Forget the financial crisis: it’s time to bet on British banks

Over a decade after the financial crisis, investors are still reluctant to consider British banks. But their worries are overblown and the stocks are cheap, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

British banks have been in the news for all the wrong reasons. We have seen queues outside Metro Bank, and it recently emerged that the Bank of England tried to prevent the prosecution of executives at Barclays for not disclosing the funding the bank received from Qatar during the financial crisis.

Stock returns have also been disappointing, with HSBC, Barclays, RBS, Lloyds and Standard Chartered all lagging the stockmarket over the last decade. However, look beyond the headlines and you will see that the major listed British banks have been grappling successfully with the legacy of the financial crisis, putting their houses in order in advance of any economic downturn, fending off competition from challenger banks, and getting down to the important task of growing revenues and profits.

Recovering from the financial crisis

Concerns that British banks haven't properly dealt with the legacy of the financial meltdown of 2007-2008 are clearly having an impact on the sector. Even though the crisis was over a decade ago, "it has taken a long time for the public to forgive the banks for what took place in 2007-2008", says David Miller of Quilter Cheviot Investment. Recurrent negative publicity over various cases of misconduct, notably the scandals over the fixing of Libor (a key interbank lending rate) and the mis-selling of payment protection insurance (PPI), have hardly helped.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Still, the good news, according to Miller, is that "there's a big difference between how British banks are perceived by the public and how they are regarded by their peers and compared with institutions in Europe and America, British banks have a good reputation". For example, regulators have forced them to increase the capital set aside to cover losses on loans. The buffer between assets and loans is far higher than the rules stipulate.

The average Tier 1 capital ratio (a key gauge of financial strength measuring equity capital as a proportion of overall assets) has more than doubled since the crisis to 18% today; the regulatory minimum is 10.5%. This means that banks could still survive even if the value of their assets fell by nearly one-fifth. More generally, there's been a "dramatic change" in the culture, which means that "they are now run in a much more prudent way".

Less legal hassle

The huge amount of money that British banks have paid out in fines and settlements may not have been good for their bottom line, but at least it means that the remaining legal risk has "greatly diminished", says Simon Gergel of Merchants Trust. Even though there is still a chance that there could be a surge of PPI claims in the run-up to the deadline (29 August), banks are "getting to the end of the process". While legal risk "will never completely go away", much tighter compliance means that "the potential losses from fines and lawsuits should be significantly lower than they were before".Of course, there are still "pockets of concern", such "as loosening credit standards" in unsecured store-cards and zero-percent balance transfer cards, says Philip Matthews, co-portfolio manager of the TB Wise Multi-Asset Income Fund. However, balance-sheet quality "appears to have been demonstrably improved".

"The potential impact of Brexit on the banks has been overstated"

Overall credit standards have also been tightened, "considerably reducing the riskiness of the assets held on banks' balance sheets". Far fewer high loan-to-value mortgages have been written compared with ten years ago. Banks have retained less of their leveraged loan exposure on their own balance sheets. The average unsecured loan exposure is lower and the banks have "pulled back from very high risk commercial real-estate lending".

Liquidity, meanwhile, has vastly improved. One of the key causes of the crisis was that banks moved away from relying primarily on customers' deposits to meet short-term obligations and instead started to lean on external money markets. Indeed, just before the crisis started they typically had only enough liquid assets, such as cash and short-term debt, to cover six weeks' worth of funding. This caused huge problems when the money markets suddenly dried up from the summer of 2007 onwards. By contrast, today they have "sufficient liquidity to cover two years of wholesale funding outflows", says Matthews.

Well prepared for a slowdown... if one comes

Investors also shouldn't worry too much about the possibility of a slowdown hitting the banking sector, reckons Gergel. The changes that the banks have been forced to make will ensure they are well prepared.

From the start of last year, the Bank of England has forced banks to follow new global accounting standards that require them to make provision for any potential losses in advance of any downturn rather than as it happens. This should pre-empt nasty surprises for investors and temper concern over systemic problems once a downturn arrives. While such provisions are currently having a negative impact on banks' balance sheets, it looks as though it will be "relatively minor".

Besides, there is no guarantee that the recession many people are expecting will actually take place. Even the potential impact of Brexit has been overstated. While the potential loss of the right to sell financial services across the EU will affect investment banks, it will have scant impact on retail banks. It's also important to remember that HSBC and Barclays are global banks with offices and operations around the world. So neither Brexit disruption nor a British downturn will particularly hurt their bottom line.

