Not invested in Japan yet? Now looks a good opportunity

Shinzo Abe’s time as Japan’s prime minister has been good for investors. With his re-election as party leader, John Stepek sees no reason for that to change.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Elections are a nail-biting event for any incumbent leader these days, regardless of how secure their majority appears to be, or how predictable the result.

So Shinzo Abe, Japan's prime minister, could have been forgiven for feeling a bit edgy ahead of his party's leadership election last week.

He needn't have worried; he won comfortably. That means Abe will be in charge now until at least 2021, which would make him Japan's longest-serving prime minister.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And that's good news for investors.

Abe's reign has been good news for investors

When Abe first came (back) to power in 2012, he embarked on an ambitious set of reforms known as Abenomics. The central bank printed unprecedented sums of money and Abe made efforts (a bit later in the process) to free up the labour market, getting more women and older people into the workplace.

As Peter Tasker puts it in the Financial Times, "It worked".

An incredibly low unemployment rate and a very high employment rate (ie, a very large proportion of those aged 15-74 are in jobs) means that wages are finally rising at a rate above inflation. Corporate profits are high, and investment is "booming" (because with wages rising, suddenly it makes a lot of sense for companies to spend money on automation).

As Tasker notes, you can't necessarily pin all this on Abe's work, but certainly the money printing and the psychological shift that it drove has helped a lot. So the continuity of that process is good news for investors.

What's also interesting from an investment point of view is that Abe is now positioning Japan as the lead "green" economy in the world. In an opinion piece in yesterday's FT, he said that world leaders needed to get together to sort out climate change, he noted: "Japan has goals such as creating ultra-high-capacity storage batteries, further decentralising and digitising automated energy control systems, and evolving into a hydrogen-based energy society."

This is encouraging for two reasons. First, these are all exciting areas of investment right now. At some point, we're going to see a proper bubble in "green" technology (we've seen small ones inflate across various individual sectors, but nothing that could be described as an epic bubble). If Japan is at the forefront of it, I want some of my money to be there too.

Secondly, it suggests that the Japanese government's focus on evolving a more shareholder-friendly society will continue. Abe is more than happy enough to use the Japanese government pension fund (a massive investor) to put pressure on companies to improve their record on "environment, social and governance" issues, one of which is being more open to listening to shareholders.

One reason many Japanese stocks trade at a discount to their assets is because of this history of intransigence when it comes to unlocking value or treating shareholders like owners rather than inconvenient hangers-on.

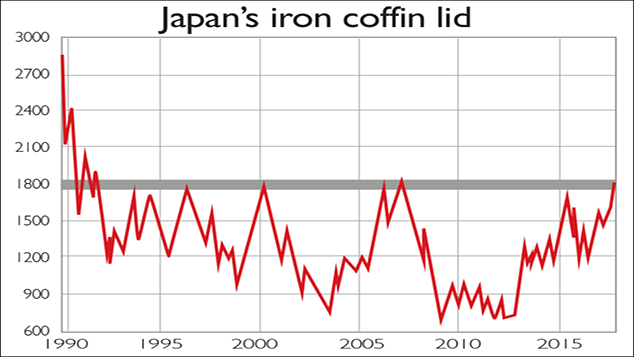

Can Japan throw off the "iron coffin lid" for good?

Finally, timing-wise, this looks a good time to invest. Technical analysis is a topic which inspires a wide range of views. If you think it's rubbish, feel free to ignore this point. But the Topic index Japan's equivalent of the S&P 500 (the Nikkei is more like the Dow) has just risen above a particularly potent "line of resistance" once again.

Put simply, a line of resistance is a point at which a market has consistently struggled to rise above, mainly because there are a lot of sellers waiting to dump their holdings at that level. One particular level has kept the Topix index suppressed for many many years now.

Here's a chart I prepared earlier (and if you're interested in charting, you can read the accompanying piece here). You can see that the Topix has often bumped its head on the 1,800 level what Jonathan Allum of SMBC Nikko describes as the "iron coffin lid":

That chart runs up to late 2017. The Topix did manage to burst through, and by the start of 2018 had managed to claw its way above 1,900.

However, as you can see in the chart below, then the correction came. By the end of March, the Topix was back down below 1,700. However, it didn't fall far. It made its way back above 1,800 in May again, then listlessly drifted back down below 1,700 by July.

But now the Topix has just pushed through "the iron coffin lid" again. It's raced back above 1,800 in the last week or so.

What's my point? It looks to me as though Japan is genuinely throwing off the last few decades and is finally ready to make a concerted push higher.

We've been recommending Japan for a long time and I suspect that many of you are already invested there. If you're not, then I'd suggest you invest using one of the several high-quality London-listed investment trusts that focus on Japan. Merryn took a look at one very interesting looking new option in the most recent issue of MoneyWeek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King