Currency Corner: is the pound brewing up a multi-year bull market?

The pound has been stuck in a range against the euro while we’ve endured seemingly endless political chaos. There’s still a way to go yet. But when we do get some clarity, the rally could be huge, says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Hello and welcome to this week's Currency Corner.

I am going to take a look at the pound again today.

However, I am going to try and ignore all the noise about the Conservative Party leadership contest; Brexit; the Federal Reserve and European Central Banks; and any other political or economic developments.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Instead, I will focus on a simple saying: "the bigger the base, the higher in space".

The pound is forming a solid base

The idea behind that saying is fairly self explanatory. If an asset whether it's a currency, an equity, an index or a commodity makes a clear base, then the rally which eventually follows off that base will be considerable. The more time involved in forming that base and the more clearly defined it is, the more bullish it is for the ensuing rally.

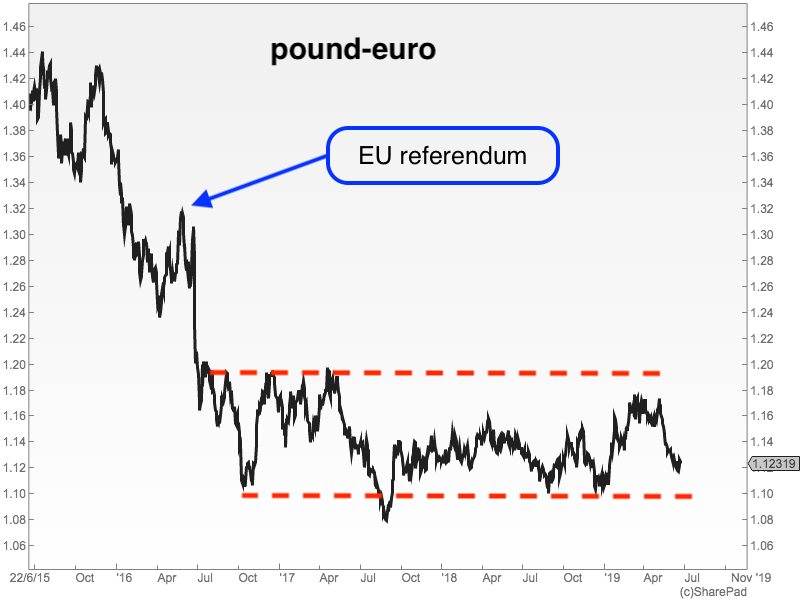

With that in mind, here is a chart of the pound against the euro over the last four years, since before the Brexit vote.

You can see how, back in 2015, the pound was trading healthily, going as high as €1.44. This was the high point in a bull market that began all the way back in 2009 with sterling almost at parity with the euro at €1.02.

In late 2015, things reversed, and the slide began. By April we were at €1.24, we then got a rally into the referendum, when the general perception was that Remain would win. It didn't, of course, and the great sterling sell-off commenced.

However, since then the pound and the euro have traded in a clear range. The top of the range being the €1.18-€1.20 area, and the bottom around €1.10. I've defined it with the dashed red lines in the chart above.

We have been in that range for three years now, and over time it has narrowed.

In other words, sterling is setting up for a considerable rally against the euro. The €1.40 to €1.50 area looks eminently possible to me.

The pound could remain in limbo for some time yet

Before you start rushing out to buy sterling, let me just stress we have Brexit to resolve first. There are still so many potential outcomes. The next Tory leader may face a vote of no confidence in parliament and a general election. Whoever he appoints as Brexit secretary may persuade the EU to agree an exit along the lines of the deal originally struck by David Davis and Steve Baker. It maybe that parliament does not agree whatever deal is struck. It maybe that a Remain party or coalition wins the next general election and we don't end up leaving at all. It may be that the Brexit Party comes out victorious. There are still so many potential outcomes.

Until we get some clarity on how this is all going to resolve, I don't see how sterling can stage any meaningful rally. It will remain stuck in this range against the euro. I rather suspect we will have a few more months of limbo, but that by the autumn a clearer outcome will be apparent.

The prognosis then is that we remain in this range between, say, €1.10 and €1.20 for a while longer. But all that means is that this multi-year base will get even bigger which adds even further potential to the rally that follows.

It might be that in the political chaos of the next few months we break to the downside of the range. We will probably need to go back and retest the €1.08-€1.10 area. But the fact remains that, technically, we have been forming a multi-year bottom a base on which an multi-year bull market can follow.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how