The charts that matter: the great central bank-sponsored rally

With the US central bank now on board with the idea of cutting interest rates, John Stpeek looks at what this means for the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. We have a new podcast this week (we'll try to keep this up, honest) jump in to listen to Merryn and I discuss Libra, Facebook's new cryptocurrency that isn't really a cryptocurrency but could nevertheless be world-changing in a way that bitcoin has yet to be; we talk about the deal to take auction house Sotheby's private; and we debate the merits of Boris Johnson.

If you missed any of this week's Money Mornings, here are the links you need:

Monday: Help to Buy has been a waste of money

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: It's decision time for the US Federal Reserve

Wednesday: Facebook's Libra is not really a cryptocurrency but it could still be world-changing

Thursday: Investors beware: politicians are now in charge, not central banks

Friday: Gold has finally broken free is its bull market here at last?

Currency Corner: Is the pound brewing up a multi-year bull market?

Chris Carter also wrote about how the Sotheby's deal could affect the wider art sector. And definitely don't miss Merryn's blogs on how we agree with a lot of Labour's views on land reform with one big caveat; and her explanation of why recent weak employment figures in the US may just be masking the fact that we're running out of cheap and easily sourced global labour.

Also, if you don't already subscribe to MoneyWeek, do it now you get your first six issues free when you sign up, not to mention a free report on what a Jeremy Corbyn government could mean for your money.

On that topic, incidentally, if you are involved in a small or medium-sized business, then you should check out this piece, sponsored by OFX, on what a Corbyn government could mean for your business.

Now, to the charts.

It was a big week for markets. This week, the world's investors agreed that Jerome Powell and the team at the Federal Reserve are now on board with the idea of cutting interest rates, and so we went off to the races again.

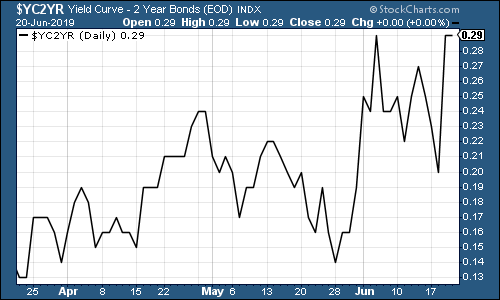

The Fed may be particularly pleased to note that the yield curve (remind yourself of what it is here) ticked higher again this week. The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two.

Once this number turns negative, the yield curve has inverted, which almost always signals a recession (although perhaps not for up to two years).

The curve between the three month and the ten year is still inverted. But while the yields on both two-year and ten-year Treasuries have fallen, the ten-year has fallen by less than the two. This suggests that investors are increasingly optimistic that the Fed's loosening activity will prevent a longer-term downturn.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

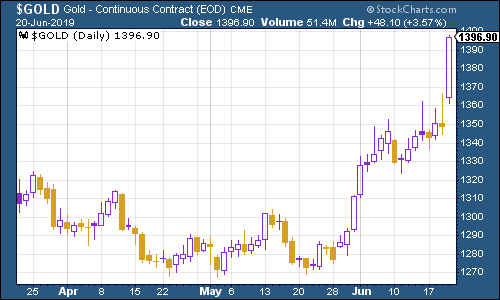

Gold (measured in dollar terms) had its most exciting week in years, surging up through "resistance" in a rather decisive manner. I wrote about it in yesterday's Money Morning read here if you missed it.

(Gold: three months)

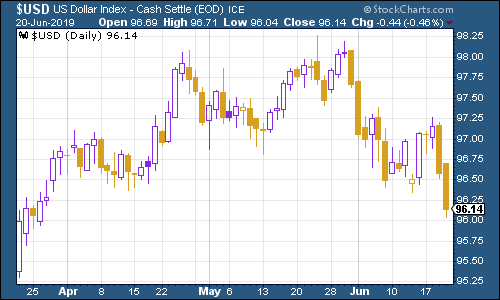

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners fell as the Fed confirmed that the next move in rates will almost certainly be down rather than up. US president Donald Trump will be pleased, but he'll want to see this continue. Hence all the harrumphing about currency wars earlier this week.

