Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

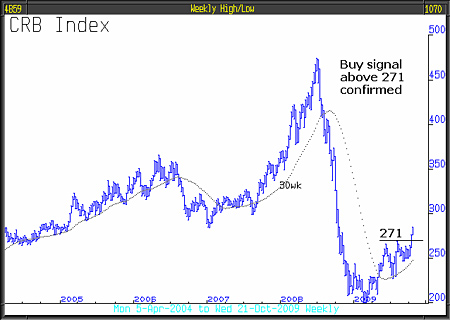

Not surprisingly, given the dollar's weakness, commodity action has been very positive. Two weeks ago we said that, on the CRB exceeding 271, commodities would become a buy opportunity. As you can see from the latest chart, that occurred. This is a signal of considerable importance and suggests that a long term commodity bull market is now secure. If that turns out to be true, it may be implying an even steeper collapse of the dollar.

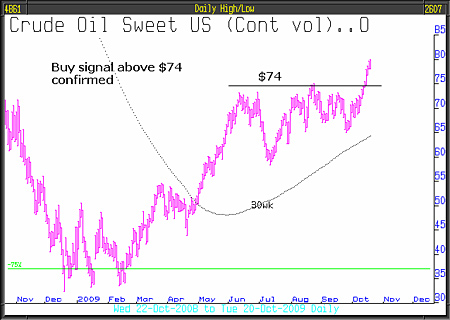

The crude oil chart also featured in the previous issue. Here we said that a break above $74 would signal a buy - it has happened. We have, accordingly, invested 7.5% in the Investec Global Energy Fund. This fund, which is positioned in high quality energy equities, should benefit considerably from a higher oil price. It is thought that globally the oil majors are valued based upon oil at $55 pb, in our view a long term outlook which is too conservative.

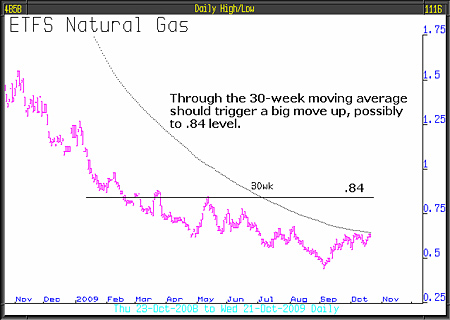

We also noted the buy signal for the CRB index, and acquired a 7.5% position in a grain ETF, which is invested approximately 29% in corn, 44% in soybean and 26% in wheat. We still hold the natural gas ETF which was purchased on 11 September; it is now ahead by 11.25%. We expect prices to be volatile but there should be a sharp recovery next year driven by considerable cuts in drilling activity.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

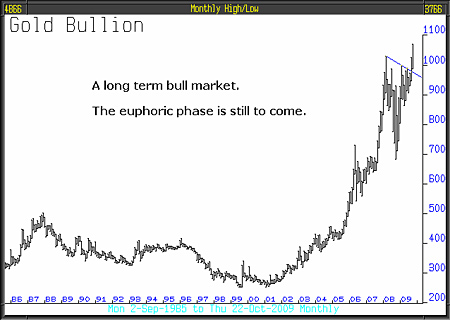

Our longstanding gold positions are set to deliver very significantly over the next year or so. A weak dollar will add considerable impetus to the gold price, as will the policy of money creation and devaluation pursued by many of the major economies of the world. The investment case for gold as the ultimate currency is very comprehensible:

Deflation and inflation both bullish for gold.

Gold is the only currency whose production is going down not up.

Negative real rates are bullish for gold.

Potential increased investor and central bank buying as a store of value in order to diversify US dollar exposure.

Since gold exceeded $1,000/oz the price has been extremely resilient with no meaningful pullback. Although there has been some large profit taking, there is plenty of demand on any weakness. In September, the Russian Central Bank added 400,000 ounces to their gold reserves; they now total 19 million ounces. This year to date they have bought a huge 2.3 million ounces.

Cheng Siwei said that China is incrementally diversifying out of dollars and gold is one of their choices. China is the world's largest producer of gold, but holds only 1,054 tonnes of gold reserves, amounting to less than 2% of total foreign reserves. Extraordinarily, the Chinese government has also been advertising gold on Chinese television, encouraging citizens to acquire it.

Good old "gold fever" is heating up. There is a huge market in scrap gold with advertisements everywhere and Harrods is now selling it.

Over the next few months we would expect the commodity sector to deliver significant returns, led by gold bullion.

This article was written by Full Circle Asset Management ,and was published in the threesixty Newsletter on 23 October 2009

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how