A Brexit boost?

What's more, if Brexit ends up being softer than expected then a great deal of pent-up demand will be released, boosting the economy and banks' balance sheets. "We've been living with Brexit for three years, so banks have had plenty of time to prepare for the worst," says Miller. Indeed, as part of the new, tightened regulatory regime, banks are regularly required to undergo "stress tests", which examine the effect a recession or a sudden drop in house prices has on their balance sheets.

"The fintech trend could end up helping big banks more than it hurts them"

All the major banks have repeatedly passed the tests, which suggests that a slowdown should be relatively easy for them to deal with. Rather than worrying about an economic slowdown that may never occur, investors should be more concerned by the fact that the Bank of England's enthusiasm for interest-rate rises seems to have dissipated. Higher interest rates are generally good for banks because they can earn more on their loans.

However, interest rates could rise unexpectedly quickly if inflation suddenly picks up a scenario that could take central banks by surprise, as we have often pointed out over the last few months.

Challengers' challenge overstated

British banks have also had to deal with new competitors. Since the crash, several "challenger banks" have emerged that aim to steal business from the incumbents. The government has encouraged the newcomers, such as Metro Bank, on the principle that increased competition will force existing banks to offer better service and more value for money. Two years ago RBS announced that it was setting up two funds, with a total value of £775m, to make it easier for small businesses to switch to challenger banks, as well as to encourage financial innovation more generally.

But while it would be wrong to write off the newcomers, the evidence suggests that the challenge they pose to the main players has been overstated. The recent turbulence at Metro Bank indicates that banking "is a matter of confidence and scale, so the challenges are more towards the newcomers than the big four", says Helal Miah, investment research analyst at The Share Centre.

Matthews believes they don't pose a significant challenge to the big players. After all, challenger banks "have disadvantages of their own... rapid levels of growth bring with them operational issues, as well as potential credit issues" if an unexpected economic downturn materialises.

Co-opting technology

A more significant long-term threat to the established institutions comes from financial technology (fintech) companies, which aim to use software or artificial intelligence to steal business from banks or make them obsolete. "We are in the middle of a wave of technological disruption," admits Georg Ludviksson, founder and chief executive of software company Meniga, which helps retail banks in the UK and Europe deal with the impact of technological change.Still, investors in the big institutions should be reassured by the fact that they are working extremely hard to stay on the cutting edge of technology, so that if there is a technological revolution, they are not being left behind. Indeed, not only are the main banks "fighting back by copying what the challengers are doing", but they are also "taking the initiative". Certainly, "all the banks realise that where technology is concerned they have to move faster and change", and as a result "most of them are making a lot of progress".

"British banks' dividends have risen from £7.7bn to £11.6bn over the past five years"

In fact, technological change in banking could end up helping big British banks more than it hurts them. Ludviksson points to the example of telecom firms such as Three, which have used the power of their brands to reinvent themselves as sales and marketing powerhouses, allowing them to outsource more capital-intensive, lower-margin tasks.

In that scenario, the big players could end up partnering with fintech firms to focus on those parts of banking that are more profitable. Even in the worst-case scenario, the traditional banks are hardly going to be supplanted in the near future. The fintech sector will only succeed by concentrating on niches "and then scaling up". It should avoid trying to "replicate everything that banks currently do".

Returning to profitability

Not only are the fears surrounding the British banking sector overblown, but there are also some compelling positive reasons for investing in it. Having absorbed nearly £100bn of costs, banks "are much better positioned to pay dividends or undertake share buybacks", says Matthews. Despite intense competition, traditional retail-banking activities remain highly profitable. One particularly lucrative area is mortgages, "with new business generating returns well above the cost of capital". This has been especially good news for Lloyds, which has used its strong focus on these bread-and-butter areas to generate "strong" returns on equity.

Things have been a little more complicated for the corporate and investment banking divisions of the major British banks. One of the big problems is that investment banking is a much more global industry, which means that British and European firms are competing "against large-scale US banks with less punitive regulatory regimes". The investment banking divisions of RBS and Barclays are "well off their return aspirations", leading to calls for Barclays to spin off its investment-banking arm. However, both banks are having some success in cutting costs, which should make it easier for them to boost margins and return on capital.

