Platinum, palladium or rhodium – which is the metal of the future?

Platinum, palladium and rhodium are all vying to be the metal of the future – evolving vehicle technology will determine the ultimate victor. Dominic Frisby looks at the best ways to invest.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I went to rather an interesting lunch last week.

The issue of the day was the most efficient catalysts known to science.

Which are?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The platinum group metals (PGMs): specifically platinum, palladium and rhodium.

There were two very interesting speakers and I'd like to share some of their arguments with you in today's Money Morning.

How the future of driving is shaping demand for platinum group metals

Simon Catt of Arlington Group Asset Management was the organiser of this event, and his speakers were analysts Ren Hochreiter (billed as the Mick Jagger of PGMs), and Roger Breuer.

(By way of explanation, I am acting as much as reporter here as commentator, so many of the views expressed below are not necessarily mine).

Hochreiter is extremely bullish about palladium and rhodium, although less so about platinum (I'll explain why in a moment). "This isn't a bubble", he kept stressing, "but early in a new bull market".

Broadly speaking, the prices of PGMs will be determined by the kind of vehicles we will be driving in the future. Around 85% of palladium and rhodium demand comes from catalytic converters. Palladium jewellery has never taken off. (And have you seen what rhodium looks like? That's a non-starter).

If you want to understand where the price of each is going, you need to understand what future vehicle demand is going to be. Different analysts have different opinions on that, of course.

Platinum's main use is in diesel vehicles, whereas palladium tends to be used in petrol engines. But rhodium is the most effective catalyst for nitrous oxide (N2O) emissions in petrol engines, as much as seven times more effective than palladium. There is no substitute for rhodium.

Platinum can substitute for palladium in petrol engines, but this substitution only tends to kick in when the palladium price is double that of platinum. In other words, if palladium is $1,500 an ounce, and platinum $750, we'll start to see substitution.

In future, it's likely we'll see three-way catalytic converters, which contain rhodium, platinum and palladium, make a comeback.

The Volkswagen diesel scandal and the resultant regulatory change which followed has meant that demand in Europe for diesel vehicles has fallen, while demand for petrol has increased. This has been duly reflected in platinum and palladium prices: the former has sunk and the latter has soared.

However, it is only diesel passenger vehicle demand that has died out. Globally, demand for commercial vehicles has remained constant and is likely to remain so. In other words, platinum demand should also remain constant. The big falls have already happened.

Electric vehicles are coming, but perhaps they are not quite as clean as the keenest proponents would have you believe. About 85% of global energy comes from burning hydrocarbons, so even for electric vehicles there's an 85% probability that the source of their energy is dirty.

Nor will they necessarily signal an end to PGM demand. Hybrid cars are the stepping stone to electric vehicles; JP Morgan says hybrids will account for 23% of global sales by 2025. However, hybrids still burn fuel 91% of vehicles will still have an internal combustion engine in 2025.

And according to the Boston Consulting Group, by 2030, 85% of passenger cars will still have a combustion engine and hence a catalytic converter. In other words, there will still be demand from vehicles for PGMs.

Another coming regulatory headache is that emission standards are different in the lab to the real world. Hybrids and other cars which turn off and on when stationary are in fact, in terms of emissions, a false economy, as the catalyst needs to be hot to function properly. This has the potential to become a big issue in the future if it gets more publicity.

So things look good for palladium and rhodium. Demand will continue and both are in a supply deficit. Palladium has an annual deficit of 8%, while rhodium demand exceeds annual mined supply of 760,000 oz by 100,000 oz. Recycling is what has saved both, but the stockpiles are shrinking all the time.

What could bring demand for platinum back?

Platinum is closer to equilibrium. The weak rand, alongside high palladium and rhodium prices, means that profitability is outrunning wage and power inflation, and so production of PGMs remains high. That is not great for platinum.

I have talked about the need for platinum to gain a new narrative. Jewellery demand is not coming to the rescue. Where is the demand going to come from? What is the story? The answer to that may be fuel-cell vehicles.

The use of fuel-cell vehicles is expected to take off, but not until the early to mid-2020s (though the story will get out sooner than that). But if fuel-cell vehicles take off, so will platinum demand and the normal prices and ratios I have discussed in other Money Mornings, where platinum trades at a premium to gold and palladium, will return.

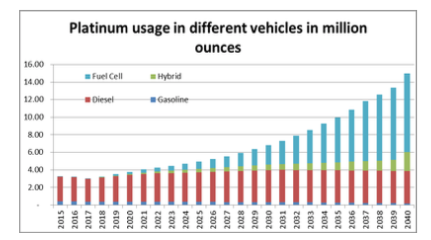

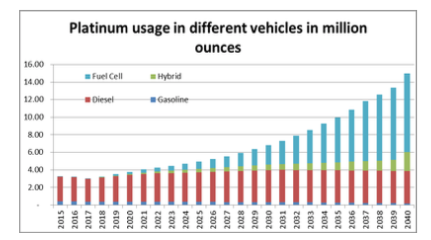

Each fuel cell, says Hochreiter, will require an ounce (30g) of platinum; a typical saloon car would require five to six ounces. By the end of the next decade, platinum demand could be double where it is today. This chart shows project platinum use in different vehicles.

But quite what platinum use will be in fuel-cell transport, and indeed what fuel-cell transport will be, is not yet fully known.

As for ways to invest in this sector you can buy the metals directly, or get exposure via exchange-traded funds (ETFs) or even spread betting (remember that spread betting is highly risky and best avoided unless you are an experienced trader and you understand that you can lose more than your original stake).

The primary PGM miners to look at are North American Palladium (Toronto: PDL), Norilsk Nickel (Moscow: GMKN), Impala Platinum (Johannesburg: IMP) and Platinum Group Metals (NYSE: PLG). The latter was the table's preference. I do not own any of the stocks mentioned here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how