The charts that matter: is this the turning point for the US dollar?

John Stepek looks at the charts that matter most to the global economy. And this week, it’s all about the US dollar.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. Some exciting news to start off the MoneyWeek podcast is finally back, now with new and improved sound quality, so you can more easily hear Merryn and I get very annoyed indeed about the financial crisis and its fallout.

Give it a listen here, and let us know what you think at editor@moneyweek.com or leave a comment below the podcast. (If you prefer iTunes to Soundcloud, you can get it here and if you feel inclined to leave a review, that would be lovely).

If you missed any of this week's Money Mornings, here are the links you need.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: The biggest economic change in the last ten years that no one talks about

Tuesday: Is the Federal Reserve really worried about inflation?

Wednesday: A warning from the goldmining boom to today's cryptocurrency investors

Thursday: When will the Bank of England raise interest rates again?

Friday: Now looks like a good time to buy gold but you need to watch this chart

I also put out a companion piece to the podcast, noting a few of the places where people (including us) warned of the 2008 crisis well before it happened.

If you missed any of Merryn's new blogs this week, she warns about why you need to make sure you're not still paying for a mobile phone you already own; on why the best answer to the financial crisis would have been a recession; and how it looks as though wage inflation is finally, finally picking up for everyone.

And as ever, don't miss this week's issue of MoneyWeek magazine! If you're not already a subscriber, sign up here now.

And now over to the charts.

It's all about the US dollar this week. Gold (measured in dollar terms) has recovered somewhat from its August malaise, primarily because the dollar has headed lower. Gold is in an interesting place just now. As we've said many times before, it benefits most when inflation is rising more rapidly than interest rates in other words, when "real" interest rates are falling.

(Gold: three months)

Will that happen? If investors grow more confident that the Federal Reserve is falling "behind the curve" in terms of keeping up with inflation, it'll be good for gold. But the market may need more convincing yet.

That said, as Dominic pointed out yesterday, gold is thoroughly unpopular at the moment, but it won't take much of a shift in sentiment to send it higher.

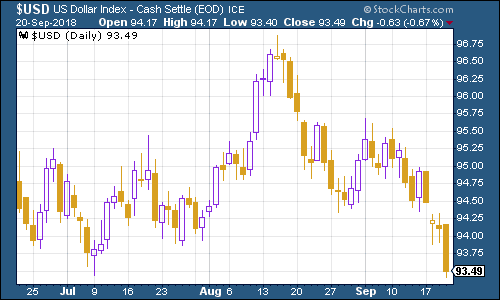

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners has, as you can see, fallen back significantly since mid-August.

(DXY: three months)

Now, frankly, this is a bit odd. In terms of the "fundamentals", it's hard to see what's changed. The US is still tightening monetary policy faster than everyone else. It has a stronger economy than most of its major rivals. The outlook is no cloudier than that for its major rivals. US sovereign debt yields more than the other options out there.

So what's changed?

It could just be the fact that bull markets don't move up in a straight line. You don't keep going up and up and up. You get the odd break.

It could be that sentiment on the dollar was simply too bullish, and sentiment on everything else too bearish. That happens too. By the time that everyone has their money riding on one outcome, it only takes a tiny shift to make betting the other way much more worthwhile. For example, people have become too bearish on emerging markets and on Europe, whereas the data in both Europe (and Japan too) has been reasonable.

There is one other interesting theory though, which I don't think we should ignore, although I don't know how much impact it's had. The point here is a technical one all about corporation tax.

Last Friday was the last day at which US companies were allowed to claim tax relief on their pension contributions at the 2017 corporate tax rate.

Now, Donald Trump, obviously, has slashed corporation tax for US firms. So a week ago, they could claim tax relief of 35%. Now that tax relief is down to 21%.

As a result, any company that could possibly squeeze in its pension contributions faster than normal would have been absolutely right to do so, because the difference in tax relief is absolutely massive.

In turn, that has driven an artificially high level of contributions into US Treasuries in particular. But the cuts to corporation tax as Kevin Muir of the MacroTourist blog points out have also driven vast quantities of repatriation (US companies bringing money held overseas back onshore). That may have played a big role in pushing up the dollar and also in holding down US Treasury yields.