(DXY: three months)

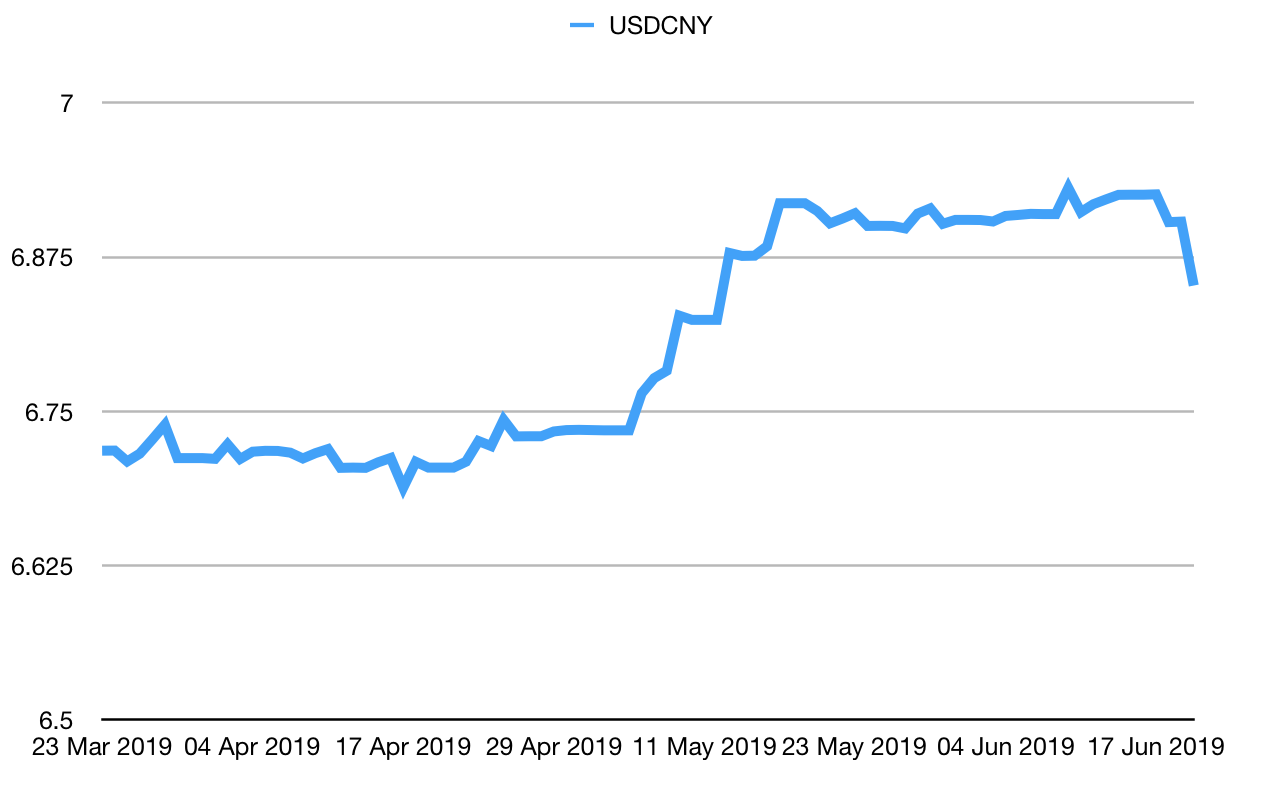

Another reason for the bullishness this week (and a direct result of the Fed's promises of more cheap money) is that the number of yuan (or renminbi) to the US dollar (USDCNY) slipped away from the critical 7.0 level that would suggest China might be on the verge of devaluing its currency, which in turn could spark deflation across the globe.

(Chinese yuan to the US dollar: three months)

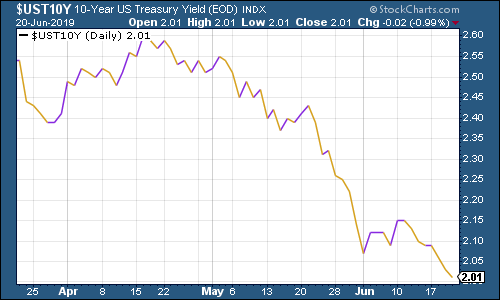

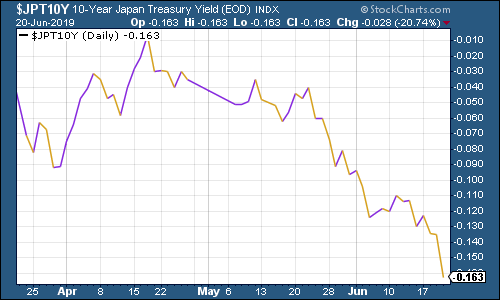

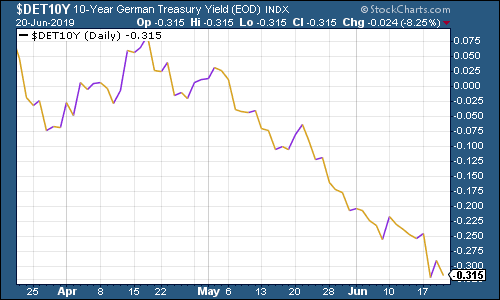

Ten-year yields on major developed-market bonds slid further. This is partly because central banks around the world (with the notable exception of Norway, although the oil link does make that a pretty unique economy) are now either cutting rates again or promising to. If central banks are cutting rates and printing money, that suggests bonds will be in demand (even if there should also be plenty to go around, what with governments borrowing more too).

