The charts that matter: markets start to worry

With bond yields sliding this week as investors started to fret about global trade, John Stepek looks at the effect on the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. The podcast has finally returned this week! We recorded it before Theresa May stepped down but the writing was on the wall, so we've had a bit of a natter about who might replace her, what it might mean for Brexit, and how it affects the odds of a government led by Jeremy Corbyn. Oh and we also take a look at what it might mean for sterling. Please do have a listen here.

And as I mention on the podcast, if you haven't yet caught up on our new weekly column, Currency Corner (in association with currency specialists OFX), then check it out now. This week, Dominic Frisby looks at the most important currency in the world (by a long way) - the US dollar.

Oh, and on 11 June at 1pm, Dominic and I will be talking to currency specialist Alex Edwards of currency broker OFX. We'll be discussing everything from the state of global trade to the effect of the current political upheaval on sterling and other major world currencies, and we'll also be taking questions during the webinar. Register now to watch it live here or to watch the recording later.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you missed any Money Mornings this week, here are the links.

Monday: No Brexit and a minority government the future for Britain?

Tuesday: The trade war between the US and China is all about tech

Wednesday: Platinum, palladium or rhodium which is the metal of the future?

Thursday: Don't worry about China selling US bonds worry about this instead

Friday: Markets don't think the Fed is sufficiently worried about the trade war

If you don't already subscribe to MoneyWeek, do it now you get your first six issues free when you sign up.

Now let's turn to the charts.

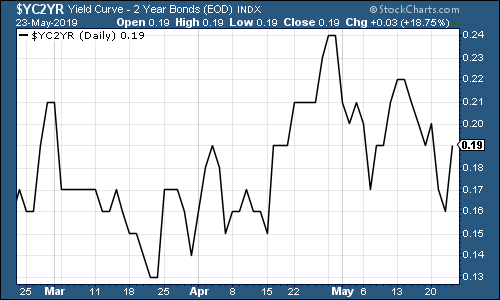

The yield curve (remind yourself of what it is here) is creeping lower again. The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted, which almost always signals a recession (although perhaps not for up to two years).

The curve between the three month and the ten year has inverted (again), but I'd rather wait for this one to follow suit before I feel completely convinced that we're facing a recession soon.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

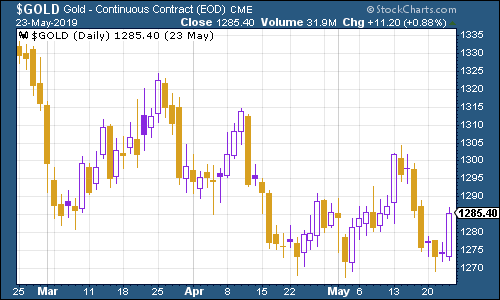

Gold (measured in dollar terms) had a very mixed week. On the one hand investors are worried, which makes gold more appealing. On the other, they are concerned that the Fed hasn't yet "got it" about easing monetary policy, and tighter monetary policy is bad news for gold.

(Gold: three months)

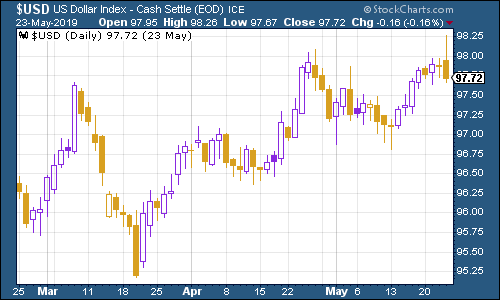

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners jumped as investors stepped up the search for safe havens, but then slipped back. Is this a turning point? Bulls will hope so but it's hard to see what would drive it lower.