"I know US dollar bulls will tell you the rise has just started. But to me, it seems like an extraordinary amount of buying has already occurred", argues Muir.

This is a very interesting and, I think, compelling theory. We'll see how it pans out, but if the dollar keeps falling, you might be surprised by how rapidly the narrative turns around.

For example, here's a replacement storyline for you: "The US dollar fell today as investors continue to worry about ballooning budget deficits, a potential Chinese Treasury sell-off, trade wars, and political uncertainty, while overseas markets have become more attractive compared to arguably overpriced US stocks."

You see how this works? We often fall for the idea that the story is what drives the price, but the price more often shapes the story. If you want a better view of what's really going on, you have to dig a bit deeper than the surface narratives.

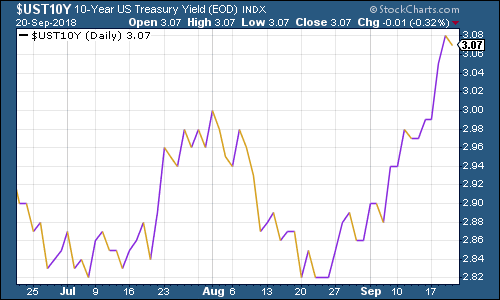

Which takes us onto what's been happening to bond yields. The yield on the ten-year US Treasury bond has shot up in the last few weeks. And what's particularly interesting is that, while the 3% mark indicated a major panic point for markets earlier this year, today almost no one is paying any real attention to it.

(Ten-year US Treasury yield: three months)

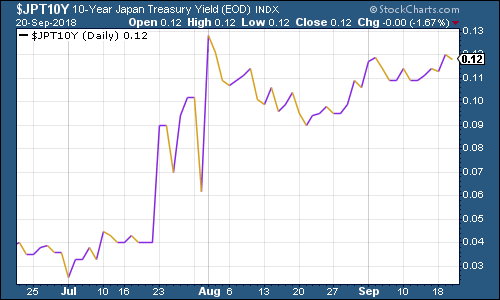

And we have other yields around the world picking up too. The Japanese government bond (JGB) yield is still floating around the 0.1% level after the Bank of Japan's recent decision to let it move around a little more.

But I wouldn't be surprised to see the Bank being forced to defend the position actively in the coming weeks. And given the recent strength in the Japanese economy, it will also be interesting to see just how far the Bank gives before it steps in.

(Ten-year Japanese government bond yield: three months)

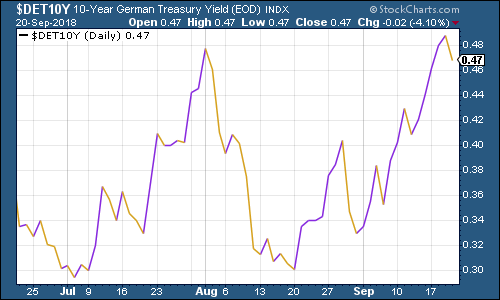

Meanwhile, the yield on the ten-year German bund (the borrowing cost of Germany's government, Europe's "risk-free" rate) has picked up sharply, alongside US yields. Again, interestingly, Italian yields have dipped this week, which suggests this is a "bullish" move.

In other words, German bunds have risen because people are more optimistic on growth, whereas Italian yields have fallen because investors are less worried about everything going pear-shaped on that front.

(Ten-year bund yield: three months)

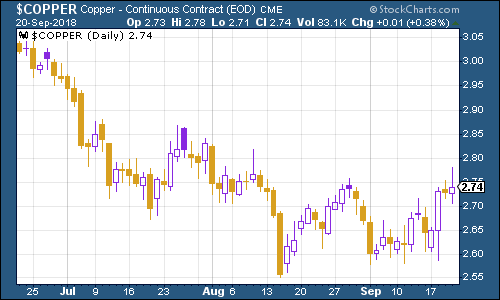

Earlier this month I tentatively suggested that it looked as though copper might have found a bottom. So far that looks as though it might still be the case. Again, this is more of a US dollar story, but there might be something to do with the sense that fears over China's economy might be easing off particularly as Trump's new tariffs were lower than expected.