There are some other potential areas of growth that banks are starting to explore. A greater emphasis on investment advice and financial products that will help people plan for the future should pay dividends. "It's clear that people are being expected to take more responsibility for their own financial security, so if you can offer good advice then you are in a good position," says Miller. He also notes that banks such as HSBC, which derives most of its revenue from outside the UK, have an opportunity to expand this business in fast-growing areas of the world, such as Asia. Standard Chartered, another global player, has the same opportunity.

A sector for income seekers

One indication that the British banking sector is in much better shape than it was a few years ago, and has finally put the legacy of the great financial crisis behind it, is the increase in the level of profits. According to data from The Share Centre, last year the listed UK banks made a collective profit of £27.7bn, nearly triple the levels of £9.5bn five years ago. While this is still below the record level of £34.4bn in 2007, dividends have also increased sharply from £7.7bn to £11.6bn during the same period. The combination of falling share prices and rising profits has resulted in enticing dividend yields, especially compared with other industries.

The banking sector's best bets

HSBC (LSE: HSBA) is the largest UK bank by market capitalisation, and one of the largest banks in the world. The fact that it derives 85% of its revenues from outside Britain means that it should be insulated from any downturn in the UK economy and should also benefit from growth in emerging markets, especially in Asia. Despite this, it still trades at only 11.2 times 2020 earnings and yields an attractive 6%.

One British bank that should also benefit from growth in emerging markets, but is trading at a much bigger discount than HSBC, is Standard Chartered (LSE: STAN). Around 90% of Standard Chartered's revenues come from the Middle East, Africa and Asia, giving it exposure to some of the fastest-growing parts of the global economy. Its increasing profitability has enabled it to announce that it will spend £770m buying back shares. It trades at a discount of 47% to its book value and offers a dividend yield of 3%.

Barclays (LSE: BARC) is in the middle of a public row between activist shareholder Edward Bramson who wants either to shut down or divest the investment banking division and chief executive Jes Staley, who opposes such a move. Staley seems to have won the argument for the moment and has made some changes designed to give him more direct control of the division. More broadly, Simon Gergel of Merchants Investment Trust thinks that Staley is doing a good job of cutting costs and reducing the level of debt. Barclays trades on a 2020 price/earnings ratio of 6.5, with a dividend yield of 4.7%.

Lloyds (LSE: LLOY) was one of the banks, along with RBS, to receive a bailout from the government. It resulted in the Treasury taking a 43% stake in the company. However, two years ago the final tranche of government shares in the bank were sold, which means that is now completely free from government interference.

David Miller of Quilter Cheviot Investment believes it's made "good progress" in pushing through the structural changes needed for the institution to prosper, as shown by the 8% return on equity, a key gauge of profitability. It currently trades at a yield of 6%, and said that it now feels confident enough to start paying dividends quarterly rather than annually.

One challenger bank worth considering is CYBG (LSE: CYBG), which was formed when National Australia Bank decided to sell off Clydesdale Bank and Yorkshire Bank and float them as a separate company. Last year, CYBG bought Virgin Money (which owned Northern Rock), which should help increase its asset base and diversify its business away from mortgages.

While it unexpectedly failed to gain any money from the banking competition fund set up by RBS (it went to Metro Bank), management has promised to outline a detailed medium-term plan for growing the bank. CYBG trades at 7.3 times 2020 earnings and yields 3.7%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Could you get cheaper loans under ‘significant’ FCA credit proposals?

Could you get cheaper loans under ‘significant’ FCA credit proposals?The Financial Conduct Authority has launched a consultation which could lead to better access to credit for consumers and increase competition across the market, according to experts.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

Will HSBC be torn apart?

Will HSBC be torn apart?News Banking giant HSBC has pleased the market with a new dividend policy. But its top shareholder thinks it should be split in two. Matthew Partridge reports.

-

Macron has failed France – but there is still plenty to invest in

Macron has failed France – but there is still plenty to invest inCover Story Emmanuel Macron won a convincing victory in France's presidential election, but he has no clear vision for halting the country’s decline. Frédéric Guirinec looks at the state of France and picks 20 French stocks to buy.

-

The best markets in Asia and how to invest in them

The best markets in Asia and how to invest in themCover Story China and Indonesia should do well over the next year, while India and Vietnam have exceptional long-term prospects. From tech giants to banks, there are plenty of cheap stocks, says Rupert Foster

-

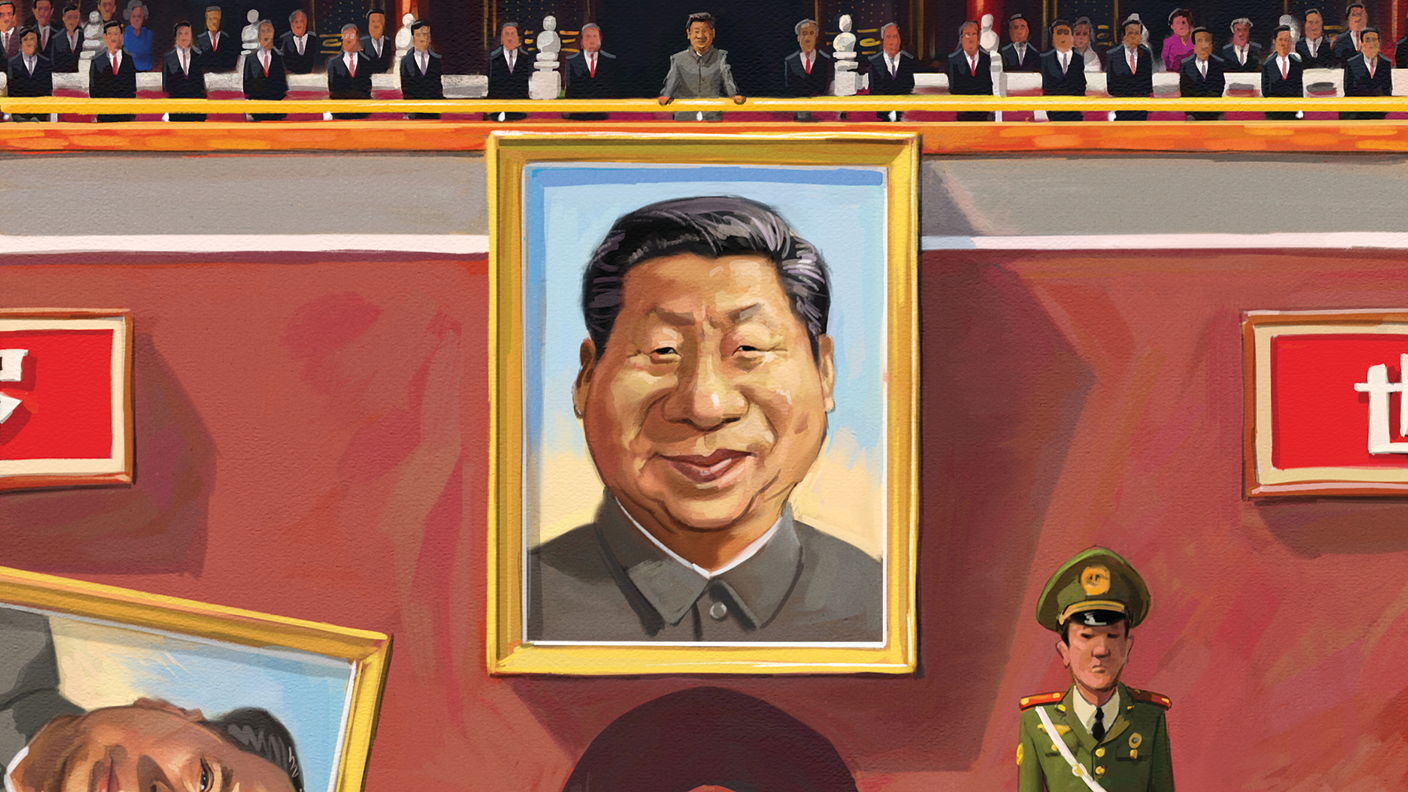

The three key risks for investors in China, and how to tackle them

The three key risks for investors in China, and how to tackle themCover Story Xi Jinping’s vision for the future of China is very different to the past. Stricter social control and the slow struggle to tackle problems in the economy may not be good news for markets, says Cris Sholto Heaton.

-

Evergrande: Chinese property giant spooks global markets

Evergrande: Chinese property giant spooks global marketsNews Global markets fell this week as investors worried about the fate of Evergrande, China’s most indebted property developer, which is teetering on the brink of default.

-

Japanese stocks offer plenty of promise at the right price

Japanese stocks offer plenty of promise at the right priceCover Story After decades of disappointment, Japan is packed with opportunities for investors, says Alex Rankine.

-

The five best ways to invest in India's promising future

The five best ways to invest in India's promising futureCover Story The pandemic has been catastrophic for India, yet the stockmarket is hitting record highs. Investors are right to remain optimistic about the long term, but they are pricing all the good news in, says Cris Sholto Heaton