(DXY: three months)

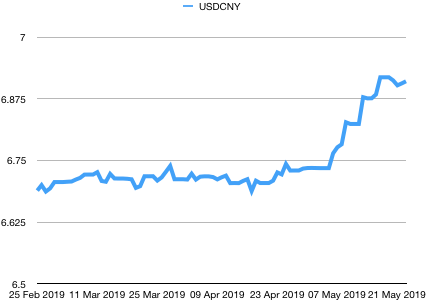

A new one this week - the number of yuan (or renminbi) you get to the US dollar - also known as USDCNY. The number we are looking at here is 7.0 if the yuan gets up to there (in other words, it gets weaker against the dollar) then a crisis could be brewing.

(Chinese yuan to the US dollar: three months)

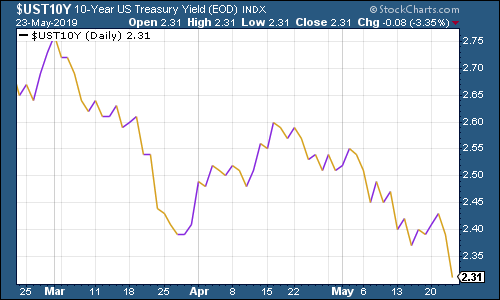

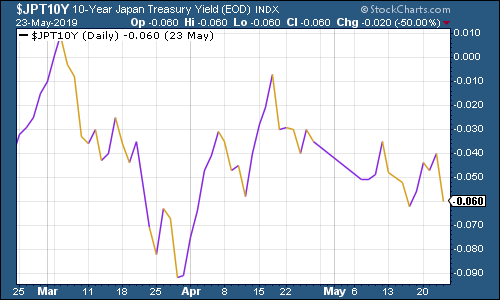

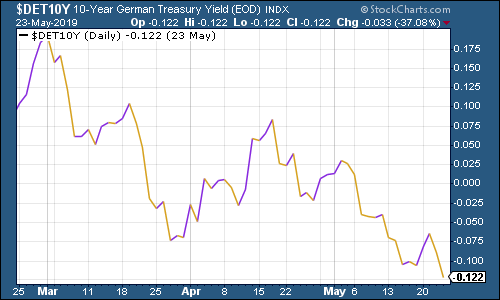

Ten-year yields on major developed-market bonds slid hard in the US this week as markets started to fret about global trade, although Japan was flat on last week (still negative though).

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

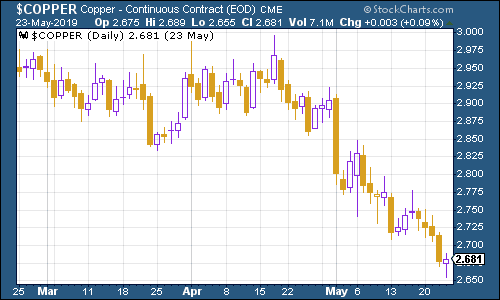

Copper slid even further this week. The trade war, stockpiling and falling oil are not good news for the auburn metal.

(Copper: three months)

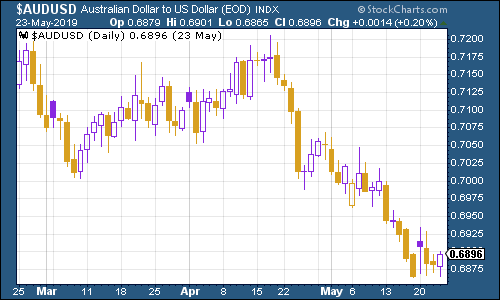

The Aussie dollar our favourite indicator of the state of the Chinese economy is wobbling along at its new home around the $0.69 level. The Australian economy looks weak while the trade war bodes ill for both China and Australia's global growth-dependent economy unless the dollar weakens (which is possible), it's hard to see the upside for the Aussie, particularly as its central bank is looking to prop up its ailing housing market.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin rebounded from last week's little slide, and appears to be benefiting from the growing sense of concern globally. I suspect a lot of it is down to concerns over Chinese capital flight again.