(Copper: three months)

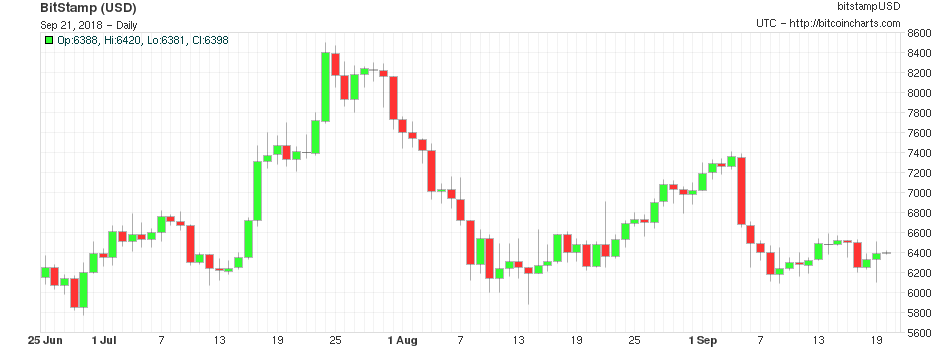

Cryptocurrency bitcoin has been languishing around the $6,000 to $7,000 mark for quite some time now, and that continued this week. Plenty of crypto-analysts seem keen to call a bottom here. I can't comment either way on that, simply because I still don't have a strong sense of what drives bitcoin prices beyond money laundering activity.

(Bitcoin: three months)

