Currency Corner: why we all need to keep a close eye on King Dollar

Dominic Frisby looks at the price of the most important currency in the world – the US dollar – and where it’s likely to be by the time Donald Trump’s term as president is up.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Hello and welcome to this week's Currency Corner.

Today I want to consider what is surely the most important price in the world that of the global reserve currency, the US dollar.

The measure I'll use is the US dollar index. This shows the US's value against the currencies of six of its major trading partners the euro, the Japanese yen, the Canadian dollar, the British pound, the Swedish krona and the Swiss franc. The euro holds the most weight in the index about 58%. The yen is next with about 14%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Interestingly, the entirety of Central and South America, Africa and Australasia, as well as most of Asia including India, China and South Korea go unrepresented. The rights and wrongs of weighting and inclusion are not up for discussion here, however. I am just giving you an idea of how this benchmark is calculated.

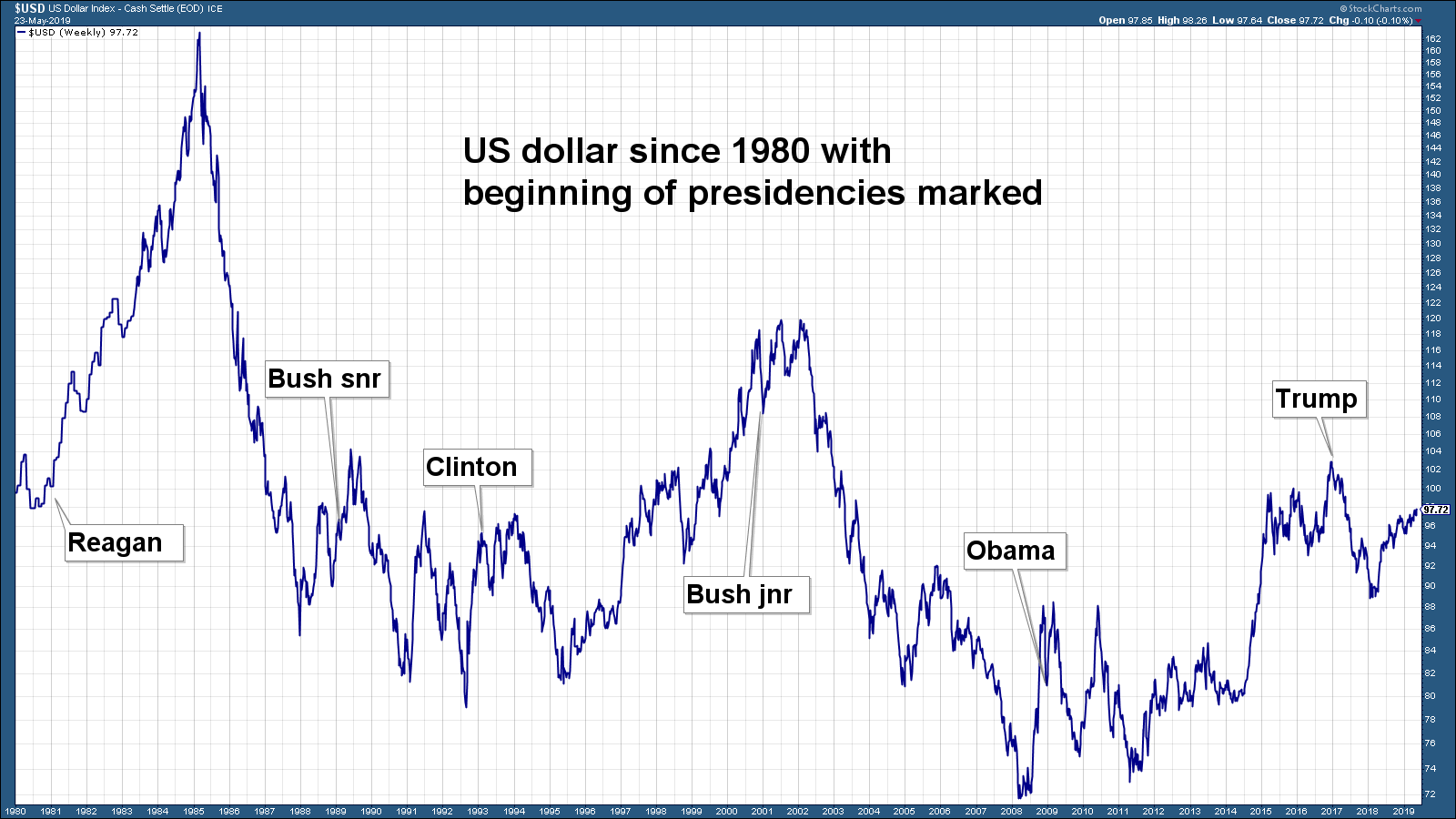

We'll start with a long-term chart of the US dollar since 1993, when Bill Clinton became president. I have marked the points on the chart late in the year when each president won the election. It's amazing how a swing in the currency almost immediately followed.

My main observation with this chart is how long periods of strength and weakness go on for. Broadly speaking, the dollar rose pretty much in a straight line during the first term of Ronald Reagan's presidency from 1981 to 1985 then fell for the next four years to 1989.

It range-traded during the four-year term of George Bush Senior (though with a downward bias) and then fell for the first two years of Bill Clinton. In 1995, however, it then set off an a bull market that did not top out until shortly after the inauguration of George Bush Junior in 2001. It then fell for six straight years, from 2002 to 2008.

Barack Obama was inaugurated as president in 2009. There were big swings during his first two years, but then we got another six-year bull market that didn't end until yup, you guessed it the election of America's next president, Donald Trump, in November 2016.

Where will the US dollar end up under Trump?

The first year of Trump's presidency saw the dollar fall sharply. The second year, however, 2018, saw the dollar recover, and that recovery has continued into 2019. What we are seeing is fairly typical for a new presidency. For Obama, Bush and Clinton, the first two years of the presidency saw similar action up a bit, then down a bit, or vice versa. You have to go all the way back to Reagan to find an example of clear direction from the get-go.

Of course there is a lot more to the direction of a currency than who is president. A million different factors will be pushing and pulling at the US dollar. But I still find the comparisons interesting and it is something I have only just noticed in the course of writing this article.

We don't yet who is likely to win the next presidential election, though Trump is currently the favourite (the incumbent normally is). So I'm now looking at these past patterns and thinking that the downs and ups of Trump's first two years are going to settle, and we could be about to embark on a trend that will last for as long as six years.

Will that direction be up or down? WIll the dollar get weaker or stronger? Global markets would almost certainly prefer that the direction be down. Trump himself would almost certainly prefer that direction to be down too. I'm not quite sure what the Federal Reserve wants at the moment it is talking the dollar up, but it's hard to imagine that the Fed really wants a stronger currency.

But the wishes of markets and politicians may be in vain. Trade wars and tariffs will surely strengthen the dollar. And at the moment the trend is very much up. Yesterday the dollar hit four-year highs. If we carry on like this, be prepared for a lot more turmoil in global markets.

And on that note as John mentioned in this morning's Money Morning, on 11 June at 1pm, he and I will be talking to currency specialist Alex Edwards of currency broker OFX.

In this live webinar, we'll be discussing everything from the state of global trade to the effect of political turmoil on sterling and other major world currencies, and we'll also be taking questions during the webinar.

So register to watch it live here totally free if you can't make it on the day, you can always watch the recording later. Just make sure you register.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how