Reading the entrails of the charts

Japan's Topix stock index has reached a classic resistance area in the charts that can give investors a clue as to where the share price will head next. John Stepek explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

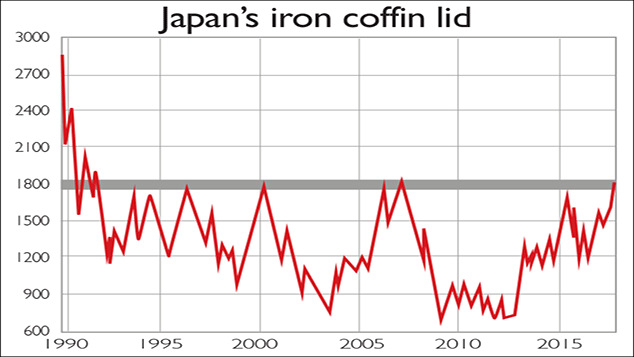

Japan's Topix index has banged its head once again on what Jonathan Allum of SMBC Nikko calls "the iron coffin lid" (the grey line on the chart). Japan's bubble burst at the end of 1989, with the Topix index at around 2,880. It first fell below 1,800 in 1990. Since 1991, despite a few attempts, it has never sustained a move back above it. Last Thursday it charged briefly above 1,800 then fell by more than 5% over the following week.

Hence the iron coffin lid. It's a great example of what technical analysts call "resistance" a price level at which the market has faltered so many times that it's worth watching for opportunities to buy or sell (see below).

Is all this chart-scrutinising and line-drawing the financial market equivalent of a horoscope, or is there more to it? The logic behind technical analysis is that while many things in markets change, human behaviour doesn't. What's more, our psychology moves in cycles, from abject panic to manic exuberance. This repetitive behaviour is expressed in the price of an asset or market, and gives rise to repeating patterns. If you look out for these patterns materialising, then you can forecast some likely scenarios for future price movements should the pattern hold.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Of course, there are reams of patterns, which leaves an awful lot of room for interpretation. And the reality is that most studies are at best inconclusive and at worst reckon that technical analysis simply doesn't work. But that doesn't mean that you can just toss it into your "too hard to understand" pile. After all, fundamental analysis doesn't have the most stunning record either. There are two main points for sceptics to bear in mind. If you insist on short-term trading (which, for most people, is a terrible idea, as Jack Bogle says on the right), then "fundamental" analysis has little value.

Understanding the long-term demand picture for copper will not tell you what's going to happen to Rio Tinto's share price tomorrow. Technical analysis forces you to look at a scenario, set a clear entry point and, more importantly, a point at which you'll sell if your plan goes wrong. It doesn't mean that your trade will turn a profit. But done properly, it does mean that you are forced to manage your risk.

Secondly, even if you don't believe in it, plenty of other people do. Whatever your take on the validity of the iron coffin lid, the retreat of the Topix is at least partly down to other investors having strong conviction that the price would falter at this key "resistance level". I'm not saying for a moment that you should become an expert on charting. It's easy to get lost down a rabbit hole and some of it is undoubtedly an esoteric waste of time. But the more active you intend to be as an investor, the more effort you should make at least to familiarise yourself with the basics.

Resistance explained

One of the most important concepts in technical analysis are the twin ideas of "support" and "resistance". A support line is a horizontal line on a chart that connects two or more (the more, the better) points at which a price has fallen to a certain level and then bounced higher. In other words, there is evidence of buyers coming in to support the price when it drops to that level. A resistance line, conversely, is a similar line where the price has risen to a certain level and then dropped back an area where the price is meeting resistance, which is acting as a ceiling (as shown in the "iron coffin lid" chart above).

When a price is approaching a resistance or support level, it is said to be "testing" it. The more often a level is tested (ie, the price bounces off it regularly), the more significant it is deemed to be. Once a level is breached (a "break out"), resistance may become future support, or vice versa. When a price gets above resistance or below support, but then returns to its previous trading range, this is described as a "false break".

For example, if we're to be sure that the Topix has really thrown off the iron coffin lid, we'd want to see the price both rise above the 1,800 mark convincingly, and if it then fell back, we'd also want to see it "bounce" off the 1,800 mark.

Technical analysts use these levels to to decide when to buy or go short (profit by selling), as well as locating places to put a stop-loss you might decide to buy when the price is near support, and enter a stop-loss just below the support level, so that if the price falls through, you will be kicked out of the trade without losing too much. As with all technical analysis, it's as much art as science. But even if you don't use it yourself, it's useful to know that these are areas where other investors might be preparing to buy or sell.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how