Why you should be glad that house prices are falling in “real” terms

House prices are now rising more slowly than inflation – could we see a soft landing for the property market? John Stepek hopes so.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

House prices are now rising at a gentle 2.5% a year, according to the latest figures from Halifax.

Consumer price index inflation, meanwhile, is at 2.7%. Wage inflation excluding bonuses is rising at 2.9% (we talk about wage inflation in the latest MoneyWeek podcast check it out here).

In other words, house prices are now falling in "real" terms.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Are we on our way to our hoped-for "soft" landing?

The housing market doesn't lack for analysis

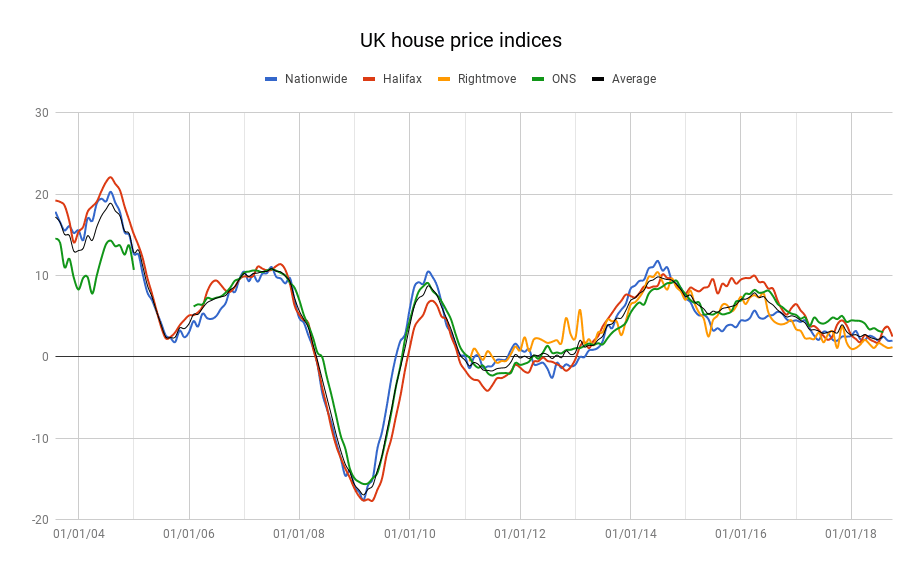

To get an idea of how important house prices are to the UK economy, you merely need glance at the number of indices we have that claim to track prices in one way or another.

For inflation, we have quite a few indices, but they're mostly variations on a theme from the Office for National Statistics (a cynic might explain this as being the product of successive governments trying to gerrymander the figures lower I won't comment).

Similarly, for employment, you'll get the odd private sector survey recruitment agencies talking about ease of hiring and wages, for example but largely we all focus on the official data again.

But when it comes to house prices you're spoiled for choice. You could be reading about a new survey every other week.

We've got Rightmove, which looks at asking prices. We've got mortgage approvals, which looks at well, mortgage approvals. We've got the official house price index from the ONS.

We've got the niche indices from upmarket estate agents, that look at prime central London property, or country houses. We've got Hometrack, which looks at trends across UK cities.

But probably the best known pair of indices partly because they have some of the longest histories are the ones compiled by Nationwide and Halifax. These two take their data from somewhere in the middle of the buying process.

So the latest Halifax house price index will probably grab a few headlines this morning. Prices apparently fell by 1.4% in the month of September, which is a big drop compared with expectations.

Looking at the month-on-month figure is fairly pointless. It's quite a "noisy" data set. However, the year-on-year data is equally striking. In the three months to September, prices rose by 2.5% compared to the same quarter last year. Analysts had expected a rise of 3.4%.

That means not only that house price growth is still slowing (last time, according to Halifax, the annual growth rate was 3.7%), but also that house price growth is now firmly below inflation.

In other words, house prices are falling in "real" terms.

Why a soft landing would be better for buyers and owners

This is good news. You want this to continue. Here's why.

From the homeowner's point of view, you shouldn't really care that much about what happens to the price of your house as long as you can continue to pay your mortgage.

But that's not the way things work. No one likes to see the value of their home fall, particularly if it then puts them into negative equity. So there's a psychological impact from falling house prices, which is not great for consumer confidence, and spending.

Moreover, widespread, sharp falls in house prices tend to be symptomatic of something else usually surging interest rates and a struggling economy. Rising borrowing costs not only push up mortgage bills, they also squeeze over-indebted businesses. That drives up unemployment and results in more forced sellers.

So a big house price crash is a messy way to get back to some sort of sensible housing market.

Instead, if the price of your house stays broadly flat, but your wages go up, then you don't get the psychological hit from a falling house price, and hopefully your mortgage also becomes more affordable relative to your pay packet. That's ideal.

Meanwhile, if you're frustrated by the unaffordability of property, then you might hope for a big crash. And I sympathise. Trouble is, getting a home loan when prices are crashing tends to be difficult. That's why the inflationary option can be more attractive even for those who don't already own property.

Basically, you want your wages to rise more rapidly than prices. If prices are flat or gently falling but your wages are rising, then it gets easier to save for a deposit.

So having made the case will this continue?

The good news is that a lot of heat has come out of the market. Buy-to-let investment is much less attractive these days. Not only are the tax changes still coming through, the fact that house prices are no longer soaring and therefore no longer seen as a "sure thing" will reduce the appeal of property as an investment.

Meanwhile, one thing mitigating against prices falling hard is that, despite mortgage rates ticking higher, as Samuel Tombs of Pantheon Economics points out, "households can offset the impact of rising mortgage rates on monthly repayments by taking out longer maturity loans, while payments as a share of disposable incomes still are low by past standards." He reckons that means that we're unlikely to see big falls in prices at a nationwide level.

Overall, I think a prolonged period of single-digit house price falls and above-inflation wage gains would be a nice way out of this affordability problem.

I think it's a definite possibility. That said, I'll admit that the experts at our recent property roundtable were less optimistic than me. But we can always hope.

(Subscribe to MoneyWeek now if you haven't already, to make sure you don't miss our future roundtables).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?