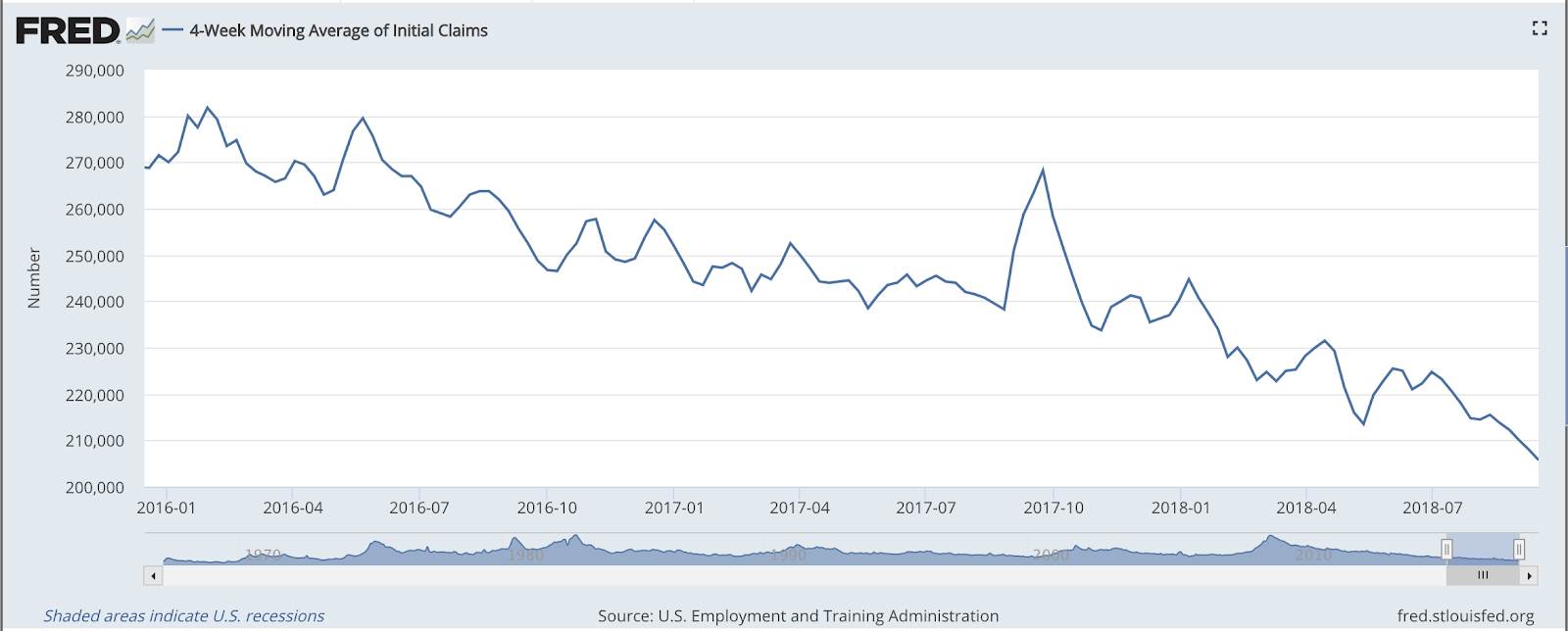

On US employment, the four-week moving average of weekly US jobless claims hit yet another fresh cycle low this week. It came in at 205,750, the lowest level since 1969. Meanwhile weekly claims fell to 201,000, the lowest figure seen since November 1969.

As David Rosenberg of Gluskin Sheff has noted in the past, the stockmarket usually does not hit its peak until after we've seen jobless claims (as measured by the 14-week moving average) hit rock bottom for a cycle.

In other words, jobless claims hitting a cyclical trough and then starting to turn up is a lead indicator for a stockmarket peak. Based on a very small number of widely varied observations, the stockmarket peak usually follows about 14 weeks from when jobless claims hit the bottom, and a recession follows about a year later.

So we've now hit a new trough and, in line with Rosenberg's observations, the stockmarket has continued to hit new highs this week.

The strength in the US labour market is quite something. And while you can caveat it with all sorts of "ifs", "buts" and "maybes", that doesn't take away from the fact that the US economy is continuing to do well. And for now at least, fears about rising interest rates are being put to one side.

(US jobless claims, four-week moving average: since January 2016)

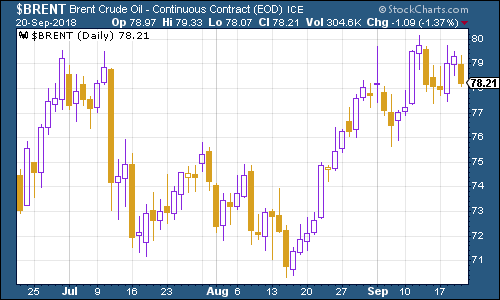

The oil price (as measured by Brent crude, the international/European benchmark) has continued to challenge the $80 a barrel mark. The Saudis have apparently expressed that they are "comfortable" with Brent at that level, which they might well be. Whether the rest of the world feels quite as comfortable at that point is, of course, another matter. And it's worth remembering that Donald Trump doesn't want oil prices to get high enough to irritate the electorate ahead of the November mid-term elections.

(Brent crude oil: three months)

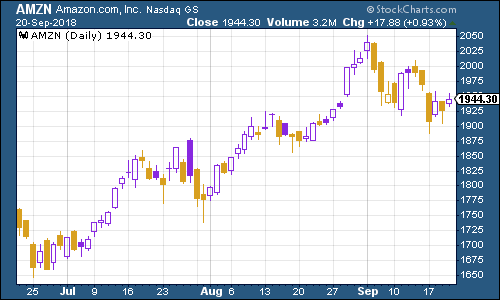

Internet giant Amazon has eased back from its recent record high amid reports that it is in the EU competition regulator's sights.

(Amazon: three months)

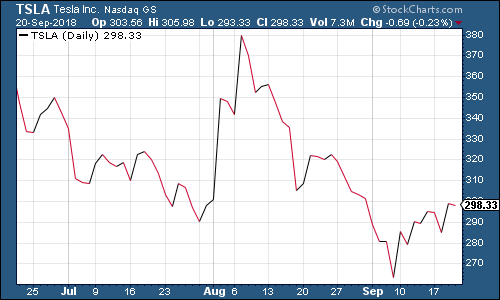

Electric car group Tesla has recovered somewhat over the last fortnight, even although the company is being investigated by the US authorities over Elon Musk's recent Tweets claiming that he was set to take Tesla private. Meanwhile, Saudi Arabia's sovereign wealth fund has invested $1bn in Tesla rival Lucid. (It does already own a stake in Tesla but it's an interesting decision to diversify.)

(Tesla: three months)

Have a great weekend. And don't forget to listen to the podcast it's nice and short!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.