It's also happening because investors have grown very nervous over the state of the eurozone economy once again, although it'll be interesting to see just how much of a false alarm this is.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

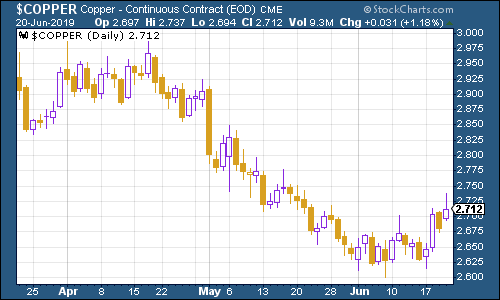

Copper managed to rally this week along with everything else.

(Copper: three months)

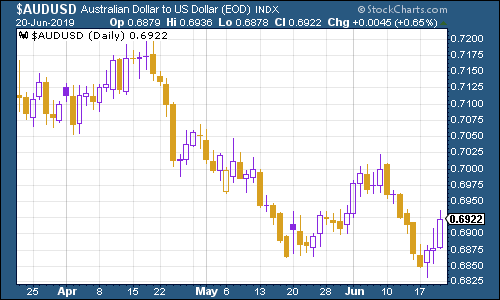

The Aussie dollar climbed too as the US dollar slipped, even although the Australian central bank was pretty dovish this week too. The Aussie is one of our favourite indicators of the state of the Chinese economy but this week it's mostly about the fall in the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin rallied along with other risk assets. The news that Facebook is launching a competitor which isn't really a competitor probably helped too. It's not far off the $10,000 mark now. Anyone who bought at the peak in 2017, is still nursing painful losses, but not as painful as they were a few short months ago.

(Bitcoin: ten days)

Unemployment is a lagging indicator (it doesn't start rising until the economy is already getting worse), but it's still not clear that it's on a rising trend. About two months ago, US jobless claims hit a fresh low on the four-week moving average measure, dropping to 201,500. This week, the moving average ticked higher to 218,750, while weekly claims came in a bit lower than expected at 216,000.

US stocks typically don't peak until after this four-week moving average has hit a low for the cycle, and a recession tends to follow about a year later (always remembering that this is a tiny sample size). Note that we've seen a new stock market peak this week, so it suggests that fears of a recession may still be a bit premature.

(US jobless claims, four-week moving average: since January 2016)

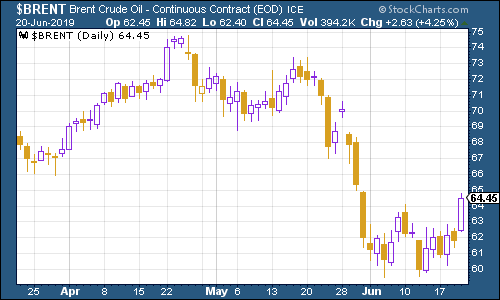

The oil price (as measured by Brent crude, the international/European benchmark) moved higher, driven both by the weakening US dollar and ongoing tensions between the US and Iran.

(Brent crude oil: three months)

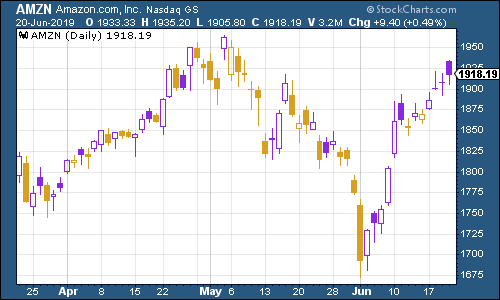

Internet giant Amazon the stock that no one gets fired for owning perked up with the wider market.

(Amazon: three months)

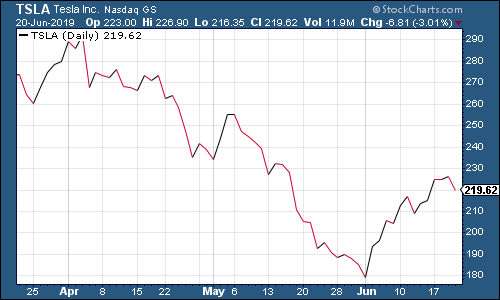

Even electric car group Tesla had a reasonably uneventful week.

(Tesla: three months)

That's all for this week just before I go, have you signed up for our free updates on the MoneyWeek Wealth Summit on 22 November? If not, do it now this is one event you really won't want to miss.

Have a great weekend! And if you haven't already treated yourself to a copy of The Sceptical Investor (my beginner-friendly book on contrarian investing), why not add it to your summer reading list?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how