Don't believe the excuses: plenty of people saw the 2008 crisis coming

The received wisdom today is that nobody saw the 2008 crisis coming. But that's just not true, says. John Stepek Lots of people saw it coming, and said so at the time.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In November 2008, the Queen opened a building at the London School of Economics. With a level of diplomacy that might be more closely associated with her husband, she asked one of the professors there why no one had seen the crisis coming. Specifically, said Professor Luis Garicano, "The Queen asked me: If these things were so large, how come everyone missed them?'"

What's interesting is that this still seems to be the accepted narrative. In many of the "ten years on" pieces, we are still being told that nobody saw the financial crisis coming, that it was a bolt from the blue, and that there was no way of preparing for it. And also that the response was absolutely, 100%, the right one.

This, to put it bluntly, is just not true, and I think it's worth setting the record straight.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It's fair to say "no one saw the financial crisis coming", if by that you mean that no one specifically said "in September 2008, Lehman Brothers will go bust". But I don't think that's what the Queen meant when she asked the question.

The reality is that plenty of people (both inside and outside of the establishment) warned that something was up. They warned on specifics, and they warned about it well in advance of the credit crunch taking hold in 2007.

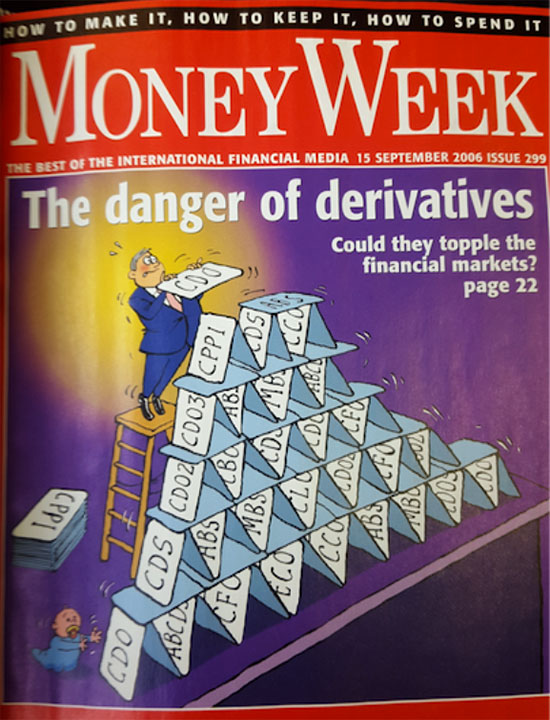

For example, here's a MoneyWeek cover from late 2006:

(I know, I know. But derivatives are hard to visualise, OK?)

Bear in mind that MoneyWeek is staffed by journalists. I like to think that we're informed journalists, but nonetheless, none of us were actually involved in constructing these derivatives ourselves. For us to have known there was something up, someone else had to be flagging up these concerns.

And if you go further back, to take another example, Raghuram Rajan (who went on to become the head of India's central bank) warned very explicitly about the dangers of derivatives in August 2005. He stood up in a room full of central bankers and economic policymakers, and presented a paper entitled Has Financial Development Made the World Riskier?

Among other choice quotes from Rajan, there's this one: "If banks face credit losses and there is uncertainty about where those losses are located, only the very few unimpeachable banks will receive the supply of liquidity fleeing other markets. If these banks also lose confidence in their liquidity-short brethren, the inter-bank market could freeze up, and one could well have a full-blown financial crisis."

That's about as close a description of exactly what happened in the run-up to 2008, as you'll find anywhere. Merryn and I discuss this in a lot more detail in the latest MoneyWeek podcast, which you can find here.

Why you should care about this

This matters. It has nothing to do with bragging rights. It's not about treating any of these people as "gurus". In fact, so many people "saw it coming", that it's simply not that big a deal to have expressed concerns ahead of 2007.

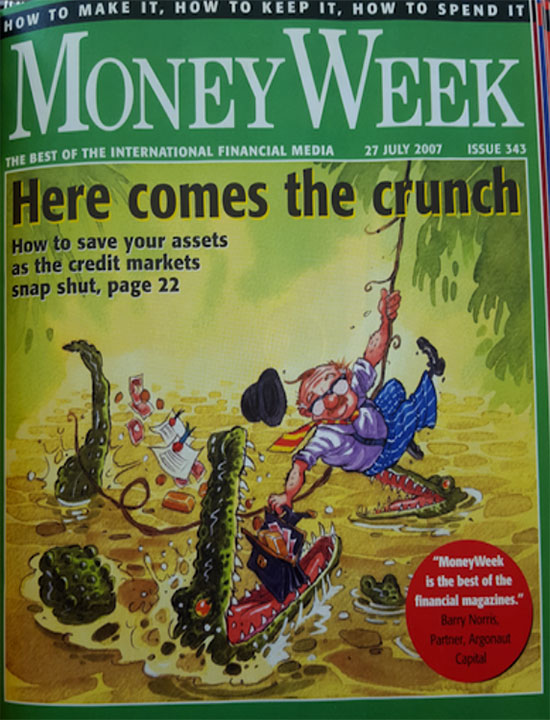

And even if you hadn't twigged there was something wrong by that point, it was really very obvious by summer 2007 here's another MoneyWeek cover, from about six weeks before the queues were forming outside Northern Rock:

The real problem is that the people who didn't see it coming who failed to accept that anything at all was wrong, or to question the build-up of debt across the global economy are still among the most influential voices today.

To say that this crisis came completely out of the blue fits their narrative, even although it's blatantly untrue. Whatever else 2008 showed us, it was that our understanding of the financial system is lacking. We need to make a serious effort to address that.

Instead, we're at risk of allowing the people and philosophies who aided and abetted the last crisis to continue running the show, and to argue that there was no alternative to the bailouts and a decade of quantitative easing, in what amounts to a massive backside-covering exercise.

That's why the correct answer to the Queen's question is: "Actually, lots of people saw it coming, but they didn't fit existing theories, so we ignored them. And we're still doing our best to ignore them".

This article is expanded from a previous Twitter thread. You can follow John on Twitter @John_Stepek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.