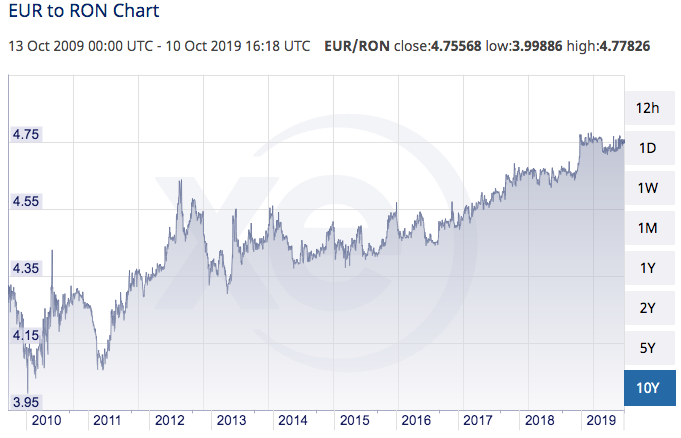

Here's the equivalent ten-year chart against the euro, which has not been as strong as the dollar. The leu has been depreciating against the euro, as well, in a similarly grinding fashion, though not to the same extent.

Back in 2009 there were roughly lei4 to the euro, compared to lei4.75 today. The falls are in the region of 15%.

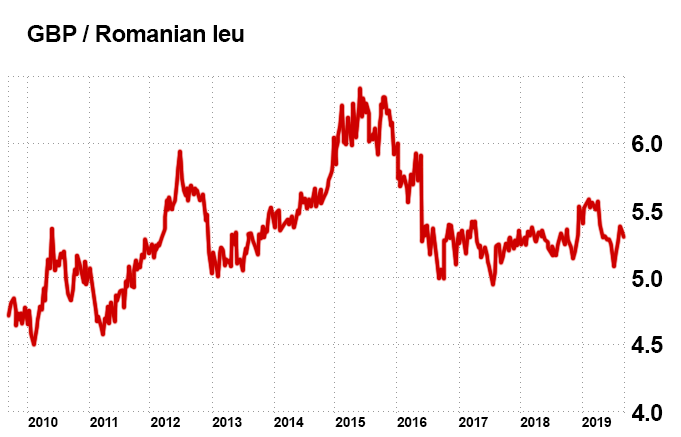

Here is the leu against the once great British pound.

Unbelievable as it may seem to those caught up in Brexit forex myopia, the pound has actually appreciated against the lea over the last ten years. Back in 2009, £1 bought you lei4.5. In 2015, we got to lei6.4. Today we sit somewhere in the middle of the range, at lei5.3.

Bottom line: the leu, like the pound, is in a bear market.

For a country described as "a fast-developing, upper middle-income, mixed economy with a very high Human Development Index and a skilled labour force, ranked 15th in the European Union by total nominal GDP and tenth largest when adjusted by purchasing power parity", that's not so impressive. Not so much a lion as a pussy cat.

Maybe Romania secretly voted to leave the EU as well?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets