Hold gold: it’s an insurance policy against global volatility

Gold has proved a wonderful hedge against recent turbulence for British investors, reaching a record peak in sterling terms. Now bulls should be looking at gold mining stocks, says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Gold was one of the go-to investments of the 2000s. From $250 an ounce back in 2001 it rose between 10% and 20% each year, seemingly without fail, until it eventually peaked in September 2011 at $1,920/oz. Mining companies went up ten, 20, in some cases even 100 times. There was a lot of noise and furore. Gold bugs got so excited that they were sure fiat money was going to collapse.

No such thing happened. For the next few years, gold was a disaster. It slid as consistently as it had risen before it eventually bottomed in December 2015 at $1,045/oz. All in all the decline lasted four years and three months, and the overall fall from top to bottom was 45%. That's better than some commodities, worse than others. Crude oil, for example, went from $147 a barrel in 2008 to an eventual low of $25 in 2016 a decline of over 80% that lasted twice as long, though there were some strong rallies along the way.

Plumbing the depths

It was the abysmal performance of the miners that made gold's bear market feel so much worse. Respectable(ish) mining companies producing gold, even at a profit, saw share-price declines of over 90%. Exploration and development companies, even those with decent deposits in safe jurisdictions, saw declines of over 95%. Many went bust. At the spivvy end of the market, the declines were 100% and mere oblivion followed. Gold mining companies did everything that fiat money was supposed to.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While all this was going on, assets as diverse as London property, bitcoin and US stocks were enjoying the mother of all bull markets. Gold investors not only saw colossal losses, but they had the opportunity costs of missing bull markets elsewhere as well. Depressing times. Many veterans in the mining capital markets described the bear market as the worst they'd ever seen. It's going to take quite something to lure mainstream investors back into gold mining after that.

Today, gold sits at around $1,520/oz. It's clawed back about 50% of the decline. The mining companies, however, haven't even clawed back 25%. It doesn't "feel" like a bull market when the miners are so woefully lagging the metal. It doesn't "feel" like a bull market when gold is still $400 off its all-time high.

A stealth bull market

But these numbers all mask something extraordinary. Last month gold hit £1,286. That is an all-time high in sterling. Blame Brexit and the weak pound, you might think. But it's at all-time highs in euros as well. And in yen, and in Canadian and Aussie dollars. We think of gold in US dollars because the US dollar is the price it is quoted in. But in fact we buy it with our local currency. In the UK we should really quote it in sterling. The pound, as we know, has been woeful since the UK voted to leave the European Union. In fact, it's been falling since July 2014, when it was trading at can you believe it? $1.70. Today it sits around $1.25. The value of UK assets has fallen by around 25%.

You invest in gold, I've always said, as your hedge against your government. "Put 10% of your assets in gold," runs the old Wall Street saying, "and hope it doesn't go up." It's insurance. If gold is going up, it means there are problems elsewhere.

For UK investors gold has been the most wonderful hedge against the disaster that has been the pound. Gold has been doing what it's supposed to do. But because we think of gold in US dollars, and the US dollar has been strong, much of gold's relative strength has been concealed. Gold might have been a saviour for citizens of countries like Australia and the UK, whose currencies have been weak, but for US investors, what's the point?

Gold is gathering strength in dollars

It's been a stealth bull market. Even though the lows came in December 2015, for years it has felt like gold has been going nowhere. Every single rally since 2014 has run out of steam in the $1,360-$1,370/oz area. There have been at least five of them. When gold rallied, people would ask me if it had legs. "Call me when it gets through $1,360," I would say. It was such a technical barrier.

This time last year gold was sitting below $1,200 per ounce. Forgotten, scorned and reviled. In June it was at $1,280. "It's the summer," I thought. "Watch it slide back, like it always does." The low for the year usually comes somewhere between June and August. The Indian wedding season (Indians are among the biggest buyers of physical metal) hasn't got going yet; the North American brokers and chief executives are all off on their summer vacation. The market tends to stagnate.

In June, gold suddenly burst through that $1,360-$1,370/oz level as though it wasn't there. It went through every other resistance level in a similarly dismissive manner on its way to a September high of $1,566. It put on nearly $300 at a time when it is supposed to be weak. What's more it rose when the US dollar was rising too. Normally gold rises on dollar weakness. Now even Americans are sitting up and taking notice of this stealth bull market. This is apparent in the inventories at gold-backed exchange-traded funds (ETFs), which now stand at multi-year highs, close to 900 metric tonnes. American money has been flowing into the market.

A technical barrier

Technical analysts are now very excited about gold because, having built a huge base over many years, it is now rallying off it. It has also formed a so-called head and shoulders pattern over the period. That would now imply a target of $1,660. But the big problem gold has, from a technical level, is the $1,550 area. Gold and this price point have a lot of previous.

This zone resisted gold's advance in 2011. It took several months to get through. Then after gold peaked in September 2011, it collapsed back to this level, where it found support. That area would prove to be support all the way through 2012 and into 2013. It was only in the spring of 2013 that it finally gave way, and so followed three of the most miserable years in gold investing history. So it's a huge technical level. And here we are, six years later, butted right up against it once again. It's a quite natural place for this gold rally to stall, as, indeed, it already has.

Sterling is due a rebound

What's more, we sterling buyers of gold need to think about something else: the value of sterling. We can all speculate, but nobody yet knows quite what will happen on 31 October. Will the UK leave the European Union on World Trade Organisation terms? Will it leave with some kind of withdrawal agreement? Will there be yet more delays to Brexit and the date get pushed back? Will it never leave? These four outcomes are all still possibilities.

But once we have clarity, surely sterling will rally. It's extraordinarily undervalued against the world's major currencies. The reason for its low valuation is simple: political instability. There is a chance we get that clarity in the lead-up to 31 October. There is a chance we get more delays, but then a general election provides the required clarity. Either way, some kind of resolution does not look to be far away. If sterling then starts to rally, gold in the short- to-intermediate term looks less enticing to sterling buyers.

So the best way for sterling investors to play a gold bull market might be, heaven forbid, the gold miners. These companies book their profits, if they have any, in local currencies or US dollars. Their deposits are valued in the same way. Sterling strength has nothing to do with their profitability.

Time to eye up the miners

However, gold mining companies have been falling in value relative to gold since 2004. Once upon a time, a gold miner was a leveraged way of playing gold. But today we have options, futures, spreadbets, ETFs and a plethora of other ways to gain exposure to the gold price. Why take on the individual company risk of buying a gold miner when there is so much that can go wrong? The quality of management at the top of gold mining companies is noticeably inferior to other businesses. Bad decision-making and excess pay have proved commonplace. Why expose yourself to it? If you want leverage to the gold price there are more effective ways to get it.

Gold miners had an extraordinary bull market in the 1930s after the stockmarket crash of 1929. Many expected something similar in the post-2008 era. It never happened. No wonder. In the 1930s it became virtually illegal for US citizens to own gold, so the only way to get exposure to the gold price was via gold miners, their outperformance makes sense. Today however there is no such concentration of capital.

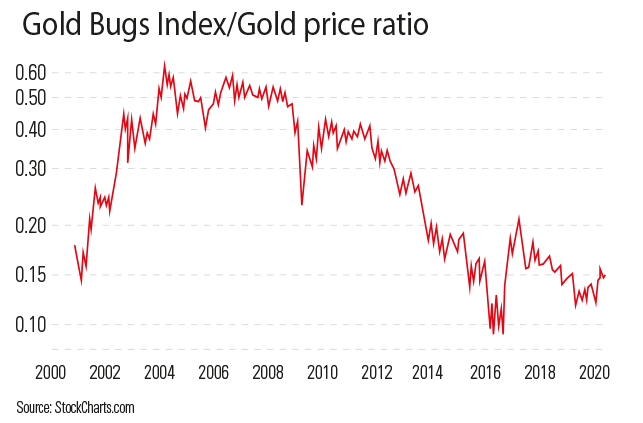

In the chart below you can see the ratio of gold miners (as measured by the HUI, an index that tracks them) to the gold price since the turn of the century. I've put it on a logarithmic scale so the percentage difference is more visible.

When the line on the chart is rising, gold miners are outperforming. When it is falling, they are underperforming. The ratio between the two hit rock bottom at the beginning of 2016. I note, though, the higher lows in 2018-19. There are signs that this ratio may be on the rise. Heaven knows it's overdue. A trend follower would certainly have this down as a change in trend.

No more dinners at the Savoy

Might we, finally, be entering a period of outperformance? The mining sector has certainly cleaned its act up. To call it slick is probably an overstatement. But shareholders' investments tend now to go into the ground, rather than into dinners at the Savoy and first-class air travel. Capital is better deployed. Costs have been cut. Investors are more careful. Many of the scammers and the incompetents have been outed. Gold can stay in the $1,500 area and a lot of mining companies will be quite happy. They can make plenty of money with gold at these prices. It's when it falls below $1,200 that things get dicey. I'm cynical about mining companies, but you can't deny there has been a change in trend.

Losing faith in governments and institutions

There are many different opinions as to what drives the gold price. Looking purely at supply and demand does not work with gold as pretty much all of the gold that has ever been mined still exists. It is not consumed in the way that other commodities are. It is a much more emotional, and speculative, metal.

Where are interest rates going next? If they rise by a lot that will be bad for gold (which has no yield, so it looks less appealing when rates are high). But if they continue to fall, and money continues to be debased, that should be gold-bullish. Real interest rates net of inflation are another factor. Monsoons in India are a driver too. Monsoons portend a good year for farmers. They'll spend much of their earnings buying gold. Then there's central banks, notably in emerging markets, buying the yellow metal to diversifying their currency reserves.

But, ultimately, gold is a deeply psychological investment. Gold does best when there is inflation, fear about the future purchasing-power of the currency, political instability and a loss of faith in institutions. That's why, measured in sterling, it has done so well. Indeed, if you were to do a survey of Remainers and Leavers, and whether they own gold or not, I guarantee a greater proportion of Leavers will own gold in their portfolios. They have less trust in the system.

A turbulent backdrop

I remember back in 2001 I had a residency on the Radio 4 programme, Loose Ends, writing a load of comedy sketches about the election. Each week I did a party political broadcast by one of the parties. When the election came, it was the lowest turn-out since the First World War. Blair's win was dubbed "the quiet landslide". Nobody cared about politics. In the US something similar was going on. I had an email from a friend the other day telling me how the 9-11 terrorist attacks punctured what he called "peak complacency" in the West. The dubious war in Iraq, the housing bubble, the bailing out of the banks and all of those other events that have so undermined public faith in leaders had not begun yet. No wonder gold was so undervalued. The world is a very different place today and, as a result, the gold price is a long way from $250 : there are a lot of reasons to own it. Everyone should hold some gold.

The gold investments set to shine

The evidence of this century is that gold itself is a much better investment than a mining company. But buy the right miner and you can do very well. There are many ways to buy gold. Pop into a dealer such as Bairds or Sharps Pixley, and purchase sovereigns as every discerning citizen should. Or you can give the good folk at Goldcore a bell and have it delivered to your door.

You can also buy your gold online or via an app and have it stored for you in the safest vaults that vault-makers have yet to create, via Goldcore, Bullion Vault, and Goldmoney. The latter also offers payment services in gold. You can use your gold to pay for things via a credit card. Sounds convoluted but it works.

You can, via your broker, buy one of the numerous exchange-traded funds (ETFs)that are listed on stock exchanges around the world. The SPDR Gold Shares (NYSE: GLD) is the most famous. London-listed ETFS Physical Gold (LSE: PHGP) is probably more convenient.

If you want leverage, you can dabble in the dark arts of futures trading and spreadbetting (but, seriously, this is risky. Don't do it unless, at a bare minimum, you understand how catastrophically wrong a leveraged bet can go).

If you want to fall victim to the lures of the dreaded gold mining company, let me offer a couple of suggestions. These are my two biggest holdings.

Wesdome (Toronto: WDO) has been producing gold for more than 30 years in Canada. It has a market capitalisation of around C$870m with about 135 million shares outstanding. A couple of years ago it made a new discovery next to one of its mines one that it had been expected to shut down soon and this has given the company a new lease of life. It has become one of the go-to speculative shares for funds, so it is quite volatile. In September, for example, it went from C$7.50 to below C$6 on what amounted to a 4%-5% correction in gold. But it's a quality company with quality assets. Buy below C$6.

Rio 2 (Toronto Venture exchange: RIO): in 2008 Rio Alto boss Alex Black bought the La Arena mine in Peru from IamGold for $48m. He built a mine that was pouring its first gold three years later. It became a 200,000-ounce producer that he eventually sold in 2015 for $1.12bn. He did much of this in the face of one of the worst bear markets known to man. Rio 2 is his next project, and he is planning something similar with the Fenix mine in Chile. Despite the project having numerous doubters the main issue being water, though I gather he has a plan to solve this this is an enormous gold oxide deposit. It wasn't sexy enough for the newsletter writers when it was announced last month, and the stock fell, but mining pros are impressed. The company is well-funded and has a current market cap just below C$100m. As with Rio Alto, the plan is to get into production quickly, then scale up. It must be a buy around C$0.50. My only doubt is that there are a lot of warrants outstanding some 46 million in a fully diluted share count of 241 million. That will put something of a brake on the stock. But if Black gets this mine built and producing as he did with La Arena, none of that will matter.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.