(Bitcoin: ten days)

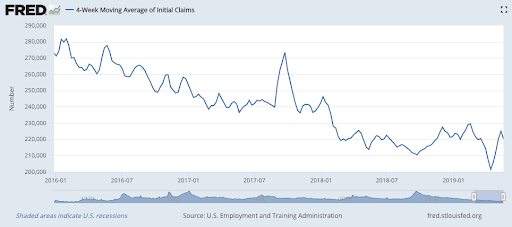

Five weeks ago, US jobless claims hit a fresh low on the four-week moving average measure, dropping to 201,500. They spiked over Easter, but appear to be heading lower now this week the moving average was down to 220,250, while weekly claims fell to 211,000.

David Rosenberg of Gluskin Sheff has noted in the past that US stocks usually don't peak until after this four-week moving average has hit a low for the cycle. A recession tends to follow about a year later (although of course this is a tiny sample size).

Have we seen the 4-week average hit a bottom already, or is there another to come? The jury's still out, despite the recent turmoil.

(US jobless claims, four-week moving average: since January 2016)

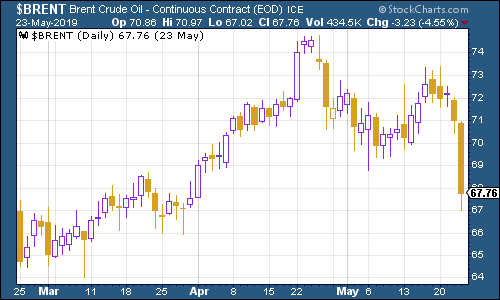

The oil price (as measured by Brent crude, the international/European benchmark) slid hard this week as concerns about global growth, trade and growing stockpiles sunk in.

(Brent crude oil: three months)

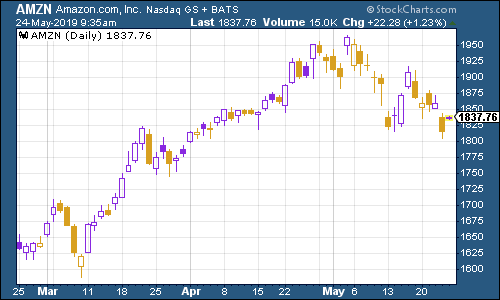

Internet giant Amazon slid again in line with the wider market.

(Amazon: three months)

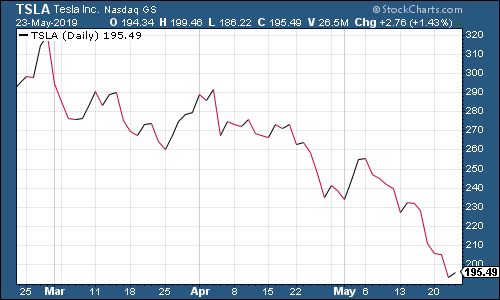

Electric-car group Tesla on the other hand, looks a lot closer to running out of road than it has in some time. We've had Tesla as a bit of a bellwether for "jam tomorrow" stocks. You could argue that Tesla has lots of problems and that this is long overdue but that's rather the point.

Why now? Why not when Elon Musk was tweeting himself into a confrontation with the US securities regulator? Why not any of the other myriad times that it's become clear that Tesla is good at over-promising and under-delivering?

The reality is that there's no other reason than that Tesla's drop suggests that this is turning into a "show me the money" market and Tesla can't do that. Morgan Stanley reckons that in a worst-case scenario, Tesla stocks could fall to $10 a share. I'd take issue with that I mean, the bottom for any company in a worst-case scenario is $0 surely

(Tesla: three months)

Money Morning will be taking a Bank Holiday break on Monday, but we'll be back on Tuesday. If you're looking for some Bank Holiday reading, here's a heavy hint from me buy my book on contrarian investor, The Sceptical Investor. If you've read this far, I reckon you'll like it.

Or get it on audio, if you're off on a long Bank Holiday drive somewhere.

(Oh and if you've already bought it and liked it, do give it a review on Amazon it's a lot more helpful than you might